Even after Beijing banned most cryptocurrency trading and mining in 2021, private interest in crypto has proved surprisingly resilient. Analysts estimate China still has on the order of tens of millions of crypto holders. Roughly 59 million people in 2025, or about 10% of global users. These holders typically trade via offshore exchanges, over-the-counter (OTC) desks, or peer-to-peer (P2P) networks, since domestic platforms and initial coin offerings (ICOs) are illegal.

Therefore, many Chinese crypto enthusiasts simply migrate to Hong Kong or overseas markets to buy Bitcoin, Ether, or stablecoins. Or use VPNs and foreign apps, even as Beijing maintains its strict bans.

China’s Mining Ban Didn’t Work – It Just Went Underground

China once dominated Bitcoin mining, hosting an estimated 65–75% of global hashing power by 2019. A 2025 industry report notes that the 2021 ban “took more than half of the world’s miners offline.” Most operations swiftly relocated to Kazakhstan, Russia, and North America. Officially, mining remains outlawed, but industry observers say Chinese miners are quietly returning.

Reuters reports that in November, “Bitcoin mining is quietly staging a comeback” in energy-rich provinces, as small players exploit cheap hydropower and new data centers.

In essence, this means some private farms and factories are plugging rigs back in, although they keep a low profile. Outside observers can only guess how much hashing power is now in China again. But it is certainly far below its peak.

Beijing’s $2 Trillion Answer: Flood the Country with e-CNY

If private crypto use is a grey market, China’s official response has been a blitz of its own digital currency. The People’s Bank of China (PBoC) launched the digital RMB (e-CNY) pilot in 2020 and has since promoted it aggressively. By September this year, the PBoC reported over 225 million personal digital wallets opened and 3.32 billion e-CNY transactions worth some 14.2 trillion yuan (≈$2 trillion). The e-CNY project now covers dozens of cities and has even set up an international operations centre in Shanghai to expand cross-border use.

As PBoC Deputy Governor Lu Lei put it, moving to digital money in the payment systems is “a historical inevitability” for modern economies. Beijing frames the e-CNY partly as a tool for making the yuan more global and challenging the dollar’s dominance.

Indeed, Chinese leaders have discussed allowing yuan-backed stablecoins internationally. In August 2025, the State Council even weighed a roadmap for wider digital-currency adoption. All told, China’s government is betting on blockchain and the Central Bank Digital Currencies (CBDCs), even as it keeps private crypto strictly in check.

At any rate, the People’s Republic of China has not been slack in enforcing crypto restrictions in various regions of the country.

JUST IN: 🇨🇳 China’s PBOC says virtual assets, including stablecoins, are not legal tender and related activities are illegal due to KYC, AML, and cross-border risk concerns. pic.twitter.com/l0JukYJ0Jj

— Whale Insider (@WhaleInsider) November 29, 2025

Crackdown 2.0: 14 Agencies, One Message – “Crypto Is Still Illegal”

Chinese regulators regularly remind citizens that private crypto is off-limits. In November, the PBoC chaired a multi-agency meeting, which reasserted the 2021 ban and warned that speculative crypto trading has resurged into a new risk. The official statement was blunt: “Virtual currencies do not hold the same legal status as fiat, and [crypto] business activities constitute illegal financial activities,” with promises to “intensify efforts” against related illegal trading.

Essentially, this means banks and payment platforms remain barred from anything crypto-related, and courts have cracked down on tokenized securities products. Even overseas exchanges and apps are blocked by China’s firewall or app stores. State media and social networks regularly bombard the public with anti-fraud warnings about crypto.

However, these controls can’t erase every trade. The authorities are vigilant. In late 2024 and 2025, various agencies explicitly banned things like tokenized real-world assets (RWAs) and reinforced stablecoin rules. At the same time, central bank officials say they are monitoring overseas stablecoin developments closely.

In short, China’s official line is still very clear. Only the state-sanctioned digital currency is allowed, even as ordinary citizens find more creative ways to trade.

Hong Kong: The Legal Backdoor for Mainland Crypto Money

China’s “one country, two systems” framework gives Hong Kong and Macau different rules. Hong Kong, in particular, has emerged as a major crypto hub catering to Chinese traders. Unlike the mainland, Hong Kong has passed laws regulating crypto exchanges, payment tokens, and even stablecoins. Large platforms (Binance, OKX, Huobi, and others) were founded by Chinese entrepreneurs and have lobbied regulators in the Special Administrative Region (SAR) to create a legal market.

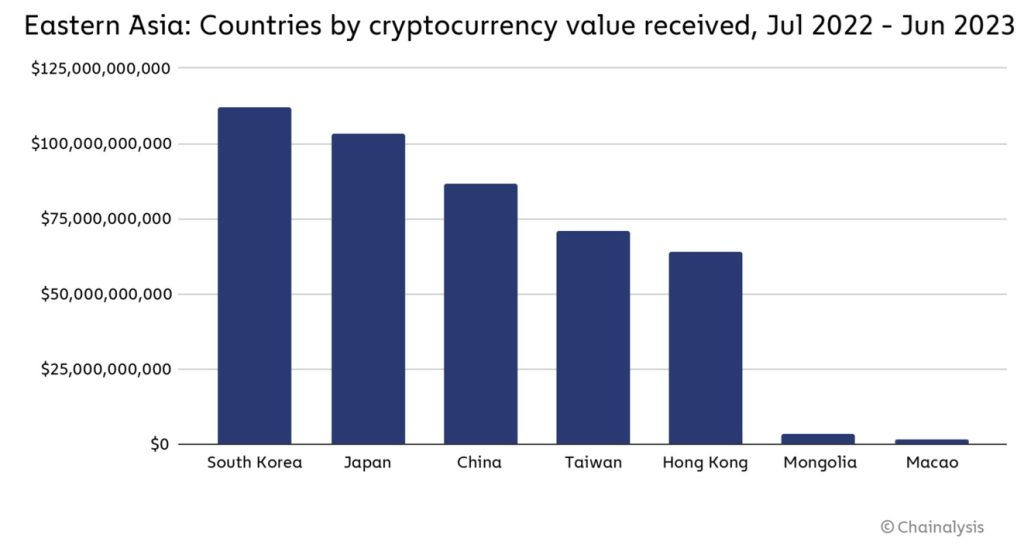

Chainalysis data shows Hong Kong handled roughly $64 billion in crypto flows annually (July 2022–June 2023), only slightly below mainland China’s $86 billion, despite its population being 1/50th the size. Much of Hong Kong’s volume is OTC trading by investment banks and whales, but retail trading is now permitted under licenses.

Observers see Hong Kong’s embrace of crypto as a possible testbed. Some Chinese state-owned firms are quietly launching crypto funds in Hong Kong, and regulators there have even opened a sandbox for yuan stablecoins. Chainalysis highlights that these trends have “created speculation” that Beijing might be softening its stance. At least indirectly, by letting Hong Kong innovate. But licensed crypto trading in the SAR does not change the mainland ban.

For now, Hong Kong provides a regulated infrastructure and an on‑ramp for Chinese capital, while mainland users must rely on those offshore options.

The $64 Billion Question: Will Beijing Ever Tolerate Private Stablecoins?

Cryptocurrency in China today lives a double life. Private traders and miners haven’t vanished. They’ve just moved underground or offshore, and there are still plenty of them. At the same time, Beijing is pushing the e-CNY everywhere it can and repeating, over and over, that everything else in crypto is illegal. That tension is why crypto interest in China keeps going: people still want it for investing, moving money, or holding value, even if the rules are hostile.

Analysts are watching to see if Beijing ever loosens up. Allowing yuan-backed stablecoins, for example, would instantly help the currency travel more easily across borders. But for now, the government’s position couldn’t be clearer: decentralized crypto is a risk, and the digital yuan is the future.

Whether this split strategy works depends on how people and businesses respond. What’s unquestionable is that China’s role in crypto, as a market, an underground mining hub, and a CBDC trailblazer, is still shifting. And it’s worth paying close attention to what happens next.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Are US tech firms scared that China will dominate Web 3.0? | Disruption Banking

Two Currencies One Nation with Invest Hong Kong | Disruption Banking