After months of investigation, the Texas State Securities Board has ordered TEXITcoin to cease and desist operations. Disruption Banking has been aware of this investigation for months.

The order, posted on the Board’s website, reads, in part, “The Texas State Securities Board has issued an Emergency Cease and Desist Order against TEXITcoin, MineTXC, Blockchain Mint, and their founder Robert J. Gray for alleged violations of the Texas Securities Act related to the fraudulent offer and sale of cryptocurrency mining investments to Texas residents.”

The hammer came down, and Robert “Bobby” Gray, founder of TEXITcoin, fled to Hong Kong, which doesn’t have an extradition treaty with the US. He hasn’t stopped selling TEXITcoin, either. On February 12, the day after the cease and desist (C&D) order, Gray hosted a Zoom call with an audience of new investors.

Disruption Banking was on the call, recording Gray’s bizarre confessions.

Seemingly aware of his legal exposure, Gray exclaimed, “I’m over in Hong Kong… I’m going to stay out here… People will accuse me of running.”

At another moment, Gray confided to his audience, “We had crisis management meetings over the last couple days.”

What was clear is that Gray doesn’t believe himself bound by the Texas State Securities Board or any other regulatory or law enforcement agency. Like Dignan in the iconic Wes Anderson film “Bottle Rocket”, Gray seems to think, “They’ll never catch me… because I’m f***ing innocent.“

Rocket Ship Gets Served

All three listed entities were served at 424 Rose Garden Drive, in McKinney, Texas. Gray ridiculed the authorities for choosing what he called “a garage” to serve court orders. Nevertheless, the Board specified the mining part of Texitcoin as a “multi-level marketing matrix,” which Gray has continuously disputed on his YouTube channel and during his lengthy Zoom rant.

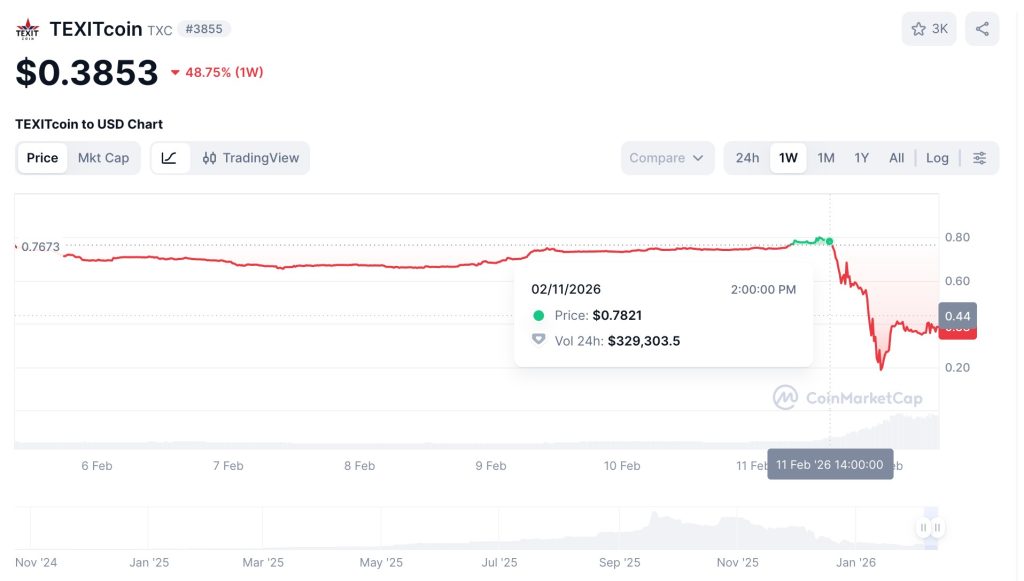

Coinciding with another drop in value of almost 50%, the C&D order comes after the price of TEXITcoin has already collapsed since reaching a high of $6.35 in September of last year, hovering below or near $1 for the past month.

Texit Raider, a YouTuber, said of the price crash, “Trust in the project was damaged, probably obliterated,” after earlier admitting that he had personally suffered major losses.

In the last weeks, Gray has been hard at work on a pivot to new crypto tokens Gray calls Downtown Digital Dollars, as well as a new shitcoin, Iskander, which abandoned the professed Texas-only operations and origin of TEXITcoin.

Disruption Enters the Gray Fray

Disruption Banking has been reporting on the TEXITCoin scam since September. Our stories first explored the project and its staff, finding little evidence of the existence of several integral staff members. The second story revealed a security breach affecting hundreds of investor accounts, and the third investigated the project’s illusory claims of sponsorship and mining. The fourth explored a year-old security breach, disclosed by Gray during a Miner’s Update, videos he records and posts on YouTube.

Disruption Banking became intrigued with the project after receiving a tip that the company was misrepresenting the nature of its flagship token as decentralized when, in fact, one person controlled every part of the business and made all the decisions. Gray openly admitted in his weekly Miners Updates that he was manipulating the price of the coin, managing sales when investors wanted to exit their positions, and deciding who could mine the coin.

All of these facts made the representation of the coin being decentralized very hard to believe, yet many retail investors in Texas and other places did not catch on to Gray’s deceptions.

Deputy Securities Commissioner Cristi Ramón Ochoa was quoted as saying, “In cases like this, when investor harm is immediate and ongoing, it’s imperative we act quickly. Their diligent, thorough, and swift work will help prevent further investor harm. This also serves as a stark reminder to investors to be cautious of investment opportunities they may come across on social media channels. Especially ones promising passive returns tied to cryptocurrency mining, particularly when promotions rely heavily on recruitment incentives instead of legitimate investment performance.”

Recruitment Over Returns: The MLM Allegations

Already, the project had been letting staff go and working on a new iteration of its website, which was unfinished and facing many setbacks and obstacles in its pursuit of selling mining shares, which Gray referred to as “seats on the rocket ship.” There was increased pressure on investors to bring in more people from among their friends and family, hallmarks of a multilevel marketing operation.

CoinMLS, a certified blockchain researcher, wrote in an email to Disruption Banking, “The supporters seem to think all Bobby has to do is register and pay a fine. The coin should be under $.10 by now, but it’s not, the hopefuls keep buying. The project is done. If Bobby were to try to keep going, I can’t imagine trying to pitch local currencies to cities with this hanging over your head. Texas’ fraud charges centered on failures to disclose, but I’m pretty sure the SEC will cover the technical fraud as well.”

No Lawyers, No Problem!

Gray is in way over his head, and he reportedly doesn’t have counsel.

On the Zoom call, he proclaimed to an audience of reporters who he thought were new marks, “We don’t have any attorneys. You know, we’ve got lots of people that know attorneys. We’ve got plenty of attorneys that are part of our mining community that have, you know, said to us from time to time, ‘Hey, you should probably sit down with an attorney and get a plan together for what you’re going to do when that day comes.’ Um, and and so, you know, this is all brand new. We don’t have, you know, uh boardrooms full of attorneys on retainer that were just sitting around waiting for this stuff to come in. Why? Either because we deluded ourselves or because we legitimately haven’t been doing anything wrong.“

In the course of our reporting on the TEXITcoin project, Disruption Banking received an unusual outpouring of support, tips, and accusations of investors who were defrauded, as well as defenses of Gray by investors trying to protect the value of their investment. We also received unverified reports that Bobby Gray and his partner have been investing in luxury real estate, as well as founding new LLCs to allegedly hide their ill-gotten gains. If true, regulators will likely confiscate many of those assets and entities to compensate the victims.

At First, TEXITcoin Investors Stand By Their Man

Gray’s supporters are taking the C&D order in stride, and many remain supportive of the project.

In a TEXITcoin group on Facebook, a user wrote, “An order like this can be a problem even if you believe in the mission, because regulators don’t need to argue about ‘crypto’ in general — they focus on how something is sold. Read the C&D carefully. It focuses on how the packages are marketed. That said it still needs to be litigated; it is not final unless there is no response within 31 days. The biggest red-flag area isn’t ‘mining exists.’ It’s the way mining packages can be described or marketed: Why the “packages” issue matters. If someone buys a package but doesn’t own or control specific mining hardware, that starts to look less like “I’m mining” and more like “I invested in someone else’s operation.”

Most commenters seemed wholly ignorant of Texas law, assuming that the order would be tread underfoot and that the project would continue as if nothing happened. They also, of course, don’t know that Gray has fled the country.

Unrepentant, Gray declared, in his Hong Kong hotel room, “First of all, we don’t have money for refunds. And even if we did, we wouldn’t do them anyway,” adding, “Now is a terrible time to sell and liquidate your TXC… the market’s fragile right now. There’s not a lot of liquidity out there.”

He added more detail, answering his own question, “‘Why not let people outside of Texas continue to do business?’ Well, the answer to that is really simple. All of our accounts are frozen. And so, if you send us money and we need to pay commission and we’re unable to do that, then all of a sudden now we’ve become the fraud that they have accused us of being.”

Then, The Dam Breaks

Other than the usual trolls, few of the TEXITcoin faithful openly criticized Gray, at first.

One user who had “TEXIT” in his profile name wrote, “Bobby had to know this before it was released. This is why he started Islander (sic). He should refund miners their investments.”

Later, another came forward, testifying, “As I began to pull back the curtain of this charade, I realized that the only real money being made was by the people at the top selling large packages. There was no real money being made in the crypto at all, and it was attached to absolutely nothing. Further investigation proved that this is a one man operation, and he is more of a hype, sales artist than he is any kind of a real entrepreneur. Nothing about this project has been built on sound financial principles. Part of me does not want to use the word ‘scam’, But I will very happily at this point at least refer to it as a ‘sham.'”

Previously, this kind of commentary was not coming from inside the community, but the Texas State Securities Board announcement seems to have caused the dam to break.

Mista Phi, a YouTuber who Disruption Banking quoted in an earlier article, said of the C&D order, “The SEC is gonna be looking at this fairly quickly.” He advised investors to exit their positions and “get what you can out now.“

Gray: Regulators Playing “Softball”

For his part, Gray is apparently not worried, referring to the C&D order as “a softball,” adding, “You don’t have to comply with an order… they have to go to court… motion to compel… contempt…”

In fact, Gray seems to think he can turn the tables on the regulator and sue them!

On Zoom, he said, “Let’s get some clarity on this [C&D order] because, you know, we’re a substantial entity in the state. A lot of lives are affected, you know, quite deeply by what you’ve done. The reputational damage is gigantic. Um, you know, you’ve made a lot of claims and accusations. We haven’t seen any proof or evidence to back up this claim about the security.”

He went on and on, pondering his options, “Let’s uh let’s double check as to whether or not Mr. Gray could be served on that dirt road with the the garage. Um let’s see if you know, you got it right before you end up harming more people in the state of Texas than we have been alleged to have harmed.“

TEXITcoin’s trajectory underscores how quickly hype can unravel when governance opacity meets regulatory scrutiny. In a market still grappling with the boundaries between innovation and compliance, the Texas order signals that branding alone cannot shield crypto ventures from the consequences of concentrated control, recruitment-driven growth, and alleged nondisclosure.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Is Texit Coin Too Good to Be True? | Disruption Banking

TEXITcoin Founder Finally Admits Year-Old Insider Hack & Investors Are Furious