Washington, DC – November 24, 2025: The Executive Board of the International Monetary Fund (IMF) completed the Article IV Consultation for Republic of Korea (See Point 1 Below). The authorities have consented to the publication of the Staff Report prepared for this consultation (See Point 2 Below).

Prolonged domestic political and global trade policy uncertainties have weighed on near-term growth. While growth has slowed, inflation remains close to the target, and financial stability risks remain manageable. With sufficient policy space, the authorities are implementing measures to stimulate the economy while tightening macroprudential policies to address housing market pressures.

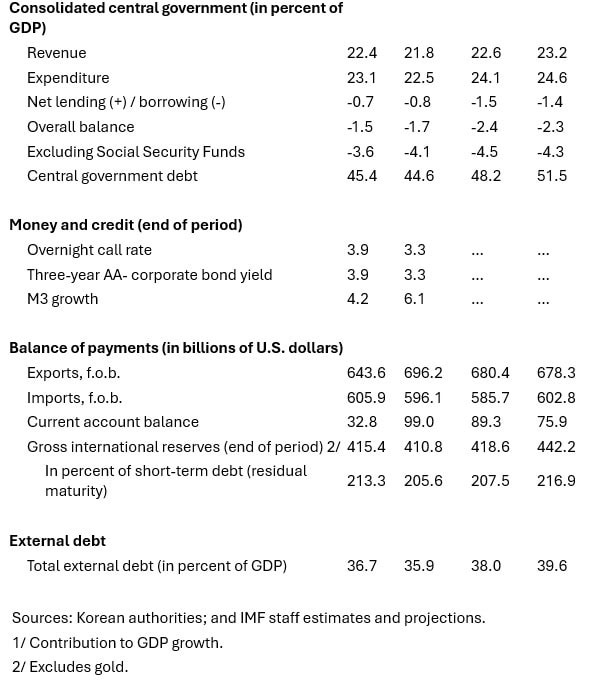

Growth is projected at 0.9 percent in 2025, as private consumption begins to recover in 2025H2, supported by more accommodative fiscal and monetary policies and easing domestic political uncertainty. Growth is expected to rebound to 1.8 percent in 2026, driven by easing uncertainties, the full impact of accommodative policies, and base effects. The negative output gap is projected to gradually close starting 2026 as domestic demand strengthens and exports recover amid easing global trade policy uncertainty. Inflation is expected to remain close to the Bank of Korea’s target of 2 percent. The current account surplus is projected to decrease in the near term, as higher effective U.S. tariffs weigh on Korean exports despite import compression and some export reallocation. In the medium term, it is expected to improve, driven by a gradual recovery in exports and stronger primary income.

Uncertainty around the outlook remains high and risks remain tilted to the downside. Downside risks stem from prolonged trade policy uncertainty, intensification of geopolitical tensions, greater financial market volatility that could lead to tighter financial conditions, higher global commodity price volatility and a slowdown of the domestic semiconductor sector.

Executive Board Assessment (See Point 3 Below)

Executive commended Korea’s economic resilience in the face of domestic and external shocks, supported by the country’s solid macroeconomic fundamentals and the authorities’ skillful policy management. While the outlook is positive, Directors noted that uncertainty remains high. Against this backdrop, they concurred that, in the near term, an accommodative policy mix is appropriate to support the cyclical recovery. To tackle longer-term challenges, Directors underscored that advancing structural reforms remains critical to revitalize domestic demand, enhance external resilience, and boost potential growth.

Directors agreed with the ongoing monetary policy easing, which is supporting domestic demand, while underscoring the need to maintain price stability. In this vein, they emphasized that monetary policy should remain agile, well communicated, and data‑dependent given the high uncertainty. Directors concurred that foreign exchange interventions should remain limited to preventing disorderly market conditions.

Directors welcomed the authorities’ current fiscal accommodation given the negative output gap, with a few Directors noting that a stronger countercyclical fiscal response may be needed to boost domestic demand. Given long-term aging-related spending pressures, Directors emphasized the importance of resuming fiscal consolidation as growth returns to potential. They also encouraged the authorities to expedite structural fiscal reforms—particularly on taxation, spending efficiency, and pensions—and to adopt a medium-term fiscal anchor to safeguard long-term fiscal sustainability.

Directors agreed that the financial sector remains broadly sound and commended the authorities for proactively addressing financial vulnerabilities in the real estate sector. They called for continued monitoring, particularly of risks related to project financing and asset quality in non-bank financial institutions. Directors welcomed recent macroprudential tightening measures to curb housing market pressures and recommended further actions, including expediting plans to increase housing supply. They also encouraged continued reduction in regulatory gaps.

Directors emphasized the need for comprehensive reforms to boost domestic demand and reduce external demand vulnerabilities. They broadly recommended reducing labor market duality and rigidity as well as mitigating aging-related declines in domestic demand. Directors encouraged further diversifying exports, including through targeted support to innovative service startups and deeper trade integration.

Directors underscored that structural reforms are crucial to boost productivity and lift potential growth. They welcomed the authorities’ Economic Growth Strategy and recommended tackling the productivity gap between large and small firms, streamlining regulation, sustaining innovation, and harnessing artificial intelligence. Directors welcomed the authorities’ ongoing reforms to further improve capital allocation.

Additional Information:

(1) Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

(2) Under the IMF’s Articles of Agreement, publication of documents that pertain to member countries is voluntary and requires the member consent. The staff report will be shortly published on the www.imf.org/Korea page.

(3) At the conclusion of the discussion, the First Deputy Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country’s authorities. An explanation of any qualifiers used in summings up can be found here: http://www.IMF.org/external/np/sec/misc/qualifiers.htm.

See Also:

IMF Staff Completes 2025 Article IV Mission to Republic of Korea | Disruption Banking