Rising prices and trouble accessing international banking are pushing many Pakistanis — especially younger, tech-savvy citizens — to try cryptocurrency instead. Though still debated, digital assets are becoming a vital way to save and send money in a country of 240 million people where six in ten are under 30.

In today’s article, DisruptionBanking takes a look at how well crypto is performing in Pakistan. Will the “The Land of the Pure,” as the country is sometimes known, find a way to grow its crypto market with clear rules and local innovation — or will government restrictions only slow things down?

Pakistan’s Crypto Surge

Cryptocurrency use in Pakistan has exploded. With inflation biting and the rupee weakening against the dollar in recent years, it offers an alternative. Estimates say 15-20 million Pakistanis now own digital assets.

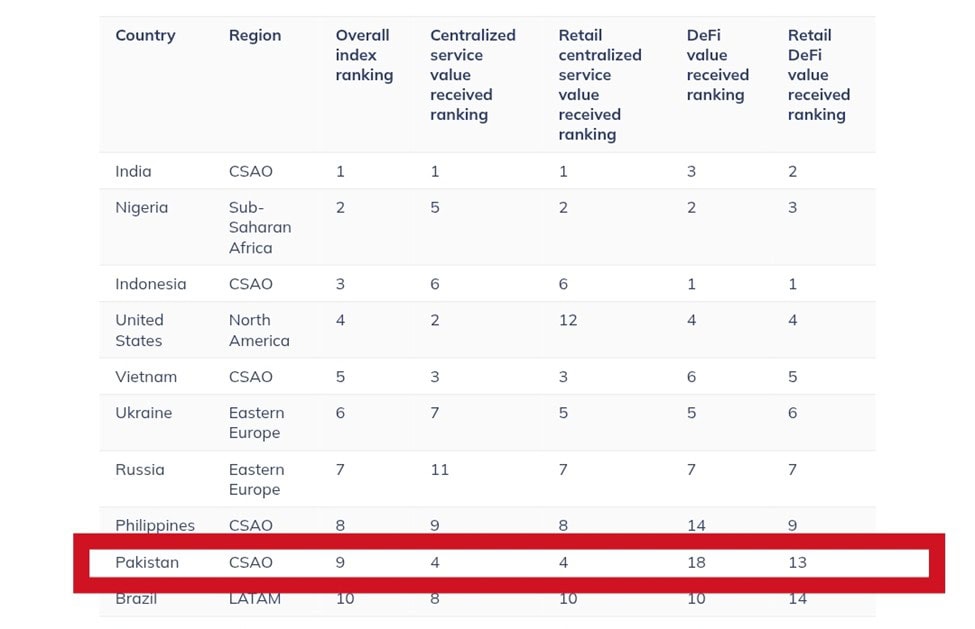

Chainalysis ranked Pakistan ninth in global crypto adoption in 2024 and crypto trading volume from wallets in Pakistan grew to $25 billion in 2023 from $20 billion the previous year, according to Business Insider.

Most of this trading comes from individuals and not big institutions, due to tough government policies around digital assets.

Chainalysis 2024 Global Crypto Adoption Index Top 10. Source: Chainalysis

A Shift in Government Policy

Pakistan used to treat cryptocurrency as a threat. The State Bank of Pakistan (SBP) banned banks from handling it in 2018. But things have begun to change in the past couple of years.

Finance Minister Muhammad Aurangzeb was reported in April as saying: “We are sending a clear message […] Pakistan is open for innovation.” The previous month, the government formed the Pakistan Crypto Council (PCC) – a public-private advisory body tasked with developing cryptocurrency and blockchain policy.

Headed by a dedicated crypto minister and entrepreneur Bilal Bin Saqib, the PCC is crafting a regulatory framework that includes mandatory KYC/AML rules and licensing for exchanges.

Honoured to lead as CEO of the Pakistan Crypto Council, working with our esteemed board and Chairman, the Finance Minister, at a defining moment for our nation.

— Bilal bin Saqib MBE (@Bilalbinsaqib) March 15, 2025

With Pakistan ranking in the top 10 for global crypto adoption and an estimated 25M+ active users, alongside a $30B+… https://t.co/iFRlHXOtXU pic.twitter.com/laj0arzpN9

Pakistan passed the Virtual Assets Act in 2025, paving the way for legal crypto operations.

The Pakistan Digital Asset Authority (PDAA) will oversee exchanges and regulate custodians, according to a report from state-owned broadcaster PTV. Though banks still can’t touch crypto, users can trade peer-to-peer (P2P).

Licensing is expected to unlock formal institutional involvement. Binance founder Changpeng Zhao was appointed strategic adviser to the PCC, reaffirming Pakistan’s shift toward pro-innovation policy.

Huge news from Pakistan!

— Ak47♛ (@HolaItsAk47) April 12, 2025

Changpeng Zhao (CZ) is now Strategic Advisor to Pakistan’s Crypto Council — helping the country build smart, scalable crypto policy.

Why does this matter?

– Pakistan is ready for crypto:

– 100M+ people still unbanked

– Billions in annual remittances

-… pic.twitter.com/SsDGD1tmjD

P2P Networks Fill the Gap

Because domestic crypto exchanges are not yet licensed, most Pakistani crypto trading happens via P2P networks and global platforms, like Binance and Paxful. They often pay through local mobile wallets like JazzCash and Easypaisa, which make it easy to convert rupees to stablecoins.

Meanwhile, fintechs are building blockchain tools beyond just crypto trading. Some are exploring supply chain uses or digital identity verification. The Punjab IT Board, for instance, uses blockchain to verify academic degrees.

As regulation improves, blockchain solutions like these are expected to spread.

.@BilalBinSaqib reintroducing Pakistan to the world at Bitcoin Vegas, through the lens of crypto.

— Pakistan Crypto Council (@cryptocouncilpk) May 29, 2025

40M+ wallets. 70% population under 30.

One of the world’s top freelance markets.

We’re coders, creators, builders

Not waiting for permission.

We’re on-chain and unstoppable. pic.twitter.com/uZIKyVQ5Gu

Remittances a Key Area

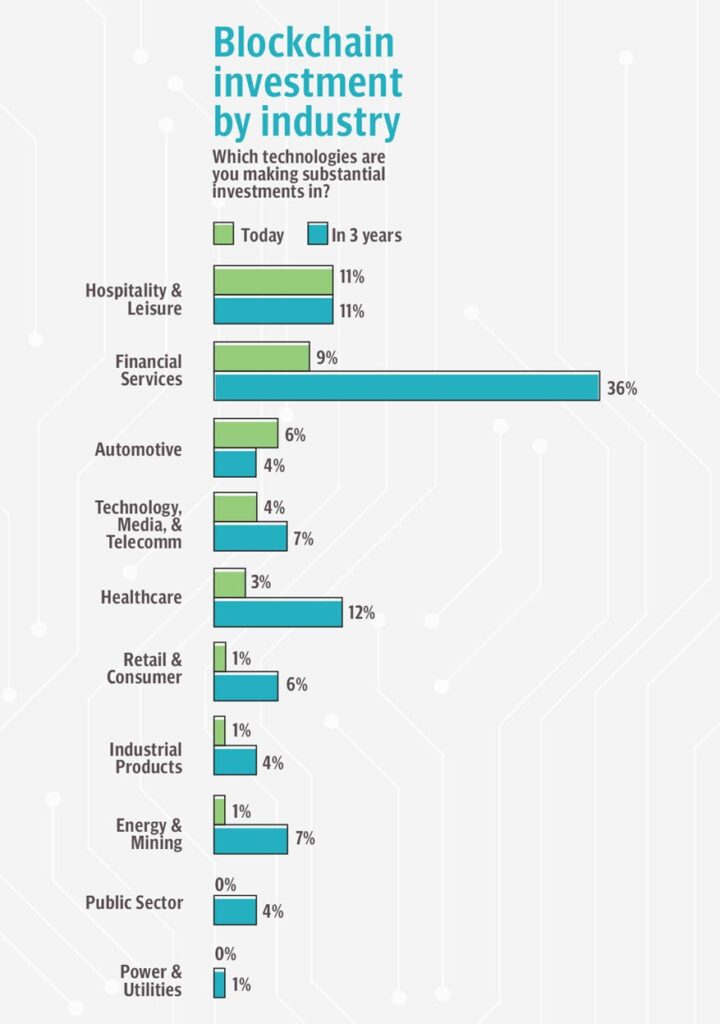

Blockchain is already being used in financial services and one key area is remittances. In 2019, Pakistan launched a blockchain corridor with Malaysia to enable faster, cheaper cross-border payments. Telenor’s Easypaisa mobile wallet and Ant Financial’s Alipay worked together to build the system.

SBP Governor Tariq Bajwa highlighted this as putting Pakistan “on the map of very few countries” using blockchain in payments.

Today, public and private players aim to use blockchain more widely for remittances. With over $31 billion in annual remittance flows between 2023 and last year, faster and lower-cost services could have a big impact. The PCC supports this shift, calling for new technologies to replace outdated transfer methods.

Current state of blockchain adoption in Pakistan 2024. Source: Tribune-Magazine

Stablecoins Gain Traction

Young Pakistanis, especially freelance workers, are driving crypto adoption, with stablecoins such as Tether (USDT) widely used. Many accept payments in USDT and USD Coin to protect savings, make transactions, and settle trades. Businesses and individuals are treating the former as digital dollars, especially during periods of high inflation.

Official remittances to Pakistan were $27-31 billion in 2022-2023, but experts believe that up to $10 billion more may be coming through crypto, bypassing traditional banks. Recognizing this, the PCC and other regulators have signaled interest in legally leveraging stablecoins.

Bin Saqib has signed a letter of intent with World Liberty Financial. This deal with the U.S. Trump-backed crypto venture will explore stablecoin regulation, including regulatory sandboxes for blockchain product testing, DeFi pilots, and tokenization of real assets.

While banks still can’t legally use stablecoins, the PCC hopes they eventually will be adopted for remittances and trade. However, in the meantime critics have warned that unregulated stablecoins could make it easier for money to leave the country, harming the domestic economy.

What a a day Pakistan

— Zeus 🔶 Hamad (@ZeusInCrypto) April 27, 2025

Today marks a major step forward for Pakistan’s digital economy.

The Pakistan Crypto Council, led by CEO @Bilalbinsaqib, has signed a Letter of Intent (LOI) with @worldlibertyfi, a decentralized finance (DeFi) platform backed by @realDonaldTrump, to… pic.twitter.com/ZNweGG09kL

Pakistan’s Crypto Moment?

Pakistan is at a tipping point. On one side are outdated regulations and economic hurdles, on the other millions of eager users and a fast-moving fintech scene. The PCC has set a target of 15 million users this year and hopes to make the country a regional crypto leader.

Legislation and oversight may bring structure and safety: if rolled out smoothly, Pakistan could see billions in crypto revenue and innovation. The question is whether the country can avoid a stop-and-go approach and move toward a clear, forward-looking crypto policy.

Pakistan’s Chief of Army Staff, Field Marshal Asim Munir met with PCC CEO @BilalBinSaqib to discuss the future of Pakistan’s digital economy.

— Pakistan Crypto Council (@cryptocouncilpk) May 23, 2025

The focus was clear: our youth must be equipped to lead in blockchain, crypto, and AI.

With 70% of the population under 30, 40 million… pic.twitter.com/efCByWyEXJ

Whatever the outcome there, crypto in Pakistan is no longer just an underground trend. It is becoming a part of how people save, invest, and transfer money: while traditional banks and regulations play catch-up, momentum is building.

With young users, fintech talent, and a softening government stance, Pakistan is poised for a digital asset future. Whether it goes one step further and becomes a crypto hub remains to be seen.

#Crypto #Blockchain #DigitalAssets #DeFi #Pakistan

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The Rise in Popularity of Crypto in Canada | Disruption Banking

South Africa’s Surprise Rise as a Crypto Powerhouse | Disruption Banking

The Rise in Popularity of Crypto in the Netherlands | Disruption Banking