Avalanche’s network has become a major hub for institutional tokenization of real-world assets. In 2025, Avalanche’s total locked value in on-chain real-world assets (RWAs) surged nearly 950% to over $1.3 billion.

This dramatic growth reflects a wave of new initiatives bridging traditional finance with blockchain. Instead of retail-driven DeFi, Avalanche’s recent projects involve large-scale finance. Leading asset managers and banks launched tokenized funds and products, crypto-finance firms executed on-chain loan securitizations, and innovative yield-bearing stablecoins were issued for institutions.

Together, these initiatives highlight Avalanche’s expanding role as a compliant, high-throughput platform for regulated assets.

Institutional RWA Boom: $1.3B+ TVL Milestone

There are high-profile deployments that have collectively driven Avalanche’s RWA TVL past the $1.3B mark, providing a durable foundation for Avalanche in 2026.

Key projects driving this momentum include:

- BlackRock & RWA funds: The world’s largest asset manager launched a $500 million tokenized fund on Avalanche in late 2025, providing a major institutional endorsement of the network.

- Tokenized credit: Galaxy’s $75 M CLO (2025-1) on Avalanche (with $50 M by Grove) modernizes legacy credit onchain.

- Stablecoins: Fosun’s FUSD is an Asia-focused stablecoin on Avalanche; its primary liquidity is on Avalanche’s C-Chain.

- Banking integration: The Avalanche Digital Liquidity Gateway (FIS/Intain) connects thousands of community banks to institutional capital, with pilot trades expected in the hundreds of millions.

Key Upgrades Powering Enterprise-Grade Performance

Avalanche’s protocol saw key upgrades. In April 2025, the Octane fork slashed the base fee by ~99.6% and cut subnet costs by~83%, so simple transfers now cost only a few cents. In Nov 2025, the Granite upgrade added dynamic block times and biometric signing for sub-2-second finality. Together, these changes make Avalanche highly efficient for enterprise use.

As analysts note, Octane made transfers cost about $0.01 instead of $0.25, a very bullish change. These infrastructure gains sharpen Avalanche’s technological edge among Layer-1 blockchains, which should pay off if heavy real-world workloads arrive in 2026.

Record-Breaking Growth: Users, Subnets, and On-Chain Activity

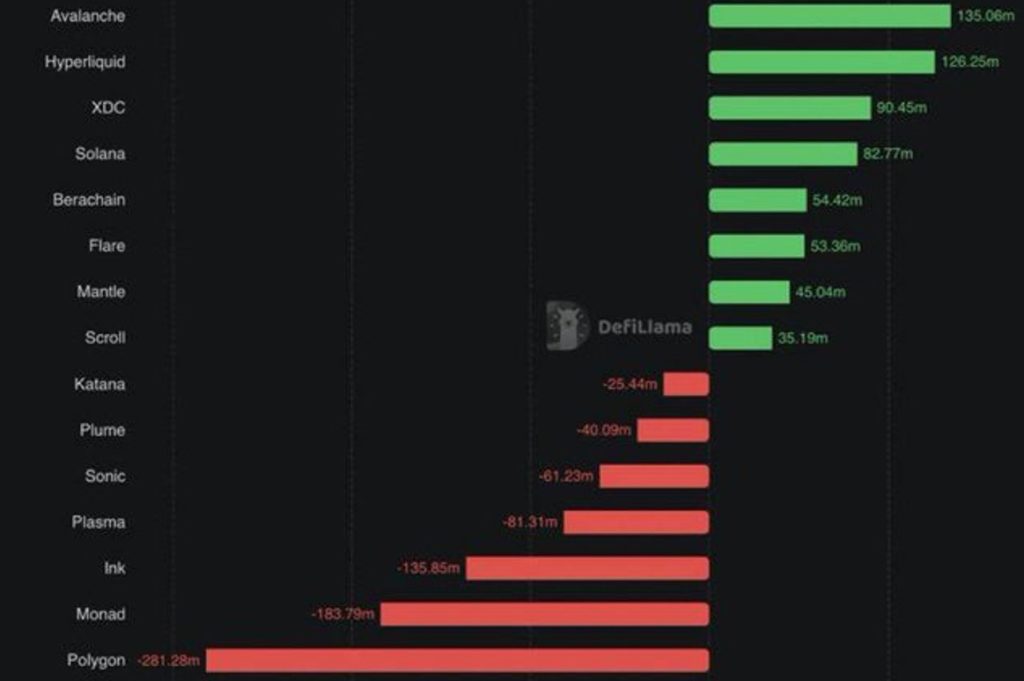

Avalanche led all chains in net inflows ($135M) as of Feb, 2026, showing strong capital interest even as the market was quiet. Avalanche’s usage metrics have exploded. By end-2025, the network had 75 active subnets (up to 158% YoY), and aggregate onchain activity hit new records: ~38.2 million daily transactions and ~24.7 million active addresses in Q4 2025.

- Activity spikes: Transaction volume and addresses are at multi-year highs. Even in a flat market, Avalanche saw $135M in net inflows in early Feb 2026 (chart above), reflecting renewed interest.

- DeFi TVL up: Total value locked (TVL) in Avalanche’s DeFi (in AVAX) rose 41.9% QoQ in Q4 2025 to 102.8M AVAX, a sign of sticky liquidity.

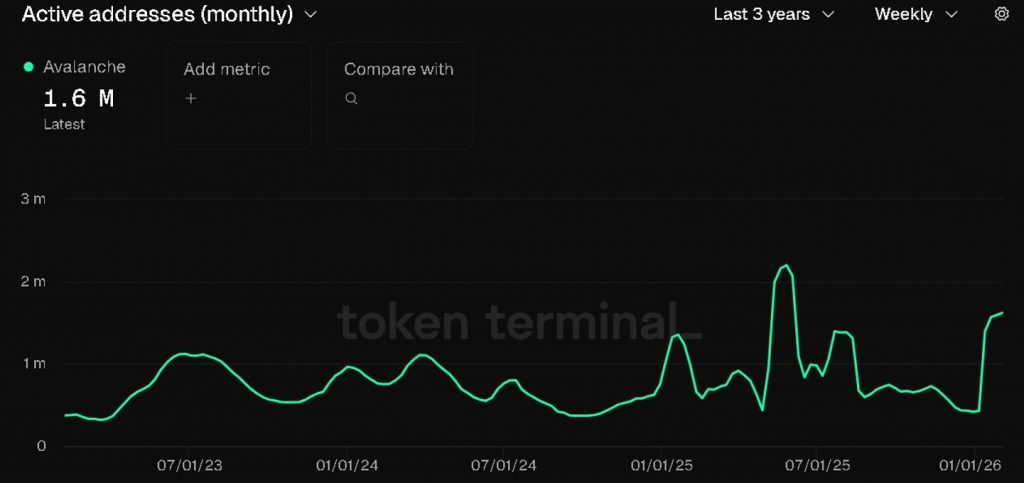

- User engagement: Active addresses jumped 242% since Jan 2026 to ~1.6–1.7 million on Feb 10. This surge is extraordinary in a bear market, indicating onchain usage is accelerating even as prices fall.

These trends underscore real adoption. Avalanche’s build-out has been “steady,” focused on usage rather than hype. In other words, usage is surging even while AVAX’s price is weak. Such decoupling often indicates underlying strength; networks built on real demand tend to recover value when sentiment shifts.

Price Lag Amid Robust Fundamentals

Despite strong fundamentals, AVAX’s price has lagged. It fell from ~$30 (Sept 2025) to ~$12.3 (Dec 2025), and by early 2026 traded around $9–$13. This downtrend has been sharp: AVAX retraced ~84% from its Oct 2025 peak and sat near $9 support. Technical indicators were very oversold into Feb 2026, suggesting buyers may get a chance.

Traders are cautious. Macro risks and unlock schedules have pressured AVAX, and on-chain charts reflect continued bearish pressure. However, on-chain data tell a different story: capital inflows and user growth continued even as the price fell.

Many see AVAX as undervalued given its growing usage. If Avalanche’s usage gains translate into staking and fees, AVAX could rebound sharply; if not, it may only rise with the broader crypto market. For now, this highlights AVAX as a crypto asset with strong fundamentals but short-term risks.

2026 Scenarios: Bull, Base, and Bear Cases for AVAX

Analyst projections for AVAX vary widely. One model sees only modest gains (AVAX ~$13.8 by late 2026). More optimistic scenarios assume continued expansion: for example, a forecast chart puts AVAX in the $60–$85 range by end-2026 under moderate growth (and even topping $100 with an extended bull run). The difference reflects the timing of the crypto cycle and Avalanche’s market share.

Plausible 2026 paths include:

- Moderate growth: Steady institutional adoption and a mild crypto upcycle. AVAX could reach ~$15–$25 by late 2026 as network activity drives demand.

- Bullish surge: Rapid embrace of RWA and DeFi use cases during a crypto bull market. AVAX might climb $30+ by year-end, fueled by heavy onchain throughput.

- Extended consolidation: Macro or regulatory headwinds persist. AVAX stays under ~$15 for most of 2026, as fundamentals improve, but token value waits for clear catalysts.

It’s clear that Avalanche’s value comes from real onchain utility. If its enterprise and RWA projects generate real transaction volume and staking, the AVAX token should benefit. Otherwise, AVAX will likely just track broader market sentiment. In 2026, the networks with the most substance will win. Avalanche now has a lot of substance.

Avalanche’s True Edge: Real Utility Over Hype

Avalanche’s technology and adoption are far stronger than its price indicates. A bullish market would likely lift AVAX, but even a stable market would see AVAX slowly catch up as its fundamentals materialize. One should be prudent, don’t expect a parabolic spike without external catalysts. Instead, see gradual appreciation backed by real usage.

AVAX looks undervalued given its onchain growth. Its best strength for 2026 is concrete: network activity, subnets, and real-world projects. Watch those as they will determine how strong AVAX truly becomes in 2026.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Is Avalanche (AVAX) About To Start A Bull Run? | Disruption Banking