At the end of April a story about Cantor Fitzgerald launching a crypto venture with Tether may have flashed up on your screen. The two firms have joined up to create Twenty One, a competitor to Michael Saylor’s bitcoin-laden Strategy. Importantly, the news also highlights how Cantor Fitzgerald holds 99 percent of U.S. treasury bills on behalf of Tether. Something that is more significant than might first meet the eye.

Howard Lutnick, U.S. Secretary of Commerce, was until recently the Chairman and CEO of Cantor Fitzgerald, or Cantor for short. He was CEO of the Wall Street institution for 30 years. The recent joint venture with Tether becomes of particular interest when you consider how in January Lutnick was quoted by Bloomberg as being a prominent booster of Tether.

This relationship between Lutnick and Tether has been ongoing for more than three years now. The prominent Wall Street investor stepped in at a time of crisis for Tether and vouched for the company. Cantor even bought a minority stake in Tether.

Tether’s Stablecoin Ambitions

Tether is already the third largest cryptocurrency by market cap. An amazing feat bearing in mind that the company is only involved in USD stablecoins. One of the people behind this achievement is the Chief Investment Officer of Tether, Richard Heathcote.

In a recent story by Bloomberg, Heathcote’s role was highlighted. In the story, it explains how Heathcote played a key role in nurturing Tether’s relationship with Cantor. Tether’s legitimacy via Cantor ties could align with broader U.S. financial interests.

Market commentators have shared how this backing of Tether by Cantor has added legitimacy to a cryptocurrency historically plagued by scandal.

The CEO of Tether, Paolo Ardoino, has recently been quoted in the press highlighting how he wants Tether to work with law enforcement. And how he wants to rollout a specific U.S. domestic stablecoin which would be different from the international stablecoin. This highlights how the company is looking to improve its reputation and how it is making steps to be the stablecoin issuer of choice in the future

Tether’s U.S. Treasury Horde

Just yesterday Tether posted on X how it has $150 billion of assets. It highlighted how more than 400 million people trust it today.

From 0 to $150B.

— Tether (@Tether_to) May 12, 2025

Born in 2014, Tether didn’t just launch USD₮ — it launched the entire stablecoin industry.

Today, USD₮ is trusted by 400+ million people & powers the digital economy.

To every user, builder & believer: thank you❤️

We’re just getting started#UnstoppableTogether pic.twitter.com/PPC2PUy1Si

Tether’s $150 billion market cap, while a fraction of the $2,259.3 billion U.S. dollars in circulation, highlights its growing role as a digital dollar alternative, sparking debate about its reserve potential.

Last week we shared how Professor Axel Weber, the former President of the German Central Bank, thought that digital currencies will take on the dominance of the dollar. This week we might be seeing the first signs of this happening.

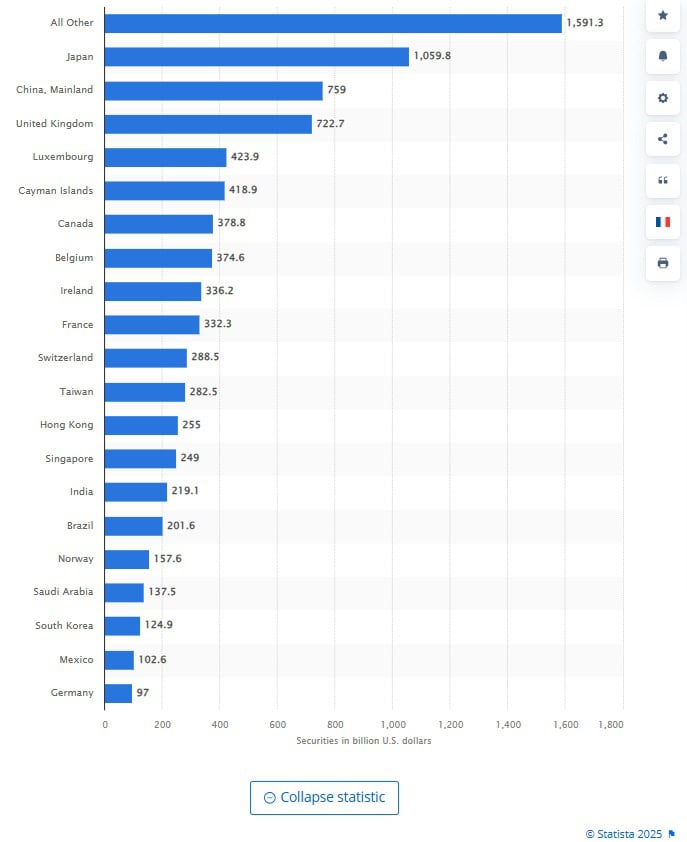

Today Tether holds more U.S treasury bonds than Saudi Arabia, South Korea, Mexico, or Germany. In fact there are only a few countries that hold more U.S. treasuries than Tether.

How long before stablecoins will be included as part of global dollar reserves?

Author: Andy Samu

#Tether #Stablecoin #USDT #Cryptocurrency #DigitalAssets

See Also:

Dr. Axel Weber Decodes Disruption in Banking at the Point Zero Forum | Disruption Banking