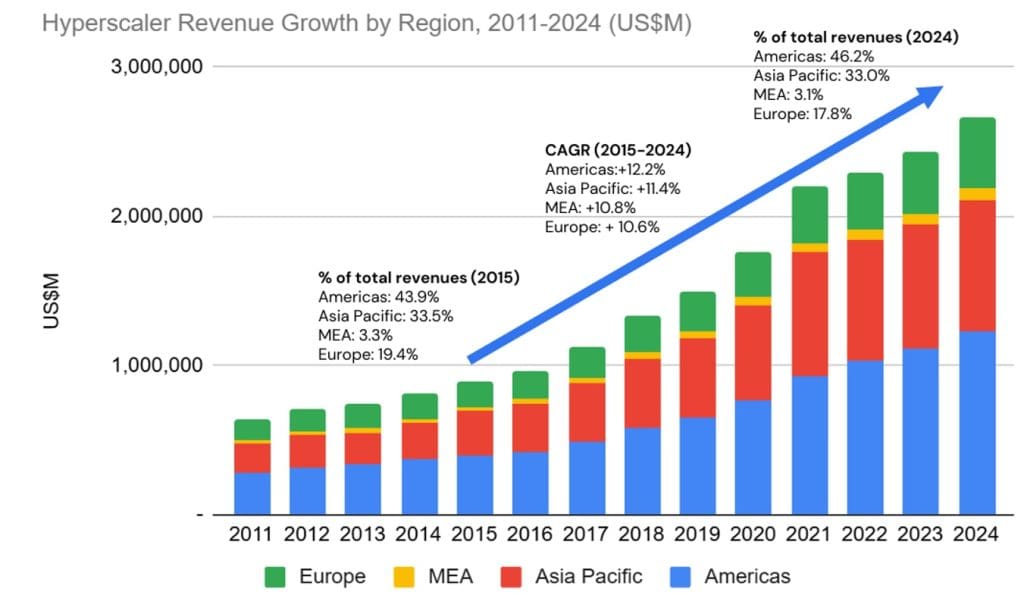

New TDICA and MTNC report tracks hyperscaler expansion, the widening US-China gap, and what it means for Asia’s infrastructure, policy, and investment decisions

Singapore, 29 January 2026 — The Digital Infrastructure Collective (Asia) (TDICA), in partnership with US telecommunications research house MTN Consulting (MTNC), today released its inaugural Hyperscaler Trends Report, examining how hyperscaler ambitions are accelerating AI infrastructure buildout and reshaping where capital, capacity, and competitive advantage are concentrating.

The report comes as governments and operators across Asia accelerate plans for AI-ready infrastructure, with power availability, data center capacity, and cross-border connectivity emerging as immediate constraints and strategic levers.

Key findings from the report:

- Hyperscaler capex has climbed at a historic pace, rising more than 3.5x over the last five years, with 2025 spend approaching US$500 billion and continued expansion expected as AI workloads drive demand for compute, storage, and networking capacity.

- A significant gap persists between US and Chinese hyperscalers across revenue, market share, and capex, signaling uneven global AI infrastructure leadership alongside the development of parallel ecosystems.

- Opinions on an “AI bubble” are mixed, with credible voices split between caution about overheated investment and conviction that AI remains in an early, generational build phase.

Implications for Asia’s infrastructure race and strategic positioning

The report details how hyperscaler intentions are shaping the AI infrastructure buildout, and how this is complicated by the ongoing US-China technological contest. As hyperscalers scale data centers, subsea connectivity, chips, and energy procurement, Asia is likely to become a focal region in the geopolitical game. The findings are most relevant to Asian governments and regulators, grid and energy players, data center operators, telcos and connectivity ecosystems, and investors assessing where the next cycle of AI infrastructure advantage will concentrate.

For Asia-based decision makers, the implication is practical: countries and companies should stay abreast of fast-moving developments in the hyperscaler space to mitigate risks and leverage opportunities. The ability to distinguish between reality and hype, and to define and execute on strategy, will be critical to navigating and winning the AI race.

US-China rivalry as the backdrop

The report situates hyperscaler expansion within intensifying US-China technological competition, a contest that now spans the full technology stack, from semiconductors to networks to cloud platforms and consumer applications. US hyperscalers currently dominate AI development and deployment, while Chinese firms, propelled by state-backed financing and industrial policy, are building parallel ecosystems, with profound implications for national competitiveness, supply chain resilience, and digital sovereignty.

“Hyperscaler intentions are now driving AI infrastructure buildout, and that buildout is increasingly shaped by the US-China technology contest. For Asia, the priority is to separate signal from noise, understand where the real constraints and opportunities are forming, and execute with clarity,” said Tim Lin, Partner at The Digital Infrastructure Collective (Asia).

“Key stakeholders and global investors remain optimistic about the ‘AI promise’, but tempering unchecked exuberance will help avoid the pitfalls of past bubbles and harness AI’s transformative potential,” notes Matt Walker, Founder and Chief Analyst at MTN Consulting, LLC.

The analysis uses a consistent definition of “hyperscaler” and draws on multi-year research compiled and tracked by TDICA and MTNC, combining proprietary tracking with market information for benchmarking and context.

About The Digital Infrastructure Collective (Asia)

The Digital Infrastructure Collective (Asia) is a collective dedicated to strengthening Asia’s digital backbone. Through independent research, policy guidance, and strategic partnerships, we empower governments, investors, and operators to build secure, inclusive, and sustainable digital infrastructure.

About MTN Consulting, LLC

MTN Consulting is a boutique analyst firm specializing in the global digital infrastructure market. Since 2017, we have provided independent, data-driven analysis to help clients worldwide make strategic, long-term decisions. We offer clarity on the entire ecosystem – from telecom networks and data centers to AI infrastructure – with validated data you can trust.