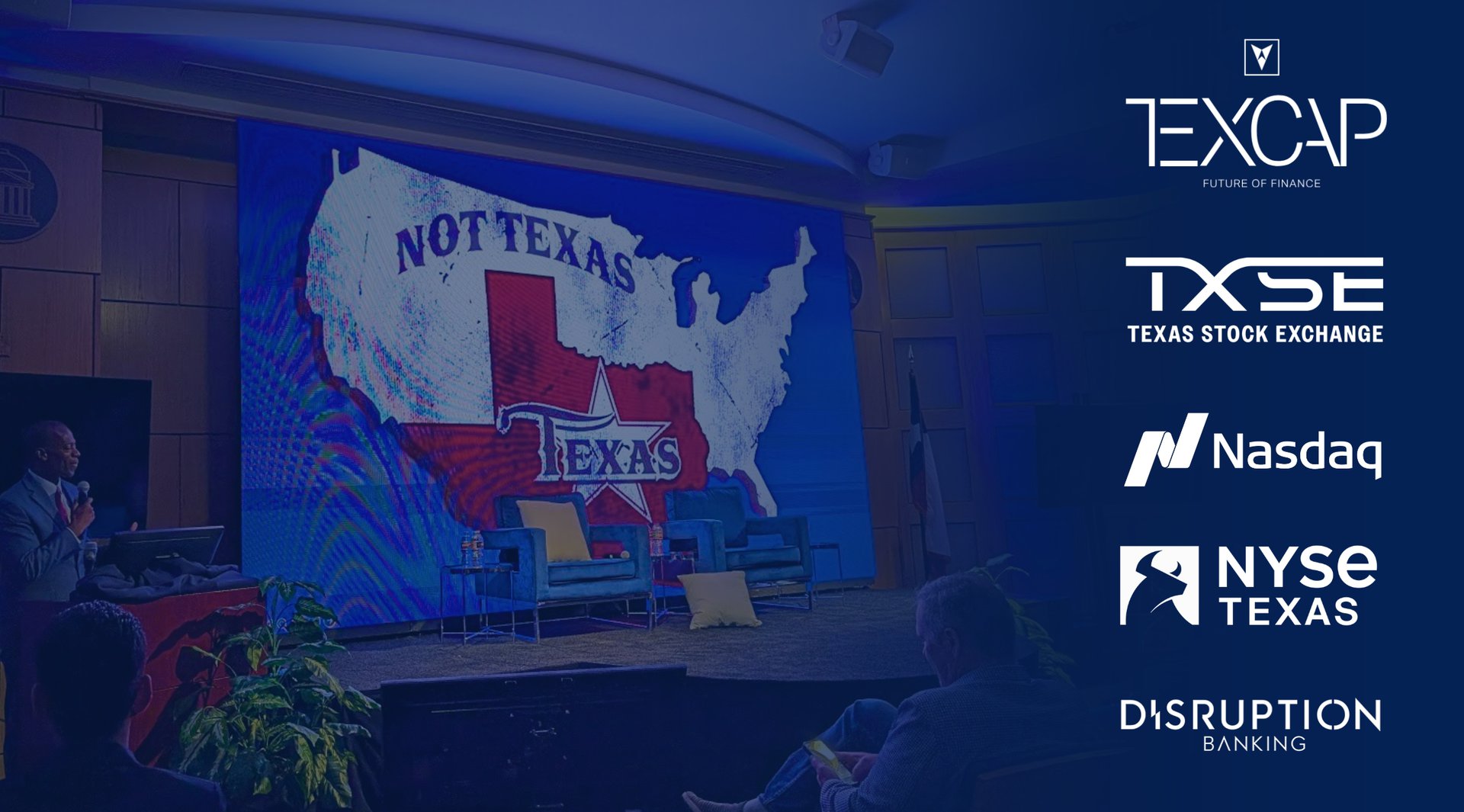

It’s a particularly warm day in Texas today. And students were everywhere at the prestigious Southern Methodist University (SMU). In the heart of its’ campus, SMU played a key role in hosting a first of its kind event in Dallas. Formed out of a partnership between the American Association of Professional Landmen (AAPL), the world’s largest marketplace for upstream energy – the North American Prospect Expo or NAPE, SMU, and the Texas Blockchain Council, TexCap took place for the first time today.

Speakers included representatives of the New York Stock Exchange’s Texas office, the Nasdaq’s Texas offices, and the newly formed Texas Stock Exchange. Lee Bratcher, President of the Texas Blockchain Council, performed the role of master of ceremonies with delegates representing a wide group of capital markets enthusiasts, many of whom had especially travelled to Dallas to participate in the first ever TexCap event.

After opening remarks from the organizers a discussion between Tom Long, Co-Chief Executive Officer at Energy Transfer and Rob Holmes, Chairman, President, and CEO of Texas Capital Bank followed. It helped delegates become more familiar with how companies list today, what the challenges are that they face, and more about the ‘Texas Miracle’.

TXSE: Bringing the Bull Market Home to Texas

The Texas Stock Exchange is also known as TXSE and has been one of the reasons why DisruptionBanking has been so bullish on Texas over the years. In the next discussion, Nicole Chambers, Global Managing Director and Robert Marrocco, Global Head of Exchange Traded Products, took to the stage to explain more to delegates. SMU provided excellent moderators for the panels and discussions that took place at TexCap today.

It was only last week that TXSE had received SEC approval to operate as a national securities exchange. Robert started by sharing with delegates how excited the team at TXSE were by the news. How they were all looking forward to the first listings of companies and exchange traded products on the exchange in the first quarter of 2026.

Nicole went further by highlighting how Texas had “really become the new center of gravity for the U.S., especially for capital formation.” She extolled how Texas has led population and GDP growth in the U.S. over the last five years, and how people wanted to be in Texas. To grow the American entrepreneur dream.

Texas has seen more corporate relocations and expansions than anyone else. If there was any place in the U.S. today that could give New York a run for its money, Nicole believes that it is Texas. She also highlighted a recent move by the Bank of Nova Scotia, which is expanding its U.S. presence by hiring about 1,025 full-time employees in Dallas. Nicole also reminded delegates of a new bill that had been submitted by the Texas legislature proposing a ban on new taxes on securities transfers and financial transactions, which aims to protect Texans and businesses.

The new #TXSE introduced at #TEXCAP at SMU in Dallas today pic.twitter.com/u0Bn0bMtXX

— #DisruptionBanking (@DisruptionBank) October 8, 2025

NYSE Texas Affirms Y’all Street’s Ambitions

Following an excellent presentation from Rebecca Zarutskie, Senior Vice President at the Federal Reserve Bank of Dallas it was time for the President of NYSE Texas, Bryan Daniel to share his thoughts with delegates.

Bryan is a Texan and shared his pride for how the ‘Texas Miracle’ had evolved over the last decades. He explained how NYSE Texas was now incorporated in Texas with its headquarters in Dallas.

Interestingly, Texas as a state boasts more NYSE-listed companies than any other state, nearly 4 trillion dollars in market value, Bryan shared. He explained how opening NYSE Texas was a chance to be closer to these companies and to offer them more benefits by offering a dual listing in the Lone Star State. Several firms have already taken advantage of this opportunity, he explained.

Bryan pointed to the incredible job growth numbers that Texas has been experiencing over the last decade. How companies continue to grow their headcount in the state, and he sees this continuing for the foreseeable future.

Regarding the competition, like TXSE, Bryan welcomes this. He explained how “some really smart people at three different organizations saw the value of the Texas marketplace.

“Competition is what really makes markets work,” Bryan shared. “It’s the foundation of the American system.” Competition can drive liquidity, innovation, and more, he added.

Nasdaq’s Deep Roots and Growth in Texas

The next speaker was the charismatic Rachel Racz, Head of Listings for Texas, Southern U.S. and Latin America at Nasdaq. Rachel explained how proud she was to see successful companies from Texas, like Firefly Aerospace from Austin, listing on the Nasdaq.

Rachel also shared how Nasdaq had a rich history in Texas. How Nicole, now at the TXSE, had once worked with her at Nasdaq. Rachel had earlier worked as a relationship manager at Nasdaq, based out of Texas, and has deep roots in the Texas energy sector herself.

Rachel shared how she has also noticed the trend of companies relocating to Texas. She praised Dallas on what a great job the city had done in attracting financial institutions and businesses to Dallas.

“It makes a lot of sense for us to expand our presence here,” Rachel shared. “When we look at the growth of the U.S. economy, where is it coming from? It’s coming from the South, but Texas is the heartbeat.

“Everyone wants access to the United States capital markets, because we have the greatest capital markets in the world,” Rachel added. “It’s an honor to be here, and it’s an honor to be able to list your company here and get investors in the U.S. to trade your stock, because that’s how we create wealth. That’s how we help investors grow. And we are the country that does it the best.”

Texas: The Future of Global Capital Markets

It didn’t feel like this would be the first and only TexCap event to take place in Texas. It felt more like the ushering in of a new era for the Lone Star State. An era where competition and liquidity would help drive further opportunity for businesses already in the State and others looking at moving or opening there.

Three key people, all from Texas, all filling important roles at two leading exchanges and one up and coming one, came together to help usher in this new era. Those who were able to attend and hear Governor Greg Abbott share his thanks in person at the end of the day will be able to tell their friends and family: “we were there when Texas became a global capital markets player. We saw that in the future Dallas would be competing with London, Hong Kong and other global financial hubs.”

For those of you who couldn’t make it, this story may help understand the importance of what is happening in Texas today, tomorrow and in the foreseeable future.

Author: Andy Samu

See Also:

Can the Texas Stock Exchange Disrupt Capital Markets? | Disruption Banking

TXSE Group Inc announces SEC approval of Texas Stock Exchange | Disruption Banking