When most people hear “Standard & Poor’s,” the first thing that comes to mind is the S&P 500 index — that famous benchmark of the U.S. stock market. Indeed, the S&P 500 has become a household name, featured daily in financial news and used in retirement portfolios worldwide. But Standard & Poor’s (now officially known as S&P Global (ticker: SPGI)) is far more than just the caretaker of the S&P 500.

Over its 150+ year history, Standard & Poor’s has evolved into a multifaceted pillar of global finance — a firm whose influence extends from credit ratings on trillions of dollars of debt to analytics and data feeding Wall Street decisions.

As we sit in the last month of the third quarter, it’s worth exploring exactly what S&P does beyond its famous stock index, and how this often misunderstood institution shapes the financial landscape.

Beyond the Index, S&P’s Many Roles

The average person knows S&P 500, but probably not that S&P stands for “Standard and Poor’s,” named after two 19th-century financiers — a name many still find unusual.

Behind the name lies a structure built around five main divisions: Market Intelligence (Capital IQ), Ratings, Commodity Insights (formerly Platts), Mobility, and the S&P Dow Jones Indices. Together, they provide tools from sustainability analytics to engineering data, while also running the benchmarks that dominate financial headlines.

Indices are the most visible contribution. Through S&P Dow Jones Indices (ticker: SPDJI) — a 2012 joint venture (S&P Global and CME Group, with the Dow Jones brand licensed) — it maintains the S&P 500, the Dow Jones Industrial Average (the “Dow 30,” which Disruption Banking is covered closely this year), the S&P MidCap 400, the S&P SmallCap 600, and thousands more.

Trillions of dollars track these benchmarks. The S&P 500 alone underpins well over $20 trillion via index funds, ETFs, and derivatives as of the end of 2024. Vanguard founder Jack C. Bogle explained its enduring power in his 2007 book: “Today, the S&P 500 remains a valid standard against which to compare the returns earned by mutual fund managers.”

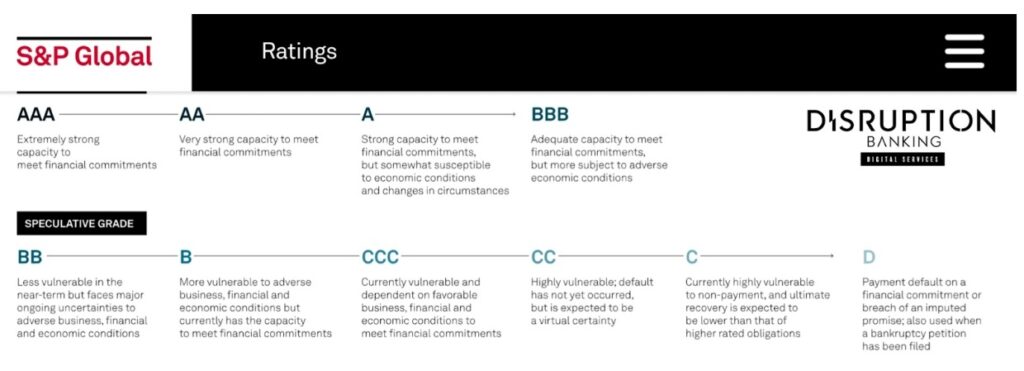

But indices are only one side of the story. S&P Global Ratings (formerly Standard & Poor’s Ratings Services) is another cornerstone. As one of the “Big Three” credit rating agencies alongside Moody’s and Fitch, it assigns letter grades — from AAA, BBB, BB, down to D — on sovereigns, companies, and securities to judge creditworthiness (how likely an entity is to repay its debts). These ratings, embedded in mandates and risk models, can raise or lower borrowing costs for nations and firms overnight.

A Historical Perspective: From Railway Books to Global Benchmarks

This global reach is rooted in a long history. S&P Global’s story begins in the 1860s, when Henry Varnum Poor published handbooks on railroad finances. Standard Statistics (1906) later brought uniform corporate data; Poor’s issued its first bond ratings in 1916; and the two merged in 1941.

From there, milestones followed quickly: the launch of what became the S&P 500 in 1957, McGraw-Hill’s acquisition in 1966 (which fueled global expansion), and the 2016 rebrand to S&P Global — a deliberate pivot from publishing to what it calls “essential intelligence.”

Today, the company stands as a roughly $165 billion (TradingView) enterprise, with its 10-year total return above 500 percent, reflecting the durability of toll-like revenues from ratings, indices, and data.

The Power and Controversy of S&P’s Credit Ratings

Of all its functions, credit ratings have carried the most power — and controversy.

In August 2011, S&P shook markets when it downgraded U.S. sovereign debt from AAA to AA+, citing fiscal gridlock. The Dow plunged the next trading day, Washington fumed, and S&P stood by its call.

Tension with regulators peaked in 2013, when the U.S. Justice Department sued S&P, alleging it knowingly inflated ratings to win business from banks. Because issuers pay for ratings, conflicts of interest were a central concern. Two years later, S&P settled for $1.375 billion without admitting wrongdoing and tightened criteria.

Former Treasury Secretary Timothy Geithner observed that agencies like S&P occupy “quasi-regulatory” roles, while Warren Buffett quipped that you only discover who is “swimming naked” when the tide goes out. In response, S&P has since published more methodology, separated commercial from analytical functions, and emphasized that ratings are opinions, not guarantees.

Still, their systemic impact is unavoidable. Because bank rules, investment mandates, and risk engines are tied to ratings, a downgrade can trigger forced selling and higher capital requirements, even as regulators push to reduce dependence on them.

The Sum of Many Parts

Taken together, Standard & Poor’s is far more than the S&P 500. As a rating agency, S&P gives investors a shared way to judge credit risk so the bond market can work smoothly. As a data and analytics company, it provides the information people need to make decisions in stocks, bonds, commodities, and government policy.

It’s safe to say that the markets have not responded well to recent developments at the White House. From a high of 6,100 on February 19th to a low of 5,600 today, the S&P 500 is feeling the strain.#stockmarketcrash #Trump #tradewars #DJIA #BigTechhttps://t.co/qVHAv2TP9b pic.twitter.com/woUZFgB8pm

— #DisruptionBanking (@DisruptionBank) March 11, 2025

In the past decade (2015–2025), S&P’s influence has grown. Indexing has widened, data-driven investing has sped up, and the need for clear credit ratings has increased. Challenges remain — such as rebuilding trust, adapting ratings for climate risks and new financial products, to using its power carefully — but its overall direction is unmistakable.

Now under President and CEO Martina L. Cheung (since November 2024) and the “Essential Intelligence” banner, S&P Global has secured its place as one of finance’s indispensable institutions. The next time someone mentions the S&P 500, it’s worth remembering the vast iceberg beneath: a credit watchdog, a benchmark curator, and a data oracle whose quiet decisions affect mortgage costs, retirement portfolios, and market movements from New York to Warsaw.

Author: Richardson Chinonyerem

See Also:

How is the Dow Jones Responding to Reindustrialisation? | Disruption Banking

What explains the S&P 500’s remarkable performance? | Disruption Banking