Hong Kong’s stock market started 2026 on a strong, optimistic note. But that early momentum is starting to fade. Investors are growing more cautious as they wait for key China economic data and weigh fresh geopolitical risks.

Hang Seng Drops 1.1% to Weekly Low

The Hang Seng Index fell 1.1% to 26,563.90 on Monday, its lowest level in a week, as signs of slower growth in mainland China ran into fresh US tariff threats. The tech-heavy Hang Seng Tech Index also slipped 1.2%. It showed rising unease across high-growth stocks.

The drop follows a sharp 28% rally in 2025, Hong Kong’s strongest year since 2017, and a solid start to the new year. Many investors had piled into the China reopening and tech self-reliance trade. Now they are taking a step back. Slower growth signals combined with renewed trade-war concerns are forcing a rethink. It’s a reality check for a market that had been expecting a much smoother 2026.

2026 Rally Fades Fast After Strong Start

The new year began on a high note. On the first trading day of 2026, the Hang Seng Index jumped 2.8%, its biggest one-day gain since May, climbing to the highest level in nearly two months. The benchmark’s 28% gain in 2025 marked a sharp turnaround, driven by heavy southbound inflows from mainland China. And the return of foreign investors after years of deep pessimism. Emerging Portfolio Fund Research (EPFR) data showed a notable pickup in overseas fund inflows during the rebound.

That bullish tone has since been tested. Last week’s pullback snapped the early-2026 rally as traders locked in gains and braced for China’s fourth-quarter GDP release. Monday’s 1.1% decline underscored how quickly sentiment has turned. “Today’s economic data really wasn’t a positive surprise,” remarked Dickie Wong, Hong Kong head of research at uSmart Securities. With valuations no longer cheap after the surge, investors are becoming more selective and less willing to chase momentum.

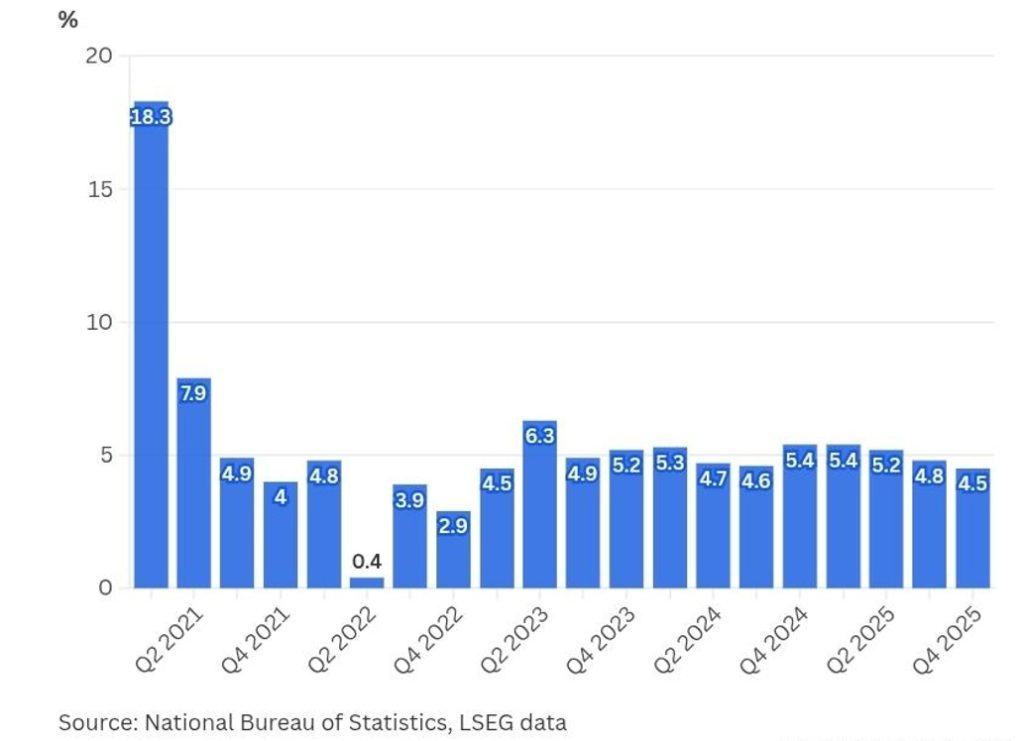

China GDP Slows to 4.5% in Q4

China’s economic trajectory is back in focus after official data showed GDP expanded 4.5% year-on-year in the fourth quarter, slowing from 4.8% in the prior quarter and marking the weakest pace in three years. While the figure broadly matched market expectations, it reinforced concerns that underlying momentum remains fragile. For the full year, China’s economy grew 5.0%, exactly meeting Beijing’s official target.

Beneath the headline numbers, the picture was mixed. Exports stayed resilient thanks to demand from Europe and other non-US markets, keeping manufacturing activity elevated. At the same time, stimulus measures and rate adjustments supported consumption as officials tried to lift post-pandemic confidence.

However, fixed-asset investment and retail sales data contracted more than expected in December and missed forecasts, pointing to continued caution among businesses and households. Wong noted that the People’s Bank of China (PBOC)’s signal that there is room for further reserve-ratio cuts is offering reassurance, even as pressure mounts to sustain growth into 2026.

Trump’s 10–25% Tariff Threat Reignites Fears

Adding another layer of uncertainty is a renewed flare-up in global trade tensions. US PresidentDonald Trump threatened fresh tariffs on several European countries, announcing a 10% levy on imports from eight nations, including France, Germany, Denmark, and the UK, warning that duties could rise to as much as 25% if the EU refuses to discuss a US purchase of Greenland. European leaders swiftly rejected the proposal and talk of retaliation quickly surfaced.

Markets reacted fast. Investors pulled back from risk. US and European stock futures slipped, while demand for safe havens jumped, sending gold to record highs. In Hong Kong, an open and trade-exposed market, the renewed uncertainty hit just as confidence had begun to stabilize, adding to caution across Asian equity markets.

Gold is smashing through record highs week after week, turning what should have been a steady start to the year into a runaway rally that has even seasoned traders recalibrating their forecasts. This is not a quiet safe-haven drift, but a market charging ahead on political… pic.twitter.com/sPwFpvbF7S

— IndiaToday (@IndiaToday) January 20, 2026

Tech & Pharma Stocks Hammered

Monday’s sell-off was broad-based, with Hong Kong’s heavyweight stocks bearing the brunt. Wuxi Biologics slid 4.8%, while Hansoh Pharmaceutical dropped 4.0%, signalling profit-taking in healthcare stocks that had previously led gains. Tech heavyweights also retreated, with Alibaba Group falling 3.5% to HK$160.40 and Tencent Holdings slipping 1.2% to HK$610, weighing heavily on the benchmark, according to a South China Morning Post report.

The weakness was striking given how recently these stocks had rallied. Alibaba and Tencent gained 4–6% in early January on renewed optimism around China’s tech outlook. With growth worries back on investors’ minds, money seems to be moving out of pricey tech and healthcare stocks. In mainland China, defence and property shares climbed while AI-linked stocks fell. That points to a more defensive shift in positioning, one that may also be starting to show up in Hong Kong.

Beijing Tightens Margin Rules to Curb Speculation

Policy signals from Beijing are also tempering market enthusiasm. After a powerful rally extending into early January, Chinese regulators made clear they want a “slower, longer-lasting” bull market rather than a speculative surge. The China Securities Regulatory Commission (CSRC) convened a high-level meeting on January 15 and vowed to “prevent sharp market swings” by cracking down on leverage-fuelled trading.

In fact, effective this week, major mainland exchanges hiked their minimum margin requirement to 100% (from 80%), meaning traders must put up more collateral for borrowed money. This move immediately tightened the spigot on margin financing that had hit record highs during the New Year rally.

The impact was swift: mainland equities ended a 17-day winning streak, and Hong Kong’s rally paused as speculative fervour cooled. While the measures are seen as prudent over the long term, they have added a short-term overhang by curbing liquidity.

Consolidation Ahead? Markets Seek Clarity

The key question now is whether Hong Kong’s retreat marks a brief consolidation or something more sustained. On the positive side, China hit its 2025 growth target, and policymakers are signalling more support. That includes targeted interest-rate cuts and possible reductions in banks’ reserve requirements. Mainland investors, who played a big role in last year’s rebound, may still see market pullbacks as buying opportunities, backed by longer-term confidence in China’s push into tech and innovation.

At the same time, downside risks remain elevated. Geopolitical uncertainty has intensified, valuations are no longer cheap after last year’s 28% surge, and earnings will need to justify further gains.

Goldman Sachs analysts expect further normalization under a “slow and long bull” framework, suggesting consolidation rather than a sharp sell-off.

For now, prudence prevails as investors await fresh China data and any fallout from Trump’s tariff threat to determine the market’s next move.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.