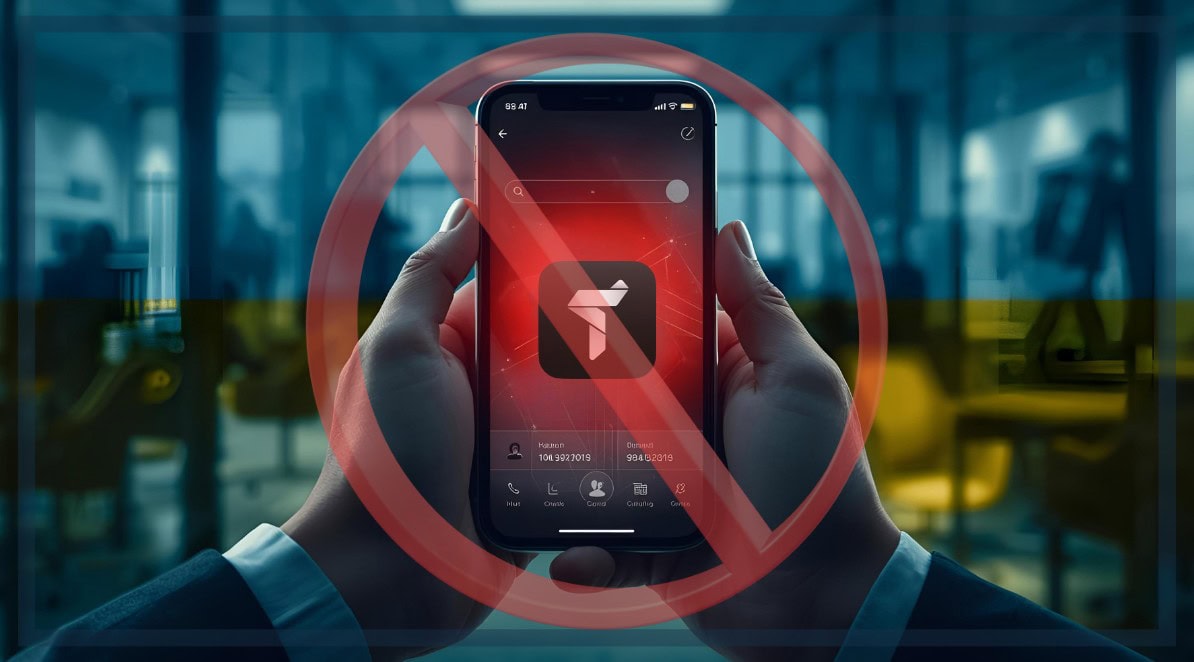

Banning a foreign fintech company in Ukraine is rare. The National Bank of Ukraine (NBU) doesn’t throw partial bans around lightly, especially not at EU-licensed companies. However, in September this year, that’s exactly what happened to Trustee Global UAB and its Trustee Plus app. As is expected, this development has led to multiple questions surrounding this extraordinary ban.

In today’s piece, DisruptionBanking investigates the circumstances that led to the ban.

The Quiet Boom: 750,000 Ukrainians and a Top-20 Finance App

The National Bank of Ukraine (NBU) stunned the fintech sector by ordering Lithuanian-registered Trustee Global UAB to halt certain services in Ukraine, citing “unlicensed financial payment services” provided via the Trustee Plus wallet. The move struck at a popular crypto/fiat platform that Ukrainian users had flocked to, and raised urgent questions about oversight.

Trustee’s CEO is Vadym Hrusha (also written Grusha) and its technical co-founder and Chief Technology Officer from day one is Kseniia Zhytomyrska. Hrusha is a Ukrainian entrepreneur with a history in blockchain startups; Zhytomyrska is a veteran software engineer and blockchain specialist. Her background includes co-founding BlockSoftLab. Together they launched Trustee Plus as a “universal” crypto wallet, pledging a seamless mix of cryptocurrencies, traditional currencies and even payment cards.

In practice, the app advertised that users could buy, sell and exchange crypto, top up with Visa/Mastercard and even transfer money to nearby phones via P2P “Swipe and Pay.” This meant that a Ukrainian could convert crypto to Ukrainian hryvnia (UAH) in-app and send it to other Ukrainians without going through a bank account, a feature now at the center of the NBU’s crackdown.

P2P “Swipe and Pay”: Turning Crypto into Instant Hryvnia – No Bank Required

The Trustee Plus offering a combined crypto wallet and payments app in one. The official descriptions show it supported multiple coins and promised easy currency exchange, bank card top-ups and a payment card. In fact, Trustee Plus touted a “completely new standard of payments” with crypto-backed Visa/Mastercard cards, Apple/Google Pay support, and even personal IBANs for euro transfers.

Ukrainian users could, in theory, move funds into euros or US dollars via the card or instant P2P swaps, then spend anywhere. Multiple sources confirm that Trustee Plus effectively enabled users to navigate around FX controls, as highlighted in its UA-focused marketing. By early 2025, Trustee reported 750,000 users.

Indeed, by traffic the service was huge: Ukraine was consistently the top country for Trustee Plus website visits and by late 2025 the app ranked within the top 20 finance apps in Ukraine. Its Ukrainian marketing even involved local influencers and ads emphasizing quick crypto-to-hryvnia conversion.

For context, Ukraine’s fintech ecosystem was considered wild territory, yet even by those standards, penetrating the market this deeply without proper licensing raised immediate flags.

Trustee Plus ranked 18th in Ukraine's finance app category and was the country's largest traffic source globally. The app enabled P2P hryvnia transfers and virtual cards via Polish partner Quicko, bypassing banking infrastructure. NBU cited aggressive local marketing and…

— CryptoCardHub (@CryptoCardHub) September 23, 2025

Euro Cards via Quicko: The Perfect FX Workaround (Until It Wasn’t)

The NBU’s findings centered on two points: Trustee’s built-in peer-to-peer (P2P) transfer service and its handling of euro transactions. Trustee’s app offered an instant “Swipe and Pay” feature (moving crypto and fiat between users). These transfers allowed Ukrainian customers to deposit or withdraw hryvnia by peer-to-peer exchange of bank card funds, all within the Trustee Plus interface.

The NBU reasoned that this amounted to a payment service, transferring value without a formal bank account, which under Ukrainian law requires a license and often a local branch. Similarly, the virtual euro-denominated payment cards issued through Quicko (a Polish fintech) let Ukrainians move euro balances freely. NBU auditors flagged these too as unlicensed “financial payment operations.”

Trustee’s counter-argument was predictable: Quicko handles fiat operations under EU regulation. We handle crypto. Case closed. It didn’t work. The NBU tested the claim empirically. Regulators registered for Trustee Plus using Ukrainian addresses and Kyiv-based operations. They conducted transactions without obstacles. The company was targeting Ukraine deliberately. The PR supported it: active advertising campaigns, engagement with Ukrainian influencers.

In late September, the board of the NBU ruled that Trustee Global “has proven to provide unlicensed financial payment services” via Trustee Plus and must stop its P2P and euro transfer services in Ukraine. All other crypto-custody functions were left untouched, but the decision made clear that shifting hryvnia (UAH) or euros (€) peer-to-peer was illegal without Ukrainian licensing.

In short, NBU forced Trustee Global UAB to suspend those parts of Trustee Plus that effectively let Ukrainians skirt hryvnia exchange controls.

Inside the NBU Sting: Regulators Signed Up, Tested, and Ruled

Quicko is critical to this story. Quicko is a Polish payment company that issues crypto-linked cards under a full EU license. From April 2024 to May 2025, Trustee Plus partnered with Quicko to give Ukrainian clients virtual Mastercard cards denominated in euros. By depositing crypto or local funds into Trustee Plus, a user could load a Quicko-issued Eurocard, spend abroad or withdraw euros, effectively bypassing Ukrainian FX restrictions.

In the spring of this year, Quicko quietly began blocking thousands of Trustee Plus cards with Ukrainian ties. Investigations found Quicko had frozen over 7,000 Trustee-issued cards due to “unclear Ukrainian address” issues, per user reports and audits. This indicates Quicko itself grew wary of being seen as enabling sanctions or FX circumvention.

Quicko’s own site highlights it as a fintech licensed for issuing Mastercard cards and facilitating payments across Europe, but its compliance checks in recent times show how cross-border crypto cards drew regulator concern.

“We Only Do Crypto” – Why Trustee’s Defence Collapsed

Trustee’s underlying tech comes from BlockSoftLab Inc., a Delaware-registered firm headed by the same team. BlockSoftLab is listed as the developer for both Trustee Wallet (the basic crypto-only app) and Trustee Plus. The app stores and Apple Store pages confirm “BLOCKSOFTLAB INC” as the provider (with a U.S. address in Wilmington, Delaware).

In practice, BlockSoftLab handles the crypto wallet coding and blockchain operations (the Trustee Wallet app is open-source and non-custodial, per its promotional material), while Trustee Global UAB is the EU-licensed entity aiming to attach fiat services like payments and cards.

This layered corporate structure, a U.S. tech development firm + a Lithuanian financial services firm, is unusual and hints at why red flags arose. It underscores that Trustee Plus is more than a peer-to-peer crypto marketplace; it aspires to full crypto-banking, mixing decentralized wallets with traditional payment rails.

Late September 2025: The Partial Ban Comes Into Place

BlockSoftLab’s involvement also ties to the people. Kseniia Zhytomyrska, Trustee’s CTO, is credited with co-founding BlockSoftLab. Her LinkedIn and press profiles highlight roles as lead blockchain developer and managing crypto products.

Vadym Hrusha, CEO, is similarly a seasoned crypto entrepreneur (he’s spoken at events on crypto payments). Yet neither their LinkedIn profiles nor press releases reveal a formal Chief Risk Officer on the team, nor do they mention any rigorous compliance division. This absence is notable given how fast Trustee expanded.

By comparison, regulations in Lithuania and the EU explicitly require crypto firms to have strong governance, AML/CFT and transparency in place. With millions of dollars flowing, the fact that Trustee Plus enabled instant hryvnia transfers suggests their risk controls may have been limited.

Indeed, Ukrainian regulators had no record of Trustee holding a local license or of an AML license in Ukraine; the NBU concluded that Ukrainian citizens using the app “enter into an agreement with Trustee Global UAB” and transact fully on its platform. That suggests Trustee Global was directly providing unregulated payment services, not merely a light conduit.

A Ban with Layers, and a Story That Doesn’t End Here

Everything above sets the stage, but it is only half the picture. Some of the picture can be found on Reddit, Trustpilot, X, and other platforms where users have added their feedback.

The enforcement itself is unusual, the corporate structure is unconventional, and the Ukrainian market exposure is undeniable. But the political environment, the corruption backdrop, Lithuania’s regulatory posture, and the global implications are still ahead.

Our editorial team reached out to Trustee Global and specifically asked the company about Proof of Reserves, Compliance, who the Chief Risk Officer of the company is, and other questions. Trustee Global were unable to provide a response to ANY of our questions even though the company was given over 2 full weeks.

The next piece continues from this point and explains why this ban matters far beyond Ukraine, how corruption and geopolitical pressure shaped the context, and how regulators across borders are reacting to crypto-fintech arbitrage.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Concerned Is The US About Corruption In Ukraine? | Disruption Banking

The Rise in Popularity of Cryptocurrency in Ukraine | Disruption Banking