When UnitedHealth Group (ticker: UNH) joined the Dow Jones Industrial Average (DJIA) on September 24, 2012, it replaced Kraft Foods and signaled a shift in the index’s composition toward the real economy of healthcare. The addition exposed the Dow to one of the fastest-growing segments of the U.S. economy: managed care and health-service data.

More than a decade later, UnitedHealth, one of only three health-care names in the DJIA (alongside Johnson & Johnson and Merck), has become one of the Dow’s key stabilizers, even as pressure mounts on its margins and business model.

In this piece, Disruption Banking takes a deeper look at UnitedHealth’s performance in the Dow (before and after inclusion), its recent financial performance, dividend payout, and and the Dow weight that keeps it firmly anchored.

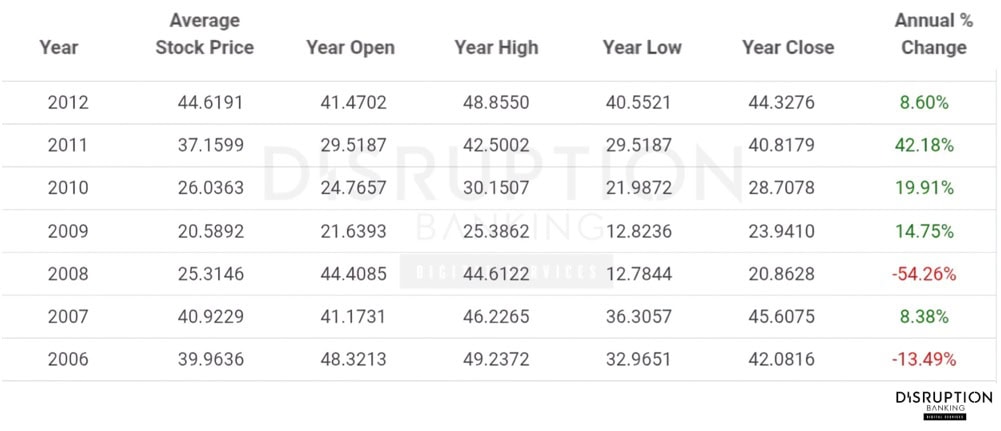

UNH Pre-Dow Growth Engine 2006-2012

Before earning a place in the Dow Jones, UnitedHealth had already built the scale that made it indispensable. Macrotrends data shows it delivered an average annual total return of ~6.2% (arithmetic) and a CAGR of –0.55%, due to a catastrophic –54% loss in 2008, despite strong rebounds in 2010 (~20%) and 2011 (~42%) followed by roughly 9% in 2012, a period when the S&P 500 grew just 13%. That consistency reflected a company riding two long-term forces: expanding U.S. healthcare coverage and the growth of private plans within Medicare and Medicaid.

By the time of its Dow inclusion in September 2012, UnitedHealth was posting annual revenue of $110.6 billion and net income of $5.53 billion for the year. A $1,000 investment at the end of 2010 was worth more than $1,500 by the end of 2012. The company had already outperformed traditional industrials and the broader Dow, which helped explain why the Dow committee wanted a healthcare insurer in the mix.

UNH Post-Dow Boom and 2025 Crash

Post-inclusion, UnitedHealth’s trajectory has been marked by strong top-line growth but greater volatility. Macrotrends data shows the stock surged 41% in 2013 and 36% in 2014, then added 18% in 2015. The pandemic years were mixed: 2020 gained 21% and 2021 soared 45% as deferred medical claims and Optum’s expansion boosted profits. Optum, a division of UnitedHealth Group, that operates as a separate health services and technology company, providing pharmacy benefits, care delivery, and data analytics to other companies and individuals. Since then, the pace has cooled. 2022 added about +7%, 2023 was almost flat, 2024 slipped -2%, and 2025 has declined roughly -31% year-to-date, reflecting investor unease about rising care costs.

Still, long-term returns remain exceptional. Its current market capitalization at the time of writing of about $309 billion (TradingView) keeps it among the Dow Jones’ top-weighted components.

2025 Reset UNH Refocuses Under Hemsley

UnitedHealth’s 2025 story has been one of adjustment rather than decline. In the third quarter, the company reported revenue of $113.2 billion, up 12% year-on-year, and adjusted earnings per share of $2.92 versus $7.15 a year earlier.

The company raised full-year guidance (adjusted EPS target to ≥$16.25). CEO Stephen Hemsley described the quarter as “solid execution” toward the company’s goals, emphasizing that the firm was positioning for “durable and accelerating growth in 2026 and beyond.” On the earnings call, he noted 2026 as a “stepping-off point” for returning to growth.

UnitedHealthcare enrollment rose to 50.1 million people, while Optum posted 8% growth on the back of its pharmacy service provider, OptumRx. The problem was profit pressure, but not only. Net income collapsed 61% to $2.35B, reflecting one-time charges and cyberattack fallout. The sharp drop in net income reflects $3.1B in cyberattack-related costs and business disruption reserves. Finally, the medical cost ratio hit 90%, the highest since 2018, driven by higher claims under Medicare Advantage.

Analysts remain divided. Some view 2025 as a necessary reset after a decade of expansion. Others argue that rising utilization signals a structural challenge that will cap profits in the coming years.

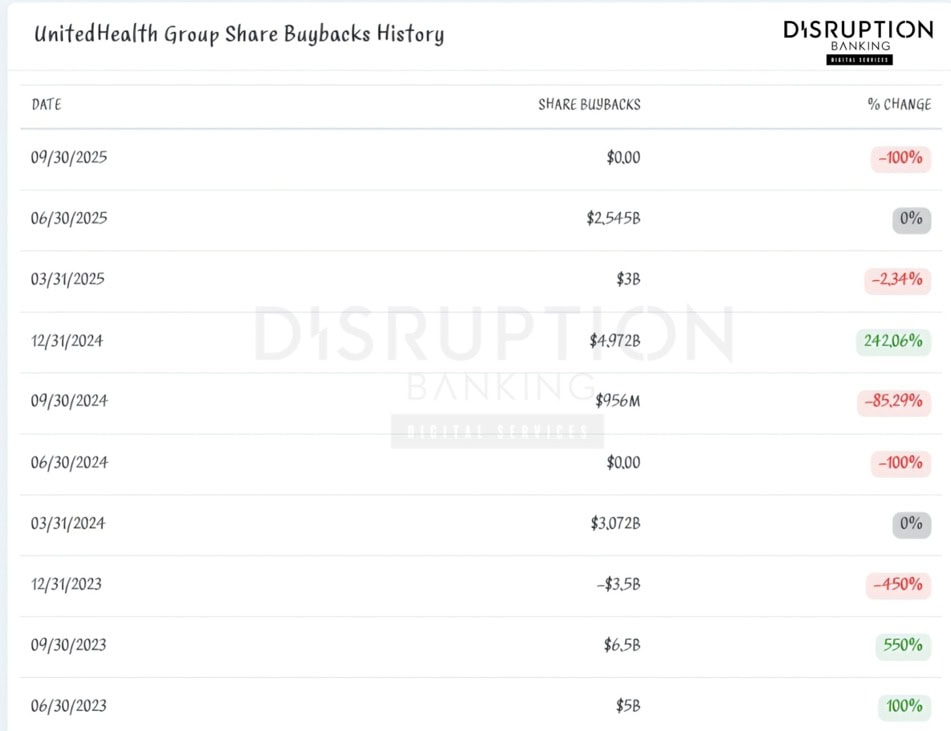

$10B Buybacks Keep UNH Shareholders Smiling

Despite near-term earnings pressure, UnitedHealth has kept rewarding shareholders. The board increased quarterly dividend in June 2025 from $2.10 to $2.21 (paid starting Q3), extending a 15-year streak of annual increases. The payout ratio remains conservative, and the yield of about 2.4% fits the Dow’s income-oriented profile. According to SEC filings, the company has also continued share repurchases, buying back nearly $10 billion over the past 12 months. Together, dividends and buybacks have returned roughly $20 billion to shareholders since 2023.

This discipline reinforces UnitedHealth’s blue-chip identity. It may not match the dividend legacy of Johnson & Johnson or the yield of Merck, but its consistent capital returns and steady balance-sheet leverage align with the Dow Jones ethos of predictability and endurance.

UNH 4.4% Dow Muscle vs J&J Merck

In the health corner of the Dow Jones, UnitedHealth stands beside two very different players, Johnson & Johnson and Merck. At around $340 per share (TradingView) at the time of writing, UnitedHealth commands roughly 4.4% of the index’s total weighting (Slickcharts), meaning its moves can sway the Dow more than most of its peers.

Compared with them, UnitedHealth bridges both worlds. It is more cyclical than J&J (~2.4%) but more stable than Merck (~1.1%). It brings health-service scale rather than drug discovery, providing the Dow with exposure to how America pays for healthcare, not just how it treats it. That distinction explains why UNH’s presence is strategic. It safeguards the Dow’s connection to one of the economy’s most resilient, if complex, sectors.

UNH Still Dow Healthcare Backbone

Looking ahead, UnitedHealth’s challenge is to prove that its size still equals strength. Cost control, technology investment, and pricing reforms must restore the margins that defined its pre-2025 run. If management executes, earnings growth could return to high single digits by 2026. If not, the Dow’s healthcare component will lean increasingly on J&J and Merck to offset UNH’s drag.

For now, the evidence suggests resilience. Revenue continues to rise, dividends climb, and the company still generates over $24 billion in free cash flow annually.

It may no longer be the flawless growth stock of the past decade, but UnitedHealth remains the Dow Jones’ health-care backbone, a company large enough to shape the index and steady enough to defend it when markets turn uncertain.

#CapitalMarkets #UnitedHealth #DowJones #DJIA #healthcare #UNH #Dividends #medicare #medicaid

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Merck’s Biotech Edge Powers Dow Jones Gains | Disruption Banking

Amgen: Biotech Pioneer’s Dow Jones Journey

Johnson & Johnson: A Steady Dose of Dividends in the Dow Jones | Disruption Banking