Visa Inc. (ticker: V) entered the Dow Jones Industrial Average (DJIA) on September 23, 2013, replacing Hewlett-Packard in a reshuffle that also saw the addition of Goldman Sachs and Nike. The move marked the Dow’s pivot from industrial legacy to digital finance, acknowledging the power of electronic payments in the modern economy.

In terms of payments, Visa was handling transaction flows on a massive scale while issuing no cards and holding no accounts, after it was spun off from bank-owned networks in 2007. This was prior to its NYSE listing in 2008.

This piece examines Visa’s stock run before and after joining the Dow, its fresh earnings and growth tactics, shareholder returns, its role in the index, analyst views, and the brewing legal fights over fees.

Wild Ride Pre-Dow: 2008–2012 Returns

Visa went public in March 2008 amid the global financial crisis. Despite the timing, it rose fast. Macrotrends data shows volatility but big gains: the stock fell ~7% in 2008, then surged +67.9% in 2009, dipped –19% in 2010, and rebounded +45% in 2011 and +50% in 2012.

Visa’s market cap climbed from $44 billion at IPO to about $127 billion by its Dow Jones debut, proof of the global shift from cash to cards. Cards proliferated globally, Visa’s network scale created increasing merchant lock-in, and early fraud/spread risks were met by the network’s growth.

Steady Climb Inside the Dow: 2013–2025

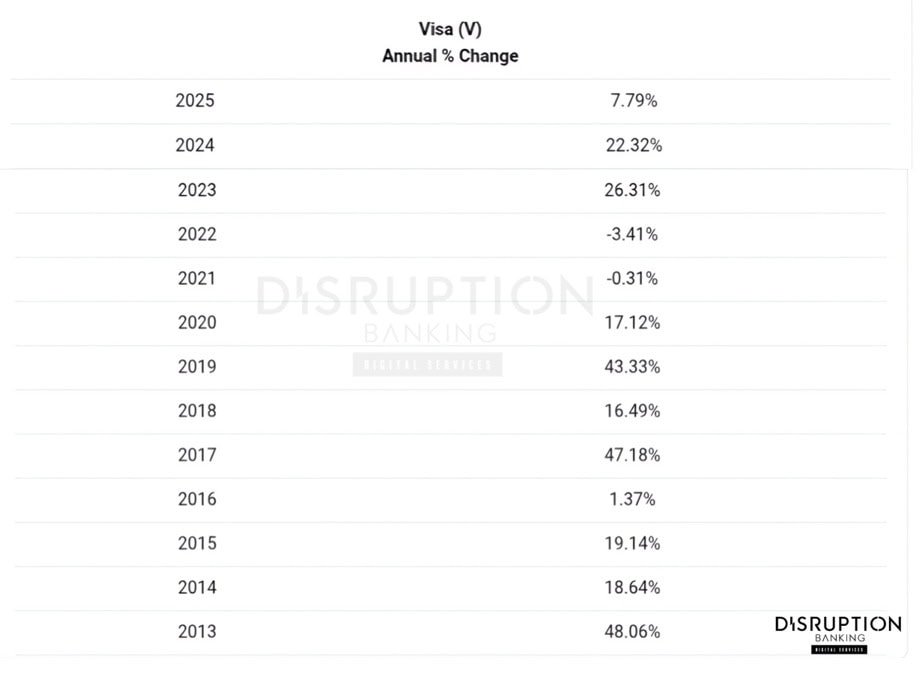

Visa’s momentum didn’t stop after joining the Dow. In 2013 the stock jumped +48%, then posted mostly double-digit returns through the 2010s, including +47% in 2017 and +43% in 2019. Even in 2020, marked by COVID-19 lockdowns, VISA delivered +17% as e-commerce offset store closures.

The following years were flat, –0.3% in 2021 and –3.4% in 2022, before new highs in 2023–2025. From 2013 to 2025, Visa’s annual market value grew from ~$127 billion to ~$631 billion (Macrotrends), solidifying it as one of the Dow Jones’ heaviest hitters.

A $1,000 IPO investment would be worth over $25,000 today, around 26 times its original investment, per Macrotrends.

The Toll-Booth Business Model & $40B Revenue

Visa’s network acts as infrastructure for global commerce, essentially a toll-collector on global spending: in 2024 Visa processed $14.1 trillion in total volume (with $11.6T in payments on its cards), yielding $35.9 billion in net revenue and $19.7 billion in net income. Fiscal 2025 revenue rose 11% to $40 billion, driven by data processing ($20 billion, +13%) and cross-border fees ($14.2 billion, +12%).

Stablecoins, AI, and Fintech Partnerships

CEO Ryan McInerney has highlighted stablecoins as one emerging tool for faster cross-border transfers: in a recent earnings call he noted that adopting stablecoins in emerging markets could help “accelerate our progress digitizing consumer and commercial payments” in cash-heavy regions. Visa is already piloting stablecoin settlements to improve remittances and B2B money movement through its Visa Direct platform. At the same time, Visa is leveraging AI to enhance fraud detection and transaction security, and partnering with fintechs (e.g. wallet providers and “buy now, pay later” firms) to ensure its network remains at the center of new payment flows.

Against this backdrop, Visa’s $631+ billion market cap (TradingView) dwarfs Mastercard’s ($490 billion) and American Express’s ($246 billion). Mastercard remains the closest peer, but Visa’s network handles the larger share of global transaction volume. AmEx operates a closed-loop model tied to lending, meaning that Visa’s pure transaction toll model is more scalable. Visa’s network processes over 60% of U.S. debit transactions, giving it a deep moat but one now drawing the Department of Justice’s attention.

Antitrust Storm: DOJ Suit + $38B Settlement

Visa’s largest threat is legal, not competitive. In late 2025, Visa and Mastercard reached a $38 billion settlement with U.S. merchants to end a two-decade lawsuit over “swipe fees.” The deal would cut interchange fees by 0.1% for five years and loosen acceptance rules. While Visa called it “meaningful relief,” merchant groups blasted it as “minuscule.”

The DOJ is also pursuing Visa in an antitrust suit, accusing it of “unlawfully monopolizing” the U.S. debit market in violation of the Sherman Antitrust Act. The DOJ argues that Visa uses exclusionary rules and incentives to block rivals, keeping fees artificially high.

In June, Judge John Koeltl of the US District Court for the Southern District of New York refused to dismiss the case, which is now going to trial. Any loss could force Visa to open its network to cheaper routing options, a potential hit to margins (could drop 2-5% by 2026), and pricing power plus potential fines that run into billions.

Dividends, Buybacks, and Shareholder Love

Visa continues to reward shareholders. With a quarterly dividend of $0.67 (annual $2.44) and a yield of ~0.7% at current pricing according to Slickcharts, the payout and buy-back trend is clear.

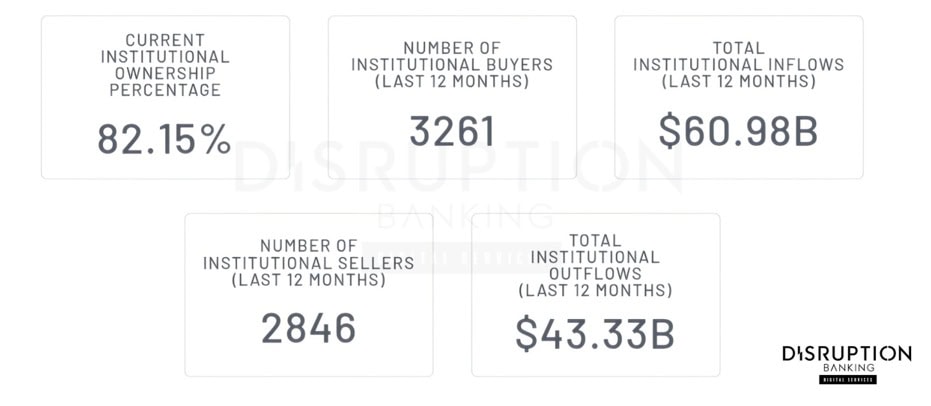

For buybacks, this year, Visa announced repurchases worth ~$12 billion, reducing share count by ~5%. Institution holdings stand at ~82%, per MarketBeat. In summary, Visa behaves like a cash-machine network. But yield is modest, growth remains the primary value driver.

Visa’s Weight in the Price-Weighted Dow

At time of writing, Visa trades around $330 per share (TradingView), and represents 4.3% of the Dow Jones’ weight (Slickcharts), making it a top-10 influencer in the price-weighted index.

Its multi-billion-dollar market cap and ~30× P/E ratio reflect both size and growth premium. While Goldman Sachs, American Express, and UnitedHealth carry heavier point influence, Visa adds a modern payments engine to a historically industrial Dow Jones. It anchors the index’s exposure to digital commerce and consumer spending.

Analyst Targets: $400+ or Regulatory Risk?

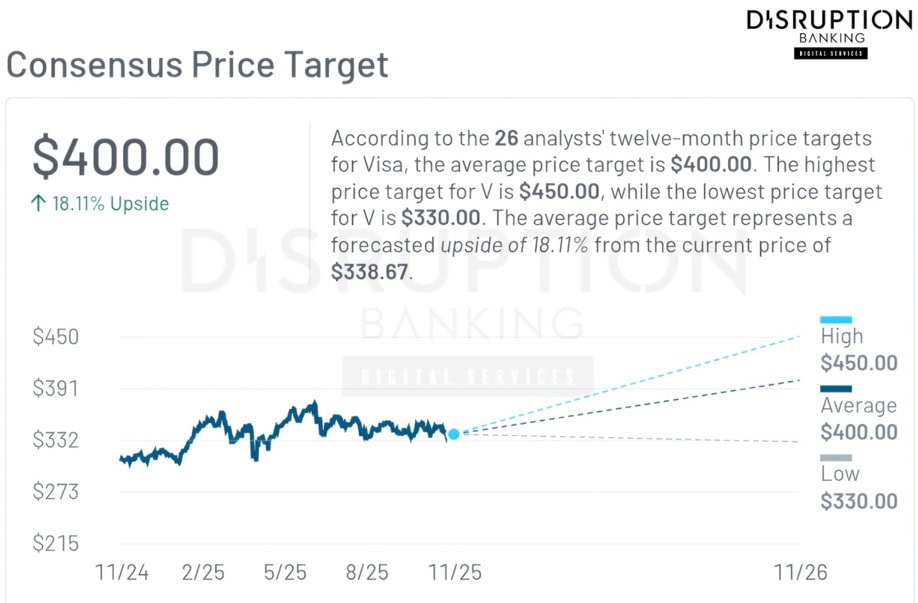

Sentiment for Visa is bullish. Consensus target on Visa stock is $400 (≈18% above recent ~$338). Analyst range indicates high ~$450 if AI/stablecoin bets pay off; low ~$330 if legal/regulation worsens.

But there are caveats: targets assume ~12% earnings growth. Visa’s track record supports that but regulatory shock remains a wildcard.

Visa’s Next 12 Years in a Digital Dow

Visa’s future depends on adapting to faster, cheaper money movement while keeping its network indispensable. Analysts expect growth as Visa extends AI fraud systems, stablecoin settlement pilots, and emerging-market digital rails. William Blair analysts say Visa’s “stablecoin solutions should accelerate its (commercial and money movement solutions) business.” Still, the company faces mounting pressure from fintech startups and regulators challenging its fee model.

For Dow investors, Visa remains a hybrid, part tech, part finance. It offers steady growth, global reach, and pricing power in a cashless world. Twelve years on, Visa is still swiping through the Dow Jones transactions that define modern commerce.

#CapitalMarkets #visa #DowJones #DJIA #electronicpayments #globalremittance #stablecoinsettlement #V #Dividends #cards #digitalrails

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Verizon: 21 Years Connecting the Dow Jones | Disruption Banking

American Express’s Ascent: Powering Up the Dow Jones | Disruption Banking

Goldman Sachs: Dow Jones’ Heaviest Hitter | Disruption Banking