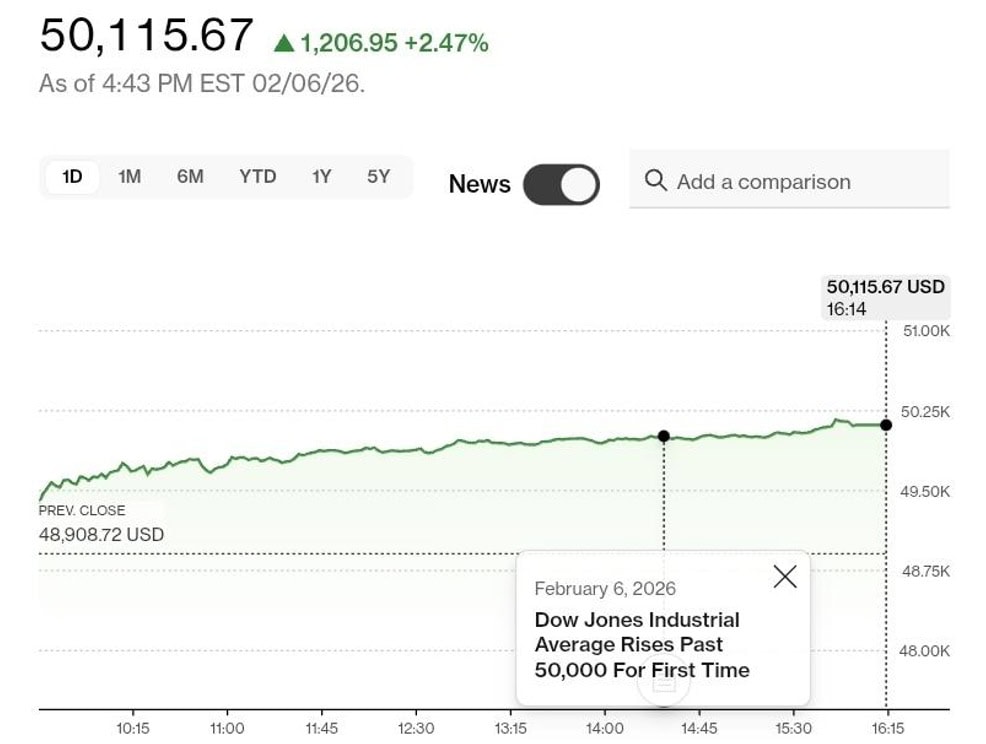

The Dow Jones Industrial Average (DJIA) shattered its own record on Friday, leaping past the 50,000-point mark for the first time ever. In a single trading session, the blue-chip index rallied roughly 1,207 points (2.5%), closing just above 50,000.

It represented a stunning reversal after the brutal tech selloff that wiped $285 billion off software stocks earlier in the week. This followed Anthropic’s Claude Cowork plugins being announced, including legal and finance tools. Free tools to automate things like legal services.

Dow Hits 50,000 Milestone: Trump Celebrates Amid Market Rebound

The 129‑year‑old indexcleared the milestone shortly after 2 p.m., finishing at 50,115.67, as investorsrotated aggressively into value, industrials, and select technology names following a volatile week. It was the Dow’s strongest one-day advance since May 2025, lifting the benchmark well beyond its January highs.

To put the move in perspective, many of the largest single-day point gains in Dow history have now occurred in the last twelve months, underscoring just how turbulent, and reflexive, markets have become.

Even President Donald Trump weighed in, declaring on social media: “The Dow Jones Industrial Average just hit 50,000 for the first time in History. CONGRATULATIONS AMERICA!”

Donald J. Trump Truth Social Post 02:47 PM EST 02.06.26

— Commentary Donald J. Trump Posts From Truth Social (@TrumpDailyPosts) February 6, 2026

The Dow Jones Industrial Average just hit 50,000 for the first time in History. CONGRATULATIONS AMERICA!

Goldman Sachs and Caterpillar Drive Dow Rally: Key Stocks Hit Records

The rally wasn’t driven by Big Tech alone. Goldman Sachs and Caterpillar, the two heaviest stocks in the price-weighted index, surged 4.31% and 7.1% respectively, with Caterpillar hitting a record high. Goldman Sachs alone represents 11.97% of the Dow, while financials account for 27.8% of total holdings. A massive tilt that helped the blue-chip index outperform the S&P 500 by nearly three percentage points year-to-date.

The index’s defensive positioning paid off during this week’s chaos. The tech-heavy Nasdaq fell 1.8% for the week amid fears that AI agents would displace traditional SaaS companies. But the Dow rose 2.5% week to date, benefiting from rotation into economically cyclical stocks. The iShares Expanded Tech-Software ETF plummeted 24% to start 2026 before Friday’s partial recovery.

Nvidia Stock Surges 7.8%: Rebound from Weekly AI Selloff Losses

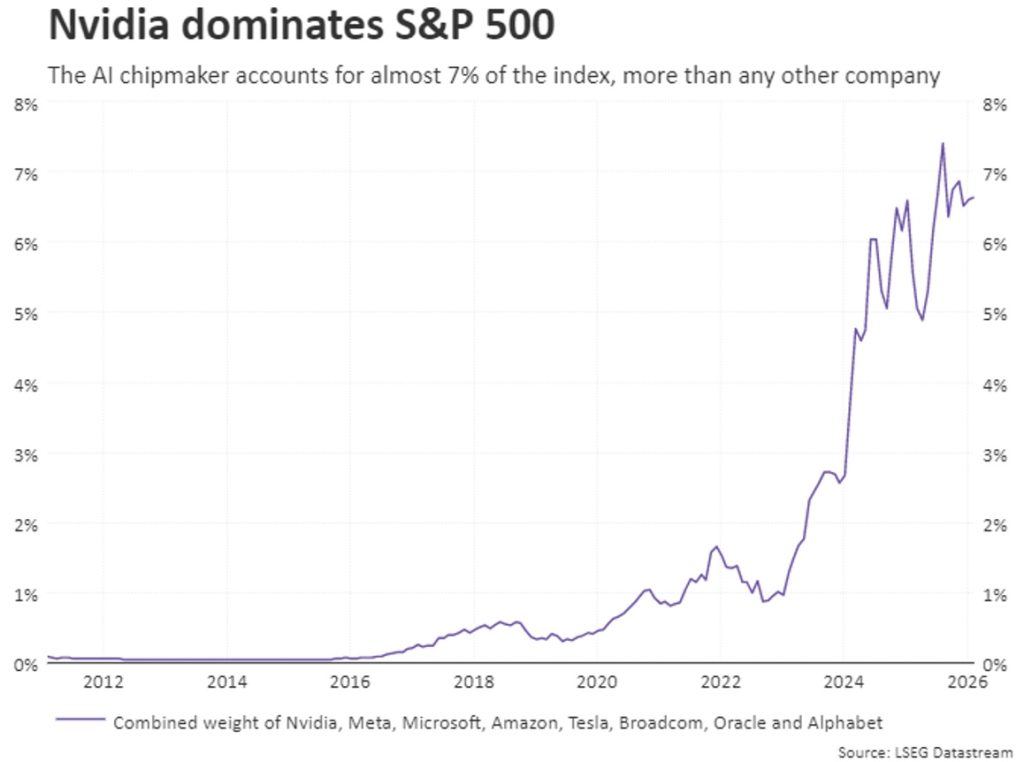

Friday’s snapback was led by the same AI stocks that had suffered the worst punishment. Nvidia surged 7.8% to trim its weekly loss from over 10%. Broadcom climbed 7.1% to erase its drop for the week entirely.

The two chip giants were the strongest forces lifting the S&P 500, which jumped 1.97% to 6,932.30, crawling back into positive territory for 2026.

Markets Reassess AI Threats: Recovery from SaaS Software Selloff

The reversal came as investors re-evaluated whether Anthropic’s Claude Cowork legal and finance plugins posed an immediate existential threat to enterprise software. Thomson Reuters and LegalZoom eachplunged more than 15% earlier in the week, alongside RELX and FactSet.

One notable laggard was Amazon, which slipped about 5.6% after announcing plans to boost 2026 capital expenditures in AI infrastructure by more than 50%. Echoing similar AI-driven spending signals from Alphabet earlier in the week.

The divergence highlighted a defining feature of the session: enthusiasm concentrated in stocks where expectations had already been compressed.

But some analysts argued the selloff was overdone, with Dan Ives of Wedbush noting enterprises can’t simply “snap their fingers” and migrate to AI models at scale.

The Great Market Rotation: Value Stocks Triumph Over Growth in 2026

The 50,000 milestone reflects a fundamental shift in market leadership. The Dow’s 4.3% year-to-date gain has crushed the S&P 500’s 1.3% return. This happened as investors rotate from growth to value, from tech to industrials and financials. The Russell 2000 surged 3.6% on Friday as small-caps joined the party.

Matt Dmytryszyn of Composition Wealth told CNN the milestone shows “we’re seeing a broadening in the market. It’s not just tech stocks and AI.” With the 10-year Treasury yield at 4.21% and unemployment holding at 4.4%, the economic backdrop supports further gains if corporate earnings deliver in the coming quarters.

Whether Friday’s rally marks the end of the “SaaSpocalypse” or just a brief reprieve remains unclear. The market has sent a brutal message: companies unable to prove “AI-defensibility” are being discarded. For the Dow’s old-economy giants, banks, manufacturers, industrials, that message has been a gift.

#Markets #AI #BlueChips #DowJones

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.