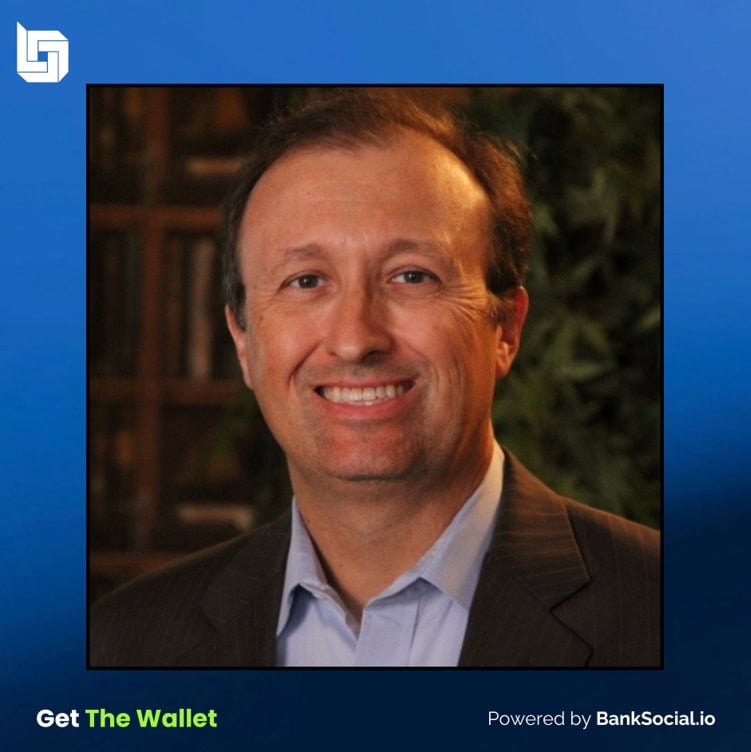

Dallas, TX – Feb 2026, Glenn Wheeler, a seasoned executive with more than three decades of experience shaping payments strategy, product innovation, and industry modernization, is emerging as one of the foremost thought leaders in the U.S. payments ecosystem.

Wheeler served as Vice President, Payments Strategy & Product Innovation at Catalyst Corporate Federal Credit Union, where he drove cutting-edge payments initiatives, including real-time and instant payment product strategy and ecosystem participation for Credit Unions nationwide. His time there was also spent leading strategic payments product management and operations, helping financial institutions modernize their payments infrastructure and leverage new rails such as the FedNow Service.

Earlier in his career, Wheeler held leadership positions across major industry organizations, including President and CEO of PaymentsNation and President of Viewpointe Clearing, Settlement & Association Services LLC. He also served as Vice President of Float Management for Bank One and held senior roles involving payments operations, strategy, and analysis at other financial institutions.

A respected speaker and industry voice, Wheeler is a frequent presenter at national payments conferences. His insights on instant payments, payments modernization, and the impact of artificial intelligence in financial services have been featured at events such as the NACHA Annual Payments Conference and the BAI Payments Conference.

In addition to his corporate leadership, Wheeler’s influence extends to the broader payments ecosystem. He has served on multiple industry task forces and boards, including working groups of the U.S. Faster Payments Council, where he contributes to advancing safer, faster, and more efficient payment systems in the United States.

“Payments systems are evolving at an incredible pace,” Wheeler says. “Innovation, collaboration, and a clear focus on delivering value for financial institutions and their customers must guide how we build the future of money movement.”

“Payments are no longer just about rails. They’re about orchestration, intelligence, and trust at scale.” John Wingate, CEO of BankSocial added about Wheeler’s addition. “Glenn understands that better than almost anyone. As we evolve our growth strategy to serve Corporate and Banker’s Banks alongside Credit Unions, his guidance will help us shape a more connected, modern payments ecosystem.”

Wheeler holds a Bachelor of Arts degree from the University of Texas at Arlington and continues to champion initiatives that support industry growth, operational efficiency, and the adoption of next-generation payment technologies.

About Glenn Wheeler

Glenn Wheeler is a seasoned payments executive recognized for his strategic leadership and contributions to payment system modernization. With leadership roles spanning credit unions, payment associations, and clearing networks, Wheeler is at the forefront of shaping how financial institutions leverage innovation, from real-time payments to emerging technologies.

About BankSocial

BankSocial (Fivancial, Inc.) provides unified programmable financial infrastructure for banks and credit unions. The platform enables real-time payments, self-custody digital asset wallets, and stock investing within a single, institution-controlled experience. Built on an ownership-first architecture, BankSocial powers modern financial services through APIs, event-streaming, and compliance-ready tooling.

Platform Availability

BankSocial’s platform is live and available for financial institutions.

Institutions can schedule a technical briefing and platform walkthrough at:

https://banksocial.io/contact-us/

The consumer application demonstrating the unified wallet experience is also available for download, showcasing real-time transactions, digital asset ownership, and integrated investing.