Brent crude is trading around $70 per barrel at the time of writing. Prices are being supported by tensions in the Middle East. But most forecasts suggest the market is heading into a period of weaker prices as global supply continues to rise.

Several analysts warn that growing production from non-OPEC countries could push average prices into the mid-$50s in 2026. At the same time, any major supply disruption could quickly reverse that outlook and send prices sharply higher.

Recent U.S. maritime warnings around the Strait of Hormuz have added an estimated $4 per barrel risk premium, according to analysts.

There is a clear case for both lower and higher prices in 2026. The oil market was already showing signs of strain last year. Since then, inventories have grown further and supply risks remain active.

So, will Brent hold above $60, or fall under pressure from oversupply? Below are the key forces shaping the outlook.

OPEC+ Holds the Line: Output Frozen at 43 mb/d Through Q1 2026

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) has paused further output increases for the first quarter of 2026. The group is keeping production steady after adding 2.9 million barrels per day (mb/d) since April 2025.

The eight core producers, Saudi Arabia, Oman, Kazakhstan, Russia, Kuwait, Iraq, the UAE and Algeria, confirmed this decision in January. They pointed to seasonal demand weakness and stable market conditions.

This freeze is designed to support prices. However, OPEC+ is still producing below its full capacity. Spare capacity could fall toward 2.4 mb/d by the end of the year if sanctions remain in place.

If the group maintains current limits, prices may stay supported in the short term. But if OPEC+ decides to unwind its 1.65 mb/d voluntary cuts earlier than expected, the market surplus could grow quickly and pressure prices lower.

Reminder: 2026 is to witness the peak in non-OPEC supply at a time when demand is expected to grow to 2050 and OPEC has only ~1.4MM bbl/d of excess capacity. By the time Venezuela can mount any meaningful increase in supply (3+ years?), the world will desperately need it. pic.twitter.com/RXGDprfSDb

— Eric Nuttall (@ericnuttall) January 3, 2026

The Surplus Wave Builds: IEA Flags 4.25 mb/d Q1 Overhang

The International Energy Agency (IEA) expects a surplus of 4.25 mb/d in the first quarter of 2026, equal to roughly 4% of global demand. Total oil supply reached 107.4 mb/d in December 2025. Although slightly below September’s peak, output is still expected to grow by 2.5 mb/d this year to 108.7 mb/d.

Most of this growth is coming from non-OPEC+ countries. Brazil, Guyana and Argentina are adding around 0.6 mb/d combined. This offsets slower growth in U.S. shale production.

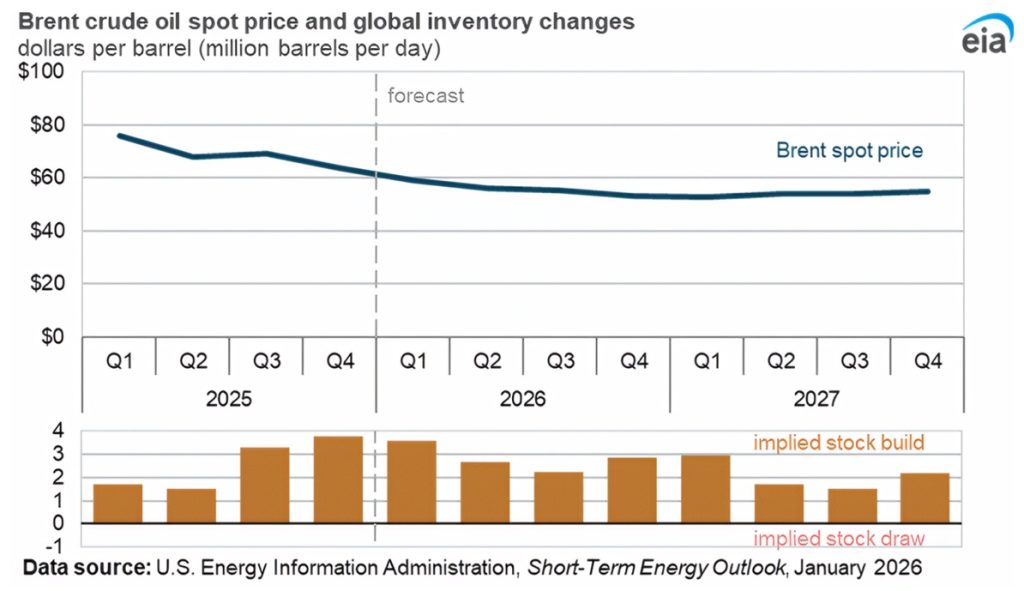

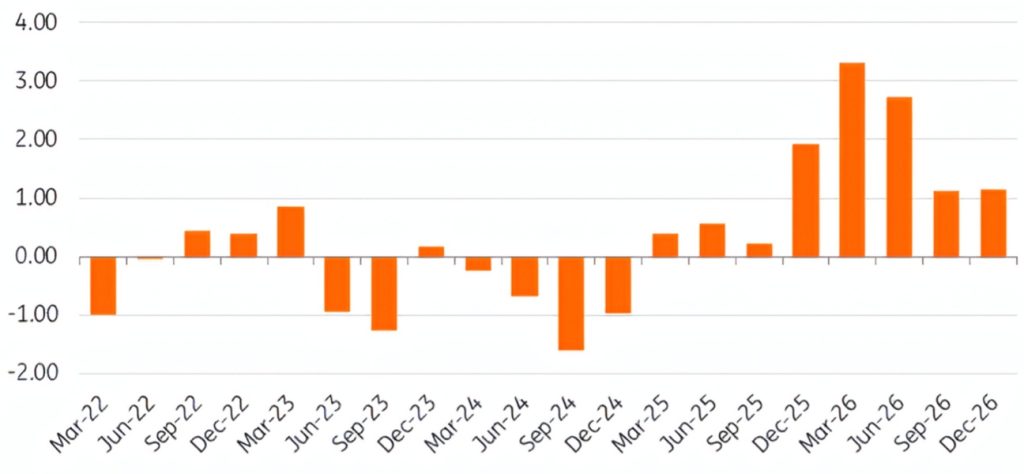

U.S. Energy Information Administration (EIA) expects significant inventory builds in 2026 as production outpaces demand, averaging 3.1 mb/d, similar to last year’s increase, per the EIA’s Short-Term Outlook (STEO) forBrent oil. Floating storage also expanded in 2025, reducing the impact of supply tensions in Russia. Large inventories act as a buffer. They limit sharp price spikes. But if demand weakens further, they could also push prices down more quickly.

Some analysts surveyed by Reuters believe oversupply will outweigh geopolitical risks, keeping Brent near $60. Standard Chartered, however, notes improving sentiment as U.S. inventories fall and shale growth slows.

If the surplus peaks early in the year, the market could rebalance in the second half of 2026.

Geopolitical Flashpoints: Iran Disruption Risks $91 Brent Spike

Geopolitical tensions remain the main upside risk.

The Middle East has already contributed to price swings this year. The IEA noted that tensions added roughly $6 per barrel in early January before easing later in the month.

BloombergNEF estimates that a complete halt to Iran’s 3.3 mb/d exports, an unlikely but possible scenario, could push average Brent prices to $71 in Q2 and as high as $91 in Q4 2026.

Tighter sanctions on Russia could remove up to 0.9 mb/d from OPEC+ supply targets. At the same time, natural decline in older fields such as Mexico’s reduces output elsewhere. Tensions in the Middle East, including renewed Israel-Hamas escalations, also keep risk premiums in place.

Historically, geopolitical tensions add short-term premiums of $1–3 per barrel. These premiums fade quickly unless actual supply is disrupted.

In a year shaped by elections and policy shifts, unexpected events could still make the price of Brent stronger than current bearish forecasts suggest.

Demand Growth Stalls: Renewables Cap Rise at 930 kb/d

Demand growth is improving slightly but remains modest. The IEA expects oil demand to grow by 930,000 barrels per day (kb/d) in 2026, up from 850 kb/d last year. Growth is mainly driven by petrochemicals and emerging markets.

However, efficiency gains and electric vehicles (EVs) continue to limit fuel demand, particularly in the Organisation for Economic Co-operation and Development (OECD) countries.

In some markets, EVs now represent up to 40% of new vehicle sales. China and parts of Southeast Asia are reaching these levels earlier than expected. Biofuels and changes in air travel patterns are also reducing demand growth.

The EIA expects global oil consumption to rise by around 1.1 mb/d, before slowing further in 2027 as renewable energy sources expand.

China’s strategic purchases and improved trade conditions are stabilising demand. But energy transitions in Europe and the U.S. continue to limit upside potential.

Deloitte expects U.S. renewable capacity additions of 30–66 gigawatts annually through 2030. While this is below earlier peaks, it still reduces long-term oil demand growth.

Unless emerging markets exceed expectations, demand growth alone is unlikely to tighten the market significantly.

2026 Price Outlook: Consensus in the $50s–$60s, With Geopolitical Wildcards

Analysts seem to have differing views on Brent’s fate in 2026. The forecasts cluster around the high-$50s to low-$60s.

- The EIA expects an average of $58 per barrel

- Reuters’ January poll of 31 experts places Brent near $62

- Goldman Sachs expects around $56, with a Q4 low near $54

- UBS forecasts $62, with recovery in the second half

- J.P. Morgan expects $58, dismissing Trump-era boosts.

“However, while the recent de-escalation in trade talks has reduced the probability of a bear case, the ‘Trump put’ does not extend to energy as the administration continues to prioritize lower oil prices to manage inflation,” said Natasha Kaneva, head of Global Commodities Strategy at J.P. Morgan.

- Trading Economics projects Brent at $69 at the end of Q1, rising toward $75 over 12 months.

- Fitch forecasts $63 for 2026.

Most projections assume supply growth will outpace demand.

However, BloombergNEF’s disruption scenario shows that prices could move much higher if major exports are halted.

The consensus outlook is cautious, but volatility remains a real risk.

This was from a couple weeks ago:

— Neil Sethi (@neilksethi) February 7, 2026

MarketWatch: Citi’s oil analyst Francesco Martoccia raised his target for Brent over the next three months from $65 per barrel to $70 due to the heightened geopolitical turbulence witnessed so far in 2026.

In a report published Jan 20th,… pic.twitter.com/9BUfbjxbxe

U.S. Shale Peaks Out: Growth Flatlines Near 13.6 mb/d

U.S. production reached a record 13.6 mb/d in 2025. The EIA expects growth of less than 1% this year, followed by a 2% decline in 2027. BloombergNEF expects slightly stronger growth of about 3% in 2026, reaching 13.8 mb/d.

However, investor discipline is limiting how quickly companies expand drilling. If prices fall toward $40, output could decline by 400 kb/d, according to CEO Jarand Rystad of Rystad Energy.

Slower U.S. growth reduces global supply pressure slightly. But it may not be enough to offset rising output elsewhere.

The Verdict: Brent Likely Around $60 in 2026, Volatility Ahead

The balance of evidence suggests moderate prices. Oversupply and slower demand growth point to averages in the mid-$50s to low-$60s. That is the base case. However, geopolitical disruptions could add $10–30 per barrel temporarily.

OPEC+ decisions will be critical. If the group extends production cuts, prices may hold firmer. If it increases output, the surplus could grow.

Without major shocks, Brent is likely to remain contained rather than break sharply higher.

The most realistic range for 2026 appears to be around $60 per barrel on average, with periods of volatility above and below that level.

2026 is shaping up to be a year of moderate prices, not a collapse, but not a sustained breakout either.

Author: Richardson Chinonyerem

#Oil #Energy #Commodities #Geopolitics

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Is The Oil Market Broken? | Disruption Banking

What Will The Price Of Crude Oil Be In 2024? | Disruption Banking