The Dow Jones Industrial Average (DJIA) closed 2025 at record territory, extending a historic multi-year rally while quietly masking sharp internal divergence.

Caterpillar (CAT) and Goldman Sachs (GS) stood out as the clear leaders in the Dow Jones Industrial Average (DJIA) during 2025, delivering exceptional returns amid a year of volatility, AI-driven infrastructure demand, and favorable conditions for financials. Caterpillar surged as a hybrid play on traditional infrastructure recovery and the booming need for power generation in AI data centers, while Goldman Sachs benefited from robust deal-making, lower interest rates, and a resilient economy. These two stocks powered much of the index’s momentum, even as broader mega-cap tech names delivered more modest gains.

This was not a year driven by broad optimism alone. It was a year defined by where growth was visible, how capital was deployed, and which companies could translate macro tailwinds into durable earnings momentum. The result was a market that rewarded precision over scale and infrastructure over applications.

In today’s anchor feature, Disruption Banking gives a full breakdown of the Dow Jones’ top winners, laggards, and the AI infrastructure forces that shaped the year 2025.

Dow Jones 2025 at a Glance: A 13% Gain That Extended a Multi-Year Winning Streak Slightly Behind the S&P 500

The Dow Jones Industrial Average (DJIA) opened in 2025 at around 42,660 and closed at 48,063.29 on December 31, 2025, roughly a 13% gain for the year. Stocks set fresh records on AI enthusiasm and Fed easing, but not without shockwaves. A major April selloff, triggered by President Donald Trump’s surprise reciprocal tariffs on U.S. trading partners, knocked the Dow 4% in a day.

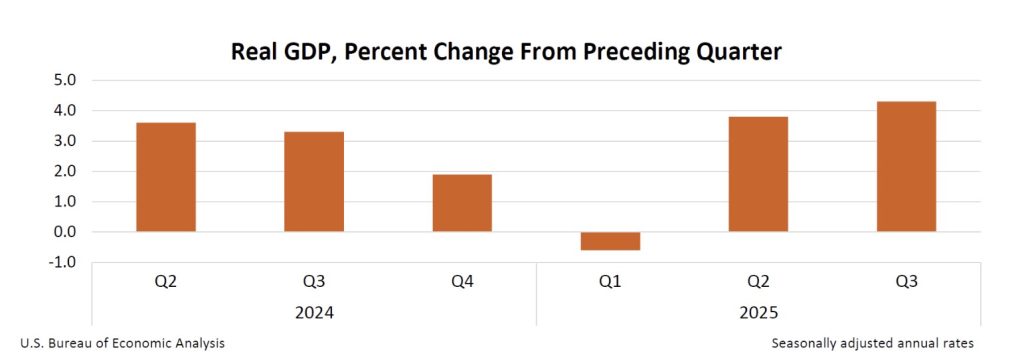

Chief Market Strategist Daniel Morris of BNP Paribas Asset Management warned the tariff move was “worse than most investors expected.” Still, resilient earnings and two Fed rate cuts in Q4 2025 (totaling -0.50%) kept markets afloat. By year-end, the U.S. economy had resumed solid growth (Q3 GDP +4.3%) even as consumer spending slowed modestly and a bitter 43‑day government shutdown clouded data. Overall, the Dow’s 2025 advance was strong but volatile, reflecting a narrow, tech-fueled surge and significant macroeconomic swings.

Source: Bureau Of Economic Analysis, U.S. Department of Commerce

Reuters reports that all major U.S. indexes ended 2025 with double-digit gains (third year in a row), thanks to “an insatiable appetite for artificial intelligence stocks.” In fact, the Dow hit new highs on AI buying by year’s end. But the rally was not uniform. Analysts note a “narrow” group of mega‑caps drove much of the gain.

In short, 2025 repriced many companies: blockbuster tech leaders zoomed, while some defensive and cyclical stocks lagged or sank.

Dow Jones Winners of 2025: The 5 Stocks That Jumped 35%–60% on AI Infrastructure

Below are the Dow’s top performers of 2025:

- Caterpillar (CAT) (+59.5%). The industrial giant led the Dow after booming demand for construction and mining equipment.

- Goldman Sachs (GS) (+55.8%).

- Morgan Stanley (+44.3%).

- Johnson & Johnson (JNJ) (+43.5%). J&J’s reliable cash flow (and 60+ years of dividend hikes) likely made it a safe haven amid turmoil.

- Nvidia (NVDA) (+40.2%). As one of the newest Dow members (added November 2024), Nvidia rocketed on the AI frenzy. Its performance helped push the Dow to all-time highs.

- International Business Machines (IBM) (+39.1%). Big Blue’s years of restructuring towards hybrid cloud and AI platforms seem to be finally paying off. According to Disruption Banking, IBM’s pivot from legacy hardware has “adapted it to remain relevant.”

Other solid winners (+20%) included JPMorgan (+36.6%), and Boeing (+21.8%). These saw modest gains as housing and energy recovered, manufacturing rebounded, and credit stayed healthy.

Banks (beyond Goldman and JPMorgan) were mixed: American Express (+24.6%) rose solidly, supported by fee income and some loan growth. Travelers (+21.7%) also posted a moderate advance. Caterpillar’s big gain aside, other industrials like 3M (+25.2%) rose meaningfully as industrial demand recovered.

Notably, the Dow’s gain was broad: 23 of 30 components rose on the year compared to 18 in 2024 and 19 in 2023, signaling broad-based participation yet concentrated in specific themes. Even “defensive” stocks like Coca-Cola and McDonald’s ended roughly flat or slightly up, contributing to the index’s advance.

Mediocre Performers of 2025: Why Mega-Cap Tech and Consumer Stocks Delivered Single-Digit to 19% Returns

Several Dow stocks eked out mild gains or traded sideways. Tech giants Apple and Microsoft, already extended from 2024, delivered uneven follow-through in 2025: Apple eked out a modest gain (+9.7%), while Microsoft posted a solid but unspectacular advance (+14.5%), leaving neither among the market’s true standout performers. Oil, biotech and entertainment giants: Chevron (+9.6%), Merck (+8.9%), and Disney (+3%) fell from previous highs. Their 2024 euphoria cooled, and 2025’s advance relied more on smaller tech plays and industrials.

Similarly, consumer staples Procter & Gamble delivered a modest advance (+12.5%), as still-elevated prices and cautious consumers constrained volume growth despite resilient demand. Telecom Verizon (+8.8%), payments leader Visa (+11.1%), and Sherwin-Williams (+3.9%) turned in subdued, below-market gains, reflecting steady revenues but little excitement in mature, saturated markets.

Retailers Walmart and Nike ended flat to down a bit: Walmart’s broad base weathered the shocks, while Nike (discussed below) fell on trade worries. Overall, the Dow’s “rest of the pack” delivered roughly average market returns. As RBC noted, the diversified Dow delivered double-digit gains and even outperformed the S&P 500 in parts of 2025. A reflection of steady economic growth once tariffs faded.

Underperformers of 2025: Earnings Misses, Policy Risk, and Consumer Weakness Dragged Returns

Here are the Dow Jones’ worst performers of 2025:

- UnitedHealth Group (UNH) (–35.0%). The worst performer by far.

- Salesforce (CRM) (–20.4%)

- Nike (NKE) (–19.1%). Trade tensions and tariffs hit the sportswear’s imports, while Europe’s slowdown and China’s zero-COVID hangover dampened sales. Early December news that Nike’s new CEO, Elliott Hill, was buying NKE shares worth over $1 million drew brief support, but on balance, Nike was one of the Dow’s weakest names.

- Procter & Gamble (PG) (–13.8%).

- Honeywell (HON) (–12.7%).

- Home Depot (HD) (–10.1%),

Other laggards (single-digit losses) included Cisco and Amgen. In short, health insurance, some consumer and industrial names felt the worst pinch.

Dow Jones 2026 Outlook: Risks and Opportunities Ahead

As 2026 sets sail, strategists see both risks and opportunities. U.S. indexes had a third straight strong year, but 2026 gains may be more modest. JPMorgan and Goldman forecasts (as of early January 2026) envision U.S. GDP staying above 2.5% with Fed easing and tax cuts boosting profits. Goldman says global stocks may return 11% and expects the U.S. to outperform substantially as tariff drag eases. Its equity team is “constructive” on U.S. shares, predicting a broadening bull market and slower (but still positive) index returns vs. 2025. Across Wall Street, many expect another bull year: consensus S&P 500 targets imply 8–17% gains, and forecasts assume strong earnings growth. LSEG head of earnings research, Tajinder Dhillon, projects +15% EPS growth in 2026 after ~13% in 2025.

Yet doubts remain. Sam Stovall, chief investment strategist at CFRA Research with a 7,400-point year-end 2026 price target, says he thinks “it will be a good year, but not a great year.” Man Group’s Kristina Hooper notes she doesn’t “see how (the U.S.) can weather the kind of headwinds it is facing and not go into a modest recession.” LPL Financial’s Jeff Buchbinder cautions that if companies rein in AI-related capex, sentiment could turn and leave markets flat or down.

CFRA's @StovallCFRA predicts the S&P will end 2026 at about 7,400: https://t.co/7kCVzHsocg

— Squawk Box (@SquawkCNBC) December 31, 2025

Investors will watch Federal Reserve policy closely: futures imply further cuts, but Fed officials are now guarded. PNC’s Yung-Yu Ma argues “the biggest driver” will be the Fed’s stance, as long as it stays dovish, equities can rally. The choice of Fed Chair under President Trump, due mid-2026, will be a key signal on future policy.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Top 10 Dow Jones ETFs by Trading Volume in 2025