Jane Street is the broker of choice for companies like BlackRock and Fidelity. The firm is a key ‘authorized participant’ (AP) for their bitcoin ETFs. But Jane Street is also a market maker and, along with rivals like Citadel Securities, now commands a fifth of global trading revenue. Including bitcoin and crypto revenue. Accusations have arisen that Jane Street is dumping bitcoin at 10am ET. Is this manipulation or tradfi reality?

One social media user, @BullTheoryio, has suggested that without leverage being applied to bitcoin today the price of the digital currency would have hit $200,000 by now.

LEVERAGE HAS RUINED CRYPTO.

— Bull Theory (@BullTheoryio) December 15, 2025

In just 4 hours, the crypto market has erased $136 billion from its market cap.

Nearly $381 million in long positions has been liquidated.

And all this is happening when the S&P 500 is down just 0.30%

Without leverage, the crypto market would be… pic.twitter.com/YRNUm7D3B3

In further posts it is suggested that the price of bitcoin takes a hit “almost everytime the US market opens.” Concerned? We certainly are.

What are the Details?

The problem is also one of supply and demand. In the case of bitcoin ETFs, the demand for crypto continues to be high, and new bitcoins are not being created in time to fill this demand. Normally this would lead to a price rally, especially as there is no decline in appetite for bitcoin. In December so far, the circulation of bitcoin has increased very slightly (according to Coinbase) which means that the price would appear to be low.

Another place for market insights is the zerohedge profile on X. On December 4 and December 10, the leading investment news portal pointed out the bitcoin 10am “slam”.

Whether Jane Street is really behind this phenomenon is hard to prove. One online commentator suggested that “the Jane Street villain story is pure narrative.” Another user suggested that“the explanation is market structure, leverage, options, and ETF mechanics not a hidden daily manipulation loop.”

Others suggest that “once Jane Street, Susquehanna and Citadel employee log onto work around 10am eastern today, its pretty safe bet that they will dump bitcoin and anything bitcoin related and complete the obvious $BTC BART and start the week with another ‘health correction’”.

Arguments For Manipulation:

- Consistent timing: Dumps align precisely with US open, suggesting coordinated selling.

- Jane Street’s profile: As a high-frequency trader with $2.5B+ in IBIT, they have the tools to “dump, liquify, and re-enter.”

- Accumulation motive: Allegedly building BTC positions cheaply via ETF flows.

Arguments Against:

- Delta-neutral strategy: Jane Street avoids directional bets; dumping would risk their own holdings.

- Broader causes: Leverage (100x perps), options gamma, and macro hedging explain volatility, not one firm.

- No proof: Distributed across exchanges; regulators see no “footprints” of manipulation.

How Has Bitcoin Performed in December During Previous Years?

Those of us who have been hodlers for many years, there is a familiar cycle to how bitcoin reacts at Christmas. December 2017 was the perfect example. At the time bitcoin pumped to record highs of over $20,000 before dropping back again in January. In December 2020 the leading crypto went even higher and remained above $16,000 even during later market dips. In 2023 bitcoin was on a run up till Christmas, hitting highs of over $40,000 before stabilizing again.

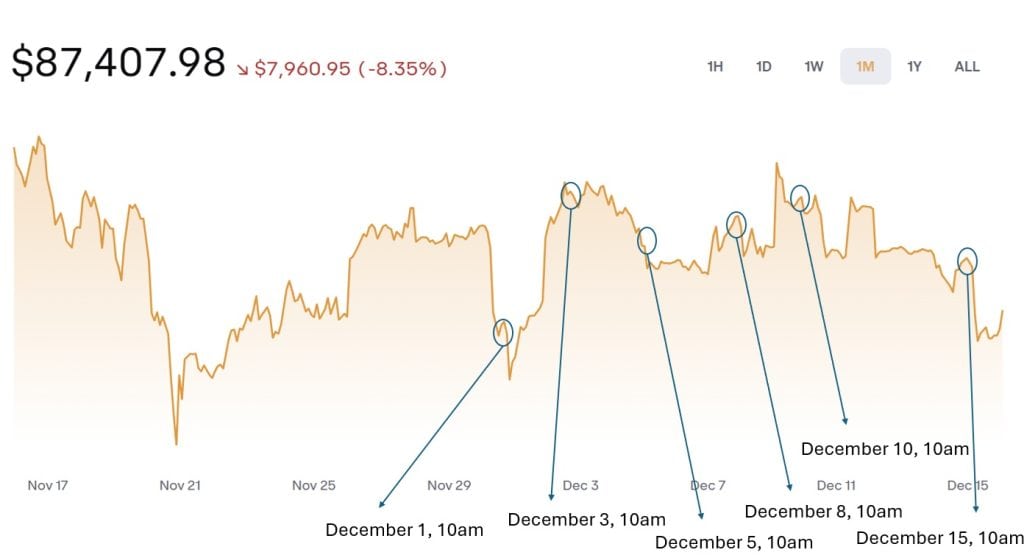

Last Christmas we all watched bitcoin pump again, hitting highs of over $87,000, higher than it is trading today. Christmas 2025 has been different. Not only has the token collapsed to a level not seen for almost a year, but it keeps dropping, often between 10am and noon US time. This started in late November and culminated on December 1 when bitcoin saw over 12% of its value wiped out in a matter of hours just after 10am eastern US.

The same happened on December 5, December 8, December 10, December 12 and yesterday the 15th. There are small rallies in between, but no real staying power which is a concern. In a market where investors are piling into gold, silver and other ‘safe haven’ investments, bitcoin is not behaving the way many of us would have hoped. Not to mention the horde of altcoins that are all down in December too.

How Much is Jane Street Exposed to Crypto?

Jane Street is not only involved in handling BlackRock’s bitcoin ETF flows. The company has also invested in leading bitcoin mining operations, Hut 8 and Cipher Mining. The firm has also taken positions in leading crypto firms MicroStrategy (MSTR) and Coinbase.

In Jane Street’s 13F filing, covering assets up till September 30, 2025, the firm lists $5.7 billion under the Ishares Bitcoin Trust ETF as well as a few other ETFs like 21shares Bitcoin ETF. It also lists Coinbase, Strategy, and leading bitcoin mining firm Riot Platforms. It doesn’t list Hut 8 or Cipher, but its exposure to crypto is growing significantly. This footprint maybe fueling speculation about Jane Street’s role in the 10am volatility we are seeing.

If the ’10am slam’ is just TradFi reality, it highlights Bitcoin’s maturation. It also highlights its vulnerabilities to leverage and institutional flows. Regulators like the SEC may need to scrutinize ETF market-makers more closely in 2026. For hodlers, the lesson? Avoid over-leveraging during US opens and watch for patterns. As @BullTheoryio notes, once big players finish accumulating, upward momentum could resume.

What do you think? Is Jane Street the villain, or is this overblown?

Author: Andy Samu

See Also:

How Jane Street’s Tech-Driven Market-Making is Reshaping Wall Street | Disruption Banking