This report does not constitute a rating action.

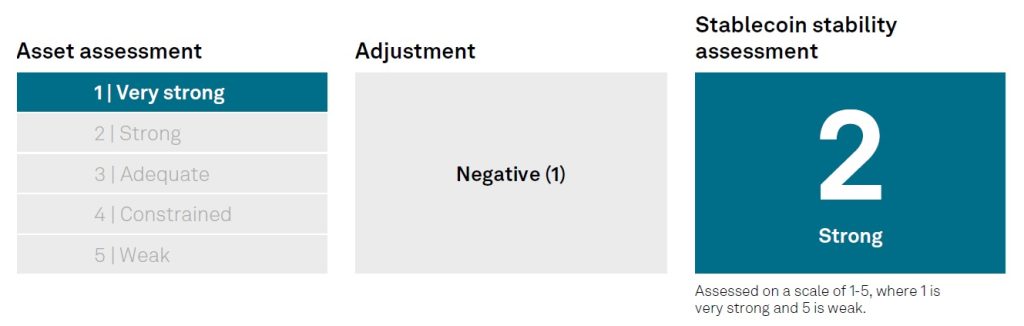

CHARLOTTESVILLE (S&P Global Ratings) Dec. 18, 2025–S&P Global Ratings said today that it assesses the ability of USDC to maintain its peg to the U.S. dollar at 2 (strong). USDC is issued by Circle Internet Financial LLC (Circle).

“Stablecoin Stability Assessment: USDC,” is available on RatingsDirect and on spglobal.com.

Our asset assessment is 1 (very strong). USDC benefits from full backing by low-risk assets, primarily short-dated securities, and deposits with banks. These are held mainly at SEC-registered Circle Reserve Fund (CRF) at BlackRock. As of Oct. 31, 2025, the fair value of assets held in reserves was $75.88 billion, with $75.81 billion USDC in circulation. Additionally, BlackRock manages CRF’s cash held at Bank of New York Mellon. Based on the October report, there is roughly $9 billion of cash held outside BlackRock management at regulated financial institutions, which are virtually all identified as highly rated Global Systemically Important Banks. The audited report shows 35% of assets held in treasuries, 53% in repurchase agreements, and 12% in cash as of Oct. 31, 2025. Overall, accounting for settlement and timing difference, 13% of assets are made of cash held outside the CRF as of the same date. We understand that this is mainly for liquidity management purposes.

The stablecoin stability assessment is 2 (strong) to reflect our view of insufficient precedent on whether assets would be protected in the event of bankruptcy of Circle. This view is although Circle reports that USDC’s underlying reserves are segregated from its other assets. Circle is registered with the Financial Crimes Enforcement Network, a department of the U.S. Treasury. USDC is regulated as a form of stored value or prepaid access under laws governing money transmission in various U.S. states and territories.

The stablecoin stability assessment could improve with certainty around compliance with the GENIUS Act. Additionally, Circle received conditional approval from the Office of the Comptroller of Currency in the U.S. to establish a national trust bank, which could further clarify bankruptcy remoteness. As these are implemented and assuming assets remain very strong, the assessment could improve. If the amount of cash or other holdings held in banks we view as less creditworthy grows, this could lead to a weaker asset assessment.

This report was not produced at the request of the stablecoin issuer or sponsor but with their input.

For more on our approach and definition of price stability, see our “Analytical Approach: Stablecoin Stability Assessments.”

Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P) receives no compensation from the stablecoin issuers or sponsors for the provision of the Stablecoin Stability Assessment (Product). S&P may receive compensation from these stablecoin issuers or sponsors related to other products and services, including providing credit ratings to the stablecoin issuer or sponsor. The Product is not produced at the request of the stablecoin issuer or sponsor.

The Product is not a credit rating. The Product is primarily based on publicly available information. The Product does not guarantee the stability of any stablecoin. The Product is not a research report and is not intended as such.

The report is available to RatingsDirect subscribers at www.capitaliq.com. If you are not a subscriber, you may purchase a copy of the report by emailing research_request@spglobal.com.