Venezuela’s economic collapse has given rise to an unlikely savior: cryptocurrency. Years of hyperinflation (prices jumped by over 1 million percent in 2018, escalating to IMF predictions of 10 million percent in 2019) and U.S. sanctions isolating Venezuela from global banking have driven many to digital currencies as a financial lifeline. Crypto is now used to preserve savings from inflation, move money across borders, and even conduct oil sales. Making Venezuela a global leader in cryptocurrency adoption.

The Market Crash: Hyperinflation and Economic Collapse

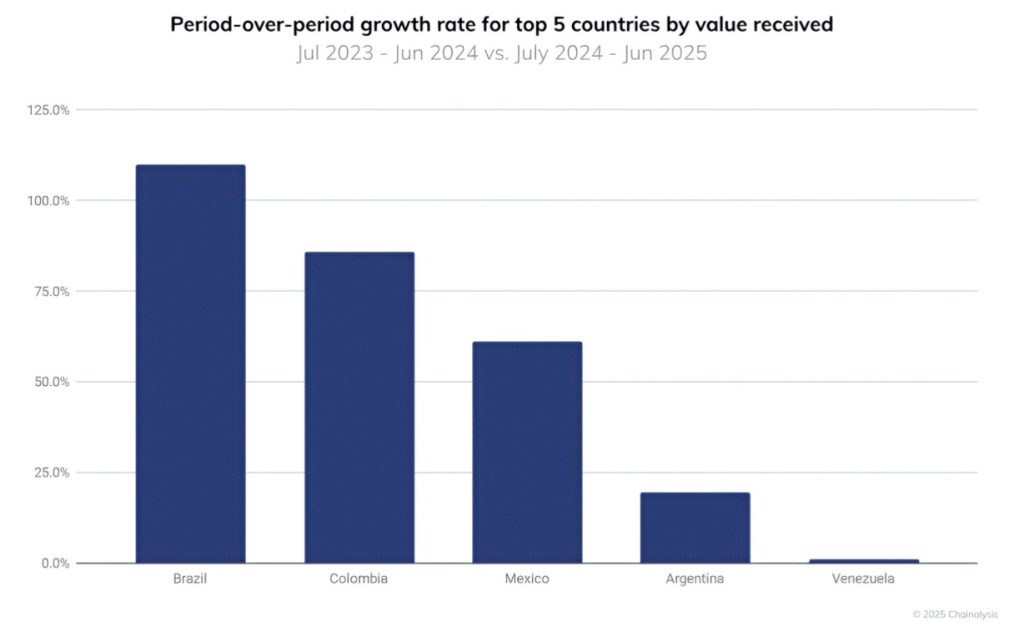

As the bolívar’s value evaporated, Venezuelans began rapidly converting bolívars into Bitcoin or dollar-pegged stablecoins to protect their earnings. Chainalysis ranked Venezuela third globally for grassroots crypto adoption in 2020, reflecting how pervasive crypto use became amid the crisis. Compared to the past adoption index for Latin America (LatAm), between July 2024 and June 2025, Venezuela raked in $44.6 billion in transaction volume, as the Chainalysis data below shows.

By one estimate, around 10% of Venezuelans now hold some form of cryptocurrency. Strict capital controls and high fees on bank transfers (up to 56% on remittances) also made crypto an attractive alternative for sending money. In 2023 about 9% of Venezuela’s $5.4 billion in remittances flowed through cryptocurrencies instead of traditional channels.

Notably, in late 2020 the opposition led by Juan Guaidó even worked with a U.S. fintech to distribute pandemic aid via USDC stablecoins to Venezuelan healthcare workers, bypassing Maduro’s banking controls.

9% of all the money sent home last year to Venezuela was bitcoin and crypto remittances on the blockchain, according to data from Chainalysis.

— Documenting ₿itcoin 📄 (@DocumentingBTC) December 30, 2024

Failed State Experiments: The Petro’s Collapse

President Nicolás Maduro launched a state-backed cryptocurrency, the Petro, in 2018 to try to evade sanctions and stabilize the currency. The government even required Petro to make some payments, such as passport fees and taxes. However, the Petro never gained public trust or international backing. By 2020, it had essentially fizzled out, and by 2024, it was largely defunct.

The Crypto Pivot: Oil Sales and Sanctions Workarounds

The government then turned to established cryptocurrencies. State oil company PDVSA began asking buyers of Venezuelan crude to pay in Tether (USDT) initially in 2023, with requirements strengthening in 2024, a stablecoin pegged to the U.S. dollar, as a sanctions workaround. By early 2024 some oil contracts required part of the payment in USDT. Selling oil for crypto was unprecedented, but it reduced the risk of proceeds being frozen in banks under U.S. sanctions.

Grassroots Boom: Everyday Crypto Adoption

On the ground, crypto has become part of daily life for many. Some shops and cafes accept payment in Bitcoin or Dash, and countless people use mobile apps to swap bolívars for USDT to store their day-to-day money. Peer-to-peer (P2P) exchange networks flourished to meet this demand. For years, Venezuela was one of the biggest markets on LocalBitcoins, bolívar trades on the platform once led Latin America.

When LocalBitcoins later shut down, users migrated to other venues. Binance’s P2P marketplace, for instance, saw Venezuelan bolívar trade volumes jump as people continued exchanging fiat for crypto. In effect, a parallel financial system has developed, allowing Venezuelans to transact and save in digital assets outside of the unstable local currency.

Mining Boom and Government Crackdown

Cheap electricity also turned Venezuela into a hotspot for Bitcoin mining. By the late 2010s, miners were using nearly free power to generate crypto, earning more stable value than any local job could pay. The government initially tolerated mining. In 2020 it set up a licensing system under the crypto regulator (Sunacrip).

However, in 2023 a corruption scandal involving missing oil revenues sparked a broader crypto crackdown. Authorities alleged that billions in PDVSA funds were siphoned off via crypto wallets. Dozens of officials were arrested, including Sunacrip chief Joselit Ramírez, who had overseen the Petro. The government suspended Sunacrip and ordered police to shut down unregistered mining farms.

By 2024, Venezuela outright banned Bitcoin mining, blaming it for straining the electrical grid. Thousands of mining rigs were seized as the once-thriving mining community was put out of action. These enforcement moves have introduced uncertainty for crypto businesses, but they have not extinguished popular use.

JUST IN: Authorities in 🇻🇪 Venezuela release video documenting the seizure of a large #Bitcoin mining facility following this week’s decree to crack down on the industry 😮 pic.twitter.com/Fe1CzlyjMt

— Bitcoin News (@BitcoinNewsCom) May 19, 2024

Revolution Complete: Crypto as Venezuela’s Lifeline in 2025

Despite the government’s crackdowns, cryptocurrency remains embedded in Venezuela’s economy. When traditional money systems failed, Venezuelans improvised: street vendors hedge their daily sales in stablecoins, families rely on crypto remittances, and savers trust digital dollars over bolívars. The government’s own crypto initiative may have flopped, but grassroots usage continues to grow.

As of writing time, Venezuela still ranks among the world’s most active crypto markets, a testament to how necessity and ingenuity have made digital assets a vital lifeline in the country’s ongoing economic storm.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The case for stablecoins in Venezuela | Disruption Banking

US should scrap Venezuela sanctions regardless of 2024 elections: Steve Hanke | Disruption Banking