For months, World Liberty Financial has promoted USD1 as a stablecoin growing through decentralization, transparency, and community-driven demand. On paper, the ecosystem appears to be flourishing, with deep liquidity, tight peg behavior, and steady transactional volume.

But the blockchain tells a more complex story, one that reveals a centrally engineered liquidity machine quietly operating behind the scenes. It also leads, by unmistakable pathways, to one of the most contentious market-making firms in digital assets: DWF Labs.

On September 2, DWF Labs hailed USD1, the stablecoin launched by WLF, writing, “Since its launch, $USD1’s market capitalization has risen to nearly $2.5 billion as of September 1, 2025, placing it among the six largest stablecoins in circulation.”

DWF Labs knows only too well about USD1’s market capitalization because DWF Labs has been secretly supporting the stablecoin by purchasing hundreds of millions of dollars worth, all of which is routed through anonymous wallets that circulate them in the WLF ecosystem.

Through a combination of analysis of dozens of wallets, mapping thousands of transactions, and a reconstruction of multi-chain flow, DisruptionBanking has identified a three-layer liquidity structure that has silently funneled more than $301 million of engineered liquidity through WLF’s TokenGovernor contract, including $84 million in the past month alone.

This is Part 1 of a 2 Part Special Investigation.

An Established Liquidity Pipeline

The pipeline starts with and arrives at WLF in a notable place.

DWF Labs → 0x81E48 → 0x2ce40f5 → WLF TokenGovernor

These flows and the funding pipeline have not been previously reported, although DWF Labs’ direct $25M purchase was already publicly known. A large share of the funds end up on Binance, which we’ll return to.

The pattern bears a striking resemblance to market-making and peg-support operations that have drawn scrutiny and regulatory attention in other markets.

This investigation does not claim that USD1 is fraudulent, nor does it allege wrongdoing by WLF or DWF Labs. Yet the structural realities uncovered on-chain show that USD1’s apparent resilience and market strength are not organic phenomena.

They are the outcome of a sophisticated, three-tiered liquidity architecture that few users, if any, would recognize as decentralization, but the opacity of the liquidity pipelines behind it reveals an uncomfortable fact: USD1’s apparent market strength is not organic. It is manufactured.

Those patterns mirror the kind of centralized, opaque market-making and potential wash-trading structures that Binance’s investigators previously identified around DWF on other tokens.

A Market Maker With a History

DWF Labs is no stranger to controversy. Rival market makers have publicly criticized DWF Labs, arguing that it blurs the line between investment and market-making and sometimes presents trading activity as long-term support.

A subsidiary of Digital Wave Finance, the firm burst into prominence in 2022, presenting itself as a “new generation” Web3 investor while rapidly becoming one of the largest market makers on major exchanges.

In 2024, reporting by The Wall Street Journal described an internal Binance investigation that accused DWF Labs of manipulating several token markets and conducting hundreds of millions of dollars in self-trading on the exchange.

DWF Labs has been accused of dumping tokens from portfolio projects (e.g., selling significant allocations into thin markets). As DisruptionBanking reported in a previous article about WLF, DWF Labs is controlled by Andrei Grachev, a Russian entrepreneur previously convicted of orchestrating pump-and-dump schemes, according to The Nation.

Price spikes and rapid crashes in tokens such as YGG, DODO, and C98 have repeatedly followed news of DWF Labs involvement, reinforcing the perception that its “investment” announcements may be intertwined with aggressive short-term trading.

Binance later stated that it found insufficient evidence to support the allegations, and DWF Labs denied them outright. The controversy has not fully receded. Rival market makers and independent analysts routinely point to unexplained price movements in DWF Labs-associated tokens, while the firm continues to operate at a scale that makes it impossible to ignore.

DWF Labs has repeatedly denied any wrongdoing.

Now, USD1 appears to sit within the same gravitational field.

Blockchain Doesn’t Lie

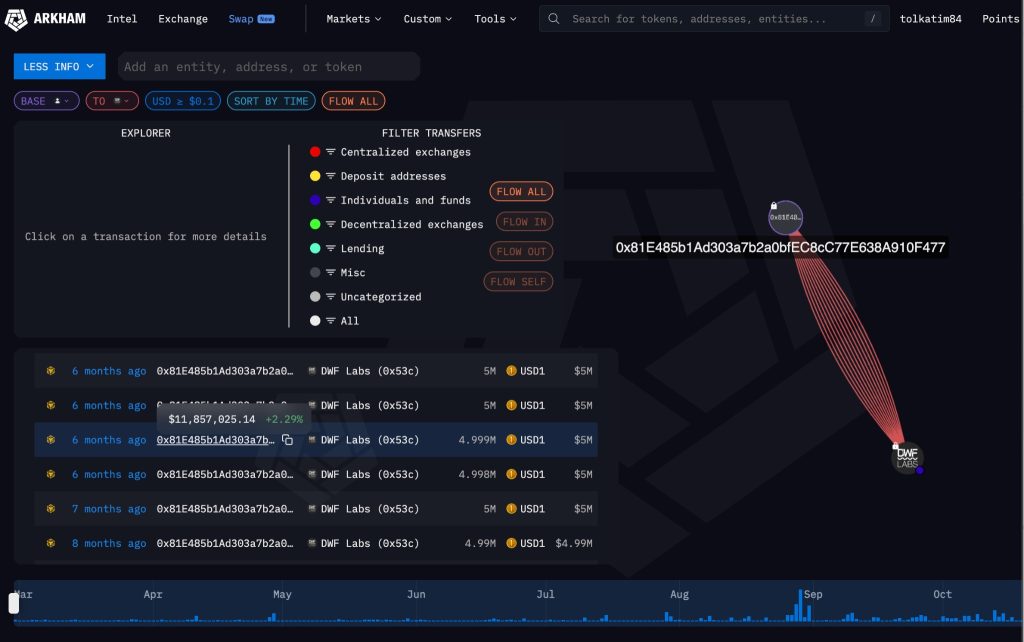

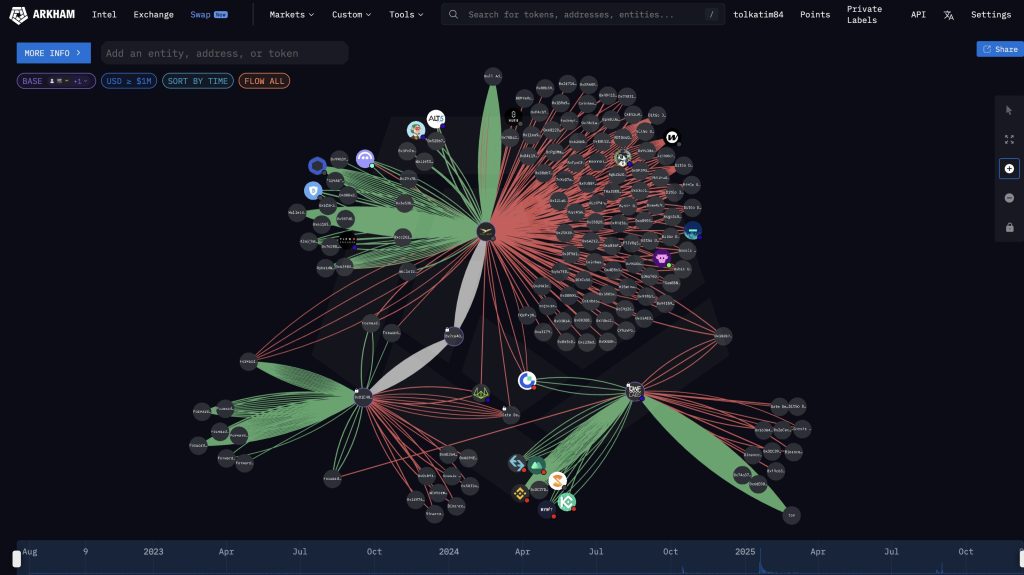

Using Arkham Intelligence to visualize blockchain activity, DWF Labs receives funds (in green) and pays an array of wallet addresses (connected in red). The thickness of the red or green band shows the frequency of transactions. The image below documents DWF Labs purchasing USD1 in batches of $5M and sending them to 0x81E48.

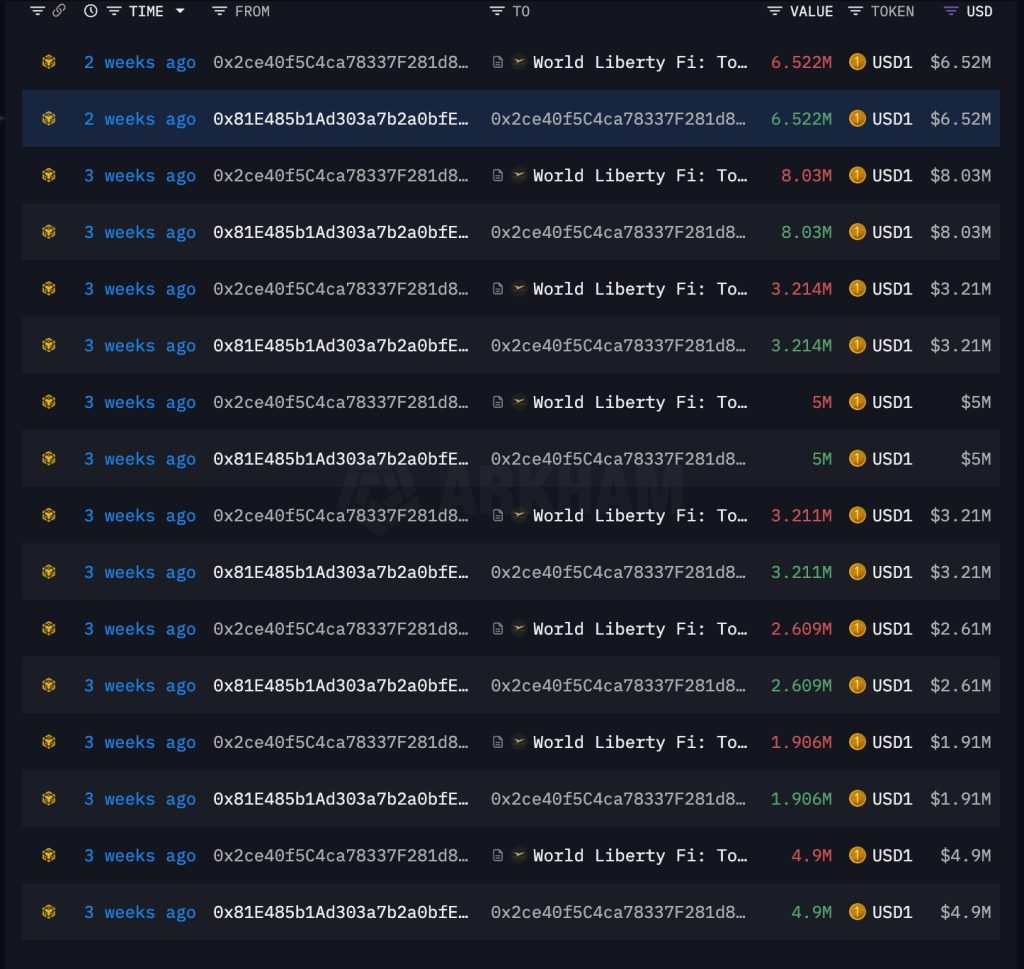

Then, 0x81E48 turns around and sends the funds to 0x2cc40, which sends it all – 99.7% – to WLF’s TokenGovernor Address.

What wallet 0x2ce40f5C4ca78337F281d85245a4977d4aB5eef1 is doing is not random, not user-driven, not organic liquidity, not investor redemptions. It is industrial-scale liquidity cycling, tied directly to the upstream DWF Labs routing wallet (0x81E485b1Ad303a7b2a0bfEC8cC77E638A910F477) and then fed into the WLF TokenGovernor contract.

No normal user interacts with the TokenGovernor. No real investor sends 20M USD1 to the TokenGovernor.

The distributor’s activity is particularly revealing. Over the past month, it sent approximately 84M USD1 into WLF’s TokenGovernor contract in repetitive, structurable bursts. These flows are too rhythmic, too precise, and too consistent to represent user activity.

The images below show 0x81E48…’s transactions with 0x2ce40… and WLF for ~$35M in the last few weeks. Look at the amounts at the far right.

Transfers fall into a narrow pattern of sizes that goes: 20 million, 10 million, 9 million, 5 million, 3.2 million, 1.8 million, 1 million, even 1,000 and $999. In some periods, these transfers occur back-to-back, with the consistency of a metronome.

This is the cadence of market-making software, not human traders. The TokenGovernor contract, for its part, becomes the focus of minting, burning, peg adjustments, and liquidity placements. It receives the structured transfers and redistributes them across centralized exchanges, minor venues, and decentralized pools.

Deep Liquidity or Artificial Activity?

From the outside, the result looks like a healthy, active market with deep liquidity and predictable peg stability. Underneath, nearly all of that activity is artificial.

Visualizing flows >$1M shows even more pathways funds follow from DWF Labs to WLF, including another ~$50 million going through Gate.io and forwarder wallets (below). The two main nodes (0x81E48 & 0x2ce40) already identified above are shown in grey.

Commercial Capital in Binance Hot Wallet

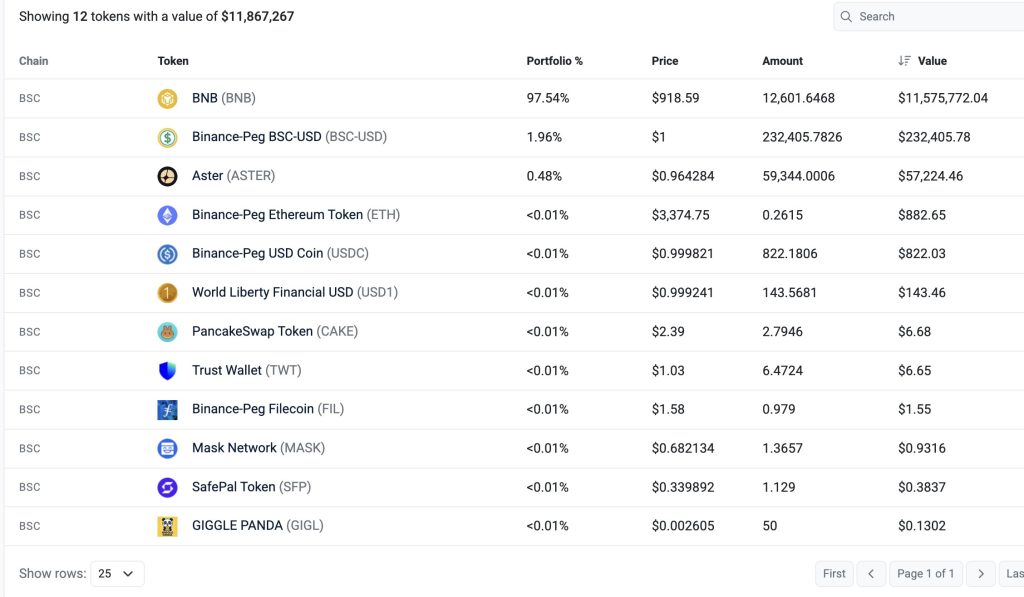

So, who is behind 0x81E48? The overwhelming concentration of BNB in this wallet is the real smoking gun. No retail participant holds twelve thousand BNB, let alone keeps more than 97% of their net worth in a single asset, sitting untouched in a hot wallet that also happens to orchestrate highly structured multi-million-dollar stablecoin flows.

That pattern is not personal investing; it is commercial capital. When a wallet’s core position is a massive BNB reserve rather than a diversified portfolio, and when that wallet behaves as a routing engine for large-scale liquidity movements, it is no longer plausible to interpret it as a human user. It is, almost certainly, a professional liquidity wallet.

It functions as operational inventory, the kind of working treasury maintained by professional market makers, arbitrage desks, internal exchange liquidity teams, or entities that resemble the operational footprint of DWF Labs.

In fact, this is exactly how a liquidity desk positions itself on-chain. The routing treasury does not behave like an investor with a position. It behaves like a distribution hub. The wallet’s transfers exhibit neither normal trading activity nor portfolio diversification.

Instead, almost every meaningful outbound transaction moves to a single downstream address: 0x2ce40f5…, a mid-layer accumulator responsible for receiving DWF’s USD1 batches and recycling them into the WLF ecosystem.

A DEX with Engineered Liquidity?

The question is not whether engineered liquidity is inherently wrong. Market makers exist to create orderly trading environments. Still, transparency matters, especially when a project heavily emphasizes decentralization while relying almost entirely on a single liquidity provider operating through a closed and centralized architecture (illustrated below).

Anyone interacting with USD1 in the belief that its liquidity reflects a broad base of users would be misled, not by false claims necessarily, but by the absence of disclosure about how the ecosystem actually functions.

The relationship also raises more subtle concerns. DWF has a known history of strategic market interventions, sometimes with dramatic effects on token prices. If USD1’s market depth depends on DWF’s continued participation, then USD1 inherits the same fragilities observed in other DWF-linked assets.

Liquidity that arrives in perfect batches can disappear just as quickly. Stablecoins anchored to a single operator are inherently brittle, even if the operator is competent.

This investigation adds an important dimension to the broader conversation about transparency in digital assets. Many tokens presented as decentralized rely heavily on centralized market-making engines. A stablecoin may maintain a flawless peg only because an external actor is propping it up.

Volume may appear organic, but it’s nothing more than internal cycling. And once users assume that liquidity is real, they may fail to question the true source of market stability, until it is too late to react when that stability erodes.

TakeAways

USD1 is not a scam. It may yet find organic adoption. However, its markets, as they exist today, are the product of engineered liquidity, orchestrated by a firm whose methods have already prompted scrutiny at the highest levels of the industry. WLF plugged itself into an already-existing liquidity and routing network rather than creating one.

There is no return of capital to project wallets, no cycle of reinvestment, and no pattern that resembles reserves management. Everything moves outward, and nothing comes back. The dispersion pattern is not random.

This pattern does not resemble any known form of decentralized treasury management. A grant program wouldn’t either. Airdrops look nothing like this.

This behavior is incompatible with any claim that WLF is building reserves, supporting its treasury, or locking funds for user benefits.

If depositors or community members were led to believe that USD1 assets or treasury reserves were locked, circulating, or being used in ways that supported the project’s stated functions, the on-chain evidence contradicts those claims.

In an era where regulators are beginning to focus on the hidden mechanics of crypto liquidity, the USD1 case shows how easily complexity can obscure centralization, and how vulnerable decentralized narratives remain when their foundations are controlled elsewhere.

The on-chain pathways are clear. The motives and relationships are not.

Stay tuned for Part 2 of this Special Investigation.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Has the Trump Family discussed a new Stablecoin with Binance? | Disruption Banking