The Trump administration is in disarray since the announcement of a criminal investigation of Jerome Powell, the chairman of the Federal Reserve. Now, the finger-pointing has begun. Trump says he doesn’t know anything about it, and many of his top advisers, including most members of his Cabinet, apparently didn’t get the memo, either.

Pirro Steps In It

Trump handpicked the US Attorney of Washington, D.C., Jeanine Pirro, a former Fox News host, has launched the investigation.

According to Axios, Trump’s own Treasury Secretary Scott Bessent told the President in a call that the investigation “made a mess” that could impact financial markets. Reportedly, the DC District Attorney announced the investigation without warning the top White House officials, the DOJ, or the Treasury Department.

“The secretary isn’t happy, and he let the president know,” an anonymous Trumpworld source told the outlet.

It’s pointless to describe the alleged criminal activity because it’s unanimously agreed by observers in law and politics on both sides of the aisle that criminal charges specifically against Powell, but also generally against any of the people on Trump’s enemies list, are entirely and without exception mere fake pretexts for retaliation contrived out of convenience and likely to be dismissed, unless any of the cases are somehow steered towards Judge Eileen Canon, whose kangaroo court has been compromised for Trump’s personal use.

Both Sides Agree Investigation Stupid

Exceedingly few issues unite legal analysts on the right and left like this investigation.

Marc Joseph Stern, a legal analyst at Slate, wrote: “This investigation is not just legally frivolous; it is a grave tactical blunder that shows exactly why the judiciary must insulate Powell and his colleagues from the president’s wrath.”

The editorial board of the Wall Street Journal, an outlet owned by News Corp, which is controlled by the Murdoch family, the former employer of the DC U.S. Attorney, lambasted the former Fox host, calling the investigation “lawfare for dummies,” recommending that Trump, “do himself and the country a big favor by firing those responsible for this fiasco.”

In fact, Chairman Powell wasted no time denouncing that the charges were fake in a public statement, highly unusual for its candor, issued January 11 and posted on the Fed’s website:

It reads, in part, “This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings. It is not about Congress’s oversight role; the Fed, through testimony and other public disclosures, made every effort to keep Congress informed about the renovation project. Those are pretexts. The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Emerging-Market Tactics, First-World Consequences

Every living former Fed chair signed a joint statement issued Monday morning that reads, in part, “This is how monetary policy is made in emerging markets with weak institutions, with highly negative consequences for inflation and the functioning of their economies more broadly.”

It would be funny if it weren’t so deadly serious for the future of the U.S. economy. If any part of this shambolic debacle is comical, it’s that it will likely blow up in Trump’s face.

Ross Delston, an independent attorney, expert witness, and former assistant general counsel at the FDIC, told Disruption Banking, “This is yet another example of the president’s attempt to muscle his opponents into complying with his demands. It might work with Republicans on Capitol Hill, but it will have the opposite effect here.”

MS NOW columnist Hayes Brown wrote, “In escalating this matter to the point that the normally staid Powell was motivated to respond with a defiant public statement, Pirro’s office has already made a mess of its hatchet job. Until lawyers formally try to obtain an indictment, this matter is going to linger in a way that lessens the pressure on Powell.”

Markets Shrug, Gold Soars

As a sign of how unserious the charges are, markets were barely impacted by the announcement. Investors seem to regard Trump’s ongoing threats as political noise that will not affect the management of the Fed.

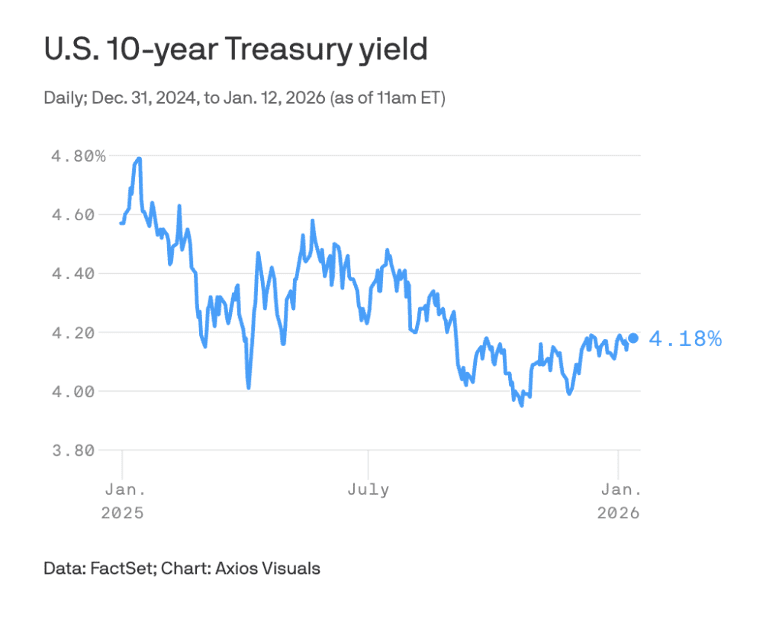

The dollar weakened slightly, falling 0.34% to 98.90, and U.S. Treasury yields increased a little.

At the same time, Gold hit a record high above $4,600 an ounce during the session but retreated to $4,592.55.

Jim Barnes, director of fixed income at Bryn Mawr Trust, said, “Any time you have a new angle on something, the market reads it, trades on it a little bit, it has to digest it, and then it realizes this is just new news that’s consistent with prior events that have come out.”

Asked what potential long-term impacts might be, Ross Delston responded in an email to Disruption Banking, “The main effect of the Powell investigation will be to undermine faith in the Trump Administration, the independence of the Federal Reserve as the nation’s central bank, and the US Dollar, which has already fallen some 9 percent since the president took office, the largest decline since 2017. This will hurt consumers, since many products are imported, importers of goods, and buyers of imports, since prices will go up, as well as Americans traveling overseas. But it also risks lessening the faith in and stability of the dollar, the world’s reserve currency. And in tumultuous times like this, instability is not good.”

Bipartisan Blowback and White House Blame Game

The move is widely unpopular with 68% of all adults, including 91% of Democrats, 75% of Independents, and 41% of Republicans, opining that the Fed should be independent of Trump for the good of the economy.

Republican and Democratic Senators have condemned the move, including Senator Thom Tillis (R-NC), a senior member of the powerful Senate Banking Committee who promised to block any move to replace Powell. Tillis stated on X, “I will oppose the confirmation of any nominee for the Fed — including the upcoming Fed Chair vacancy — until this legal matter is fully resolved.”

Inside the White House, officials expect the episode to do more damage to the White House than to Powell. Some expect that Powell may decide not to resign from the Fed’s Board of Governors for the remaining two years of his tenure, after his chairmanship is over in May.

Anonymous White House officials and Trump allies have blamed Bill Pulte, the director of the Federal Housing Finance Agency, according to Politico. Pulte is reportedly responsible for some of the most universally panned ideas Trump has floated, including the infamous “50-year mortgage,” which, like many of Trump’s weakest policy announcements, appeared on social media and was abandoned just as swiftly.

When Intimidation Replaces Governance

The WSJ editorial board blamed Pulte and miscommunications inside the administration, writing, “Alas, someone forgot to tell the rest of the Administration to let the matter go… Our sources say Bill Pulte of the Federal Housing Finance Agency wrote a report that made its way to Jeanine Pirro, the U.S. Attorney for Washington, D.C. Ms. Pirro’s office sent the subpoena, though Attorney General Pam Bondi no doubt signed off.”

What this episode ultimately exposes is not a scandal at the Federal Reserve, but a profound weakness inside the executive branch itself. By turning a policy disagreement into a criminal threat, the Trump administration has crossed a line that markets, lawmakers, and even longtime institutional loyalists recognize as dangerous.

Asked why the Fed should remain independent, Ross Delston wrote, “One of the most common ways people interact with the economy is through interest rates via mortgages, loans, and/or savings. This makes interest rates a particularly powerful tool because it influences both the broader economy and people’s perception of it. Since these effects are so visible and immediate, political desire to manipulate interest rates can be strong. This is why it’s vital for the Fed to be independent, to insulate it from these immediate political machinations and focus on long-term economic stability.”

The independence of the Fed has survived wars, inflationary crises, and partisan pressure precisely because it is insulated from political vendettas. Weaponizing the justice system against the central bank chair does not intimidate the Fed; it erodes confidence in the presidency. And once that confidence is lost, no amount of finger-pointing can restore it.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

International central bankers on the statement by Federal Reserve Chair Powell on 11 January 2026