Sperax (SPA) has recently begun appearing on major exchanges such as Coinbase, drawing attention from both crypto traders and cautious investors. It’s not a meme coin or a hype-driven token. It’s a small DeFi project promising an automated yield ecosystem that blends AI-driven finance with stablecoin innovation. But, with thousands of crypto tokens claiming similar ambitions, Sperax’s visibility has prompted a familiar set of questions: like what exactly is this project, who’s behind it, is it credible, and does it deserve a place in your portfolio?

What Is Sperax? Dual Token System Explained

Sperax (ticker: SPA) is a decentralized finance (DeFi) protocol launched in 2019 that uses smart “AI agents” to automate yield strategies. It bills itself as a SiliconValley–based blockchain company building a “trusted infrastructure for a decentralized economy.” The project’s native token (SPA) is the governance and utility token of its ecosystem.

Sperax (SperaxUSD on X) runs on Ethereum Layer‑2 networks (Arbitrum and BNB Chain) and issues its own yield-bearing stablecoin called USDs. Holders of USDs automatically earn interest on their balance. The SPA token must be staked to participate in the Sperax DAO (decentralized autonomous organization) and share protocol fees. In short, SPA powers a dual-token system: SPA for governance, and USDs as an “auto-yield” stablecoin.

In short:

- SPA = governance + utility

- USDs = auto-yield stablecoin

We’re building the foundation for autonomous, AI-powered finance on @BNBCHAIN

— SperaxOS – Coming Soon (@SperaxUSD) August 4, 2025

SperaxOS is a financial operating system where smart agents automate capital, not just actions. Staking, swapping, bridging, and rebalancing happen based on your intent, not endless transactions.

For… https://t.co/d6lX89apyn

Backing & Listings Real Credibility?

Sperax has attracted a number of high-profile backers and appears to have passed typical exchange listing vetting. Its 2020 ICO raised around $4.7 million, and ChainBroker (a crypto data site) notes institutional investments from firms like Alameda Research, Jump Capital, Polychain Capital, Amber Group, Outlier Ventures, and FBG Capital. These names, including Binance-linked Alameda and venture funds like Polychain, suggest credible support.

Major trading platforms have listed SPA: for example, Crypto.com added Sperax in May 2023, allowing users to buy SPA with fiat currencies. Coinbase also shows a live price page for SPA, implying it met Coinbase’s listing criteria.

The Sperax team and code are public (the whitepaper and GitHub are available), and the project has taken steps to improve security. Notably, in July 2025, Sperax locked about $413K of liquidity in audited smart contracts via audit firm GoPlus, a move intended to prevent immediate “rug pulls” and protect long-term holders.

We did not find any major regulatory warnings against Sperax specifically. However, as with all crypto projects, investors must exercise caution; user reviews (e.g., on Trustpilot) are mixed, with some praising the professional team and others complaining about deprecated features.

Market Reality 97% Down $17M Cap

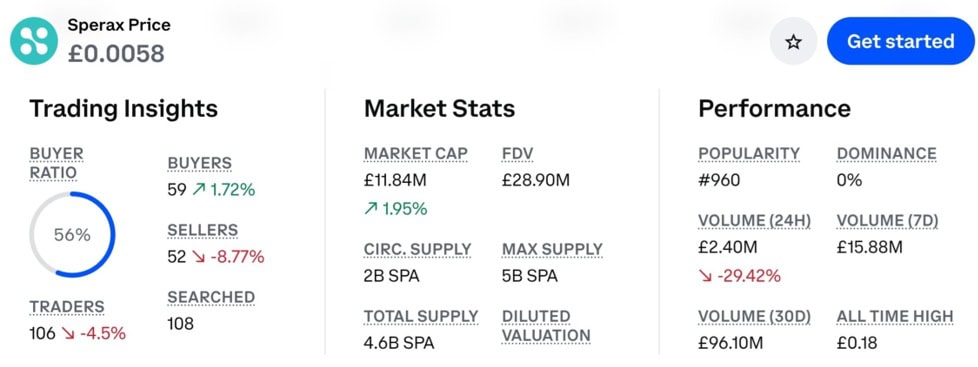

By autumn 2025, SPA remains a tiny, volatile asset. Its market capitalization is only on the order of $15–20 million, making it a micro-cap crypto. Trading volume is modest: Coinbase reports a 24‑hour volume around $4–6 million, almost entirely on centralized exchanges. On-chain usage is negligible: DefiLlama reports only about $2.33 million (around 12% of the market cap) locked in Sperax contracts (mostly staking).

The price history underscores the risk: SPA’s all-time high was about $0.2395 (March 2022) and its all-time low about $0.0033 (September 2023). At roughly $0.0076 today, SPA is trading ~96–97% below its peak.

Recent trends have been bearish: CoinMarketCap’s analysis notes SPA fell roughly 46% over a 90‑day span, reflecting “skepticism toward its AI-driven agent economy vision.” In short, while the technology is ambitious, adoption and liquidity remain limited, and the token has shown severe price swings.

UK Warning No FCA Protection

For investors, SPA should be treated as highly speculative. Algorithmic stablecoins like Sperax’s USDs face growing regulatory scrutiny. The UK’s Financial Conduct Authority (FCA), for example, is consulting on stablecoin rules, defining “qualifying stablecoins” as those explicitly pegged to fiat currencies.

Sperax USDs is algorithmically managed and not issued by an FCA‑authorised firm, so it likely would not qualify under these rules. That means no special protections (unlike regulated fiat-backed stablecoins).

More broadly, SPA is a crypto token with zero regulation, so UK crypto rules on e-money and custody apply in the usual way.

Verdict High Risk Bet

As a blockchain journalist-investigator, we find that Sperax is not an obvious scam — it has credible investors, exchange listings, and some security measures like liquidity locks. However, its novel design (AI-driven finance and an auto-yield stablecoin) is unproven at scale.

Investors should weigh SPA as a very early-stage asset: it offers exposure to bleeding-edge DeFi innovation, but it can be extremely risky. If someone chooses to add SPA to a portfolio, it should be a small, high-risk allocation only after doing due diligence.

In summary: SPA is a genuine project with real backing, but its small size, volatile history, and unregulated algorithmic model make it a high-risk bet. Especially for cautious investors

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.