Washington, DC – November 26, 2025: The Executive Board of the International Monetary Fund (IMF) completed the Article IV Consultation for India. (see point 1 below) The authorities have consented to the publication of the Staff Report prepared for this consultation. (see point 2 below)

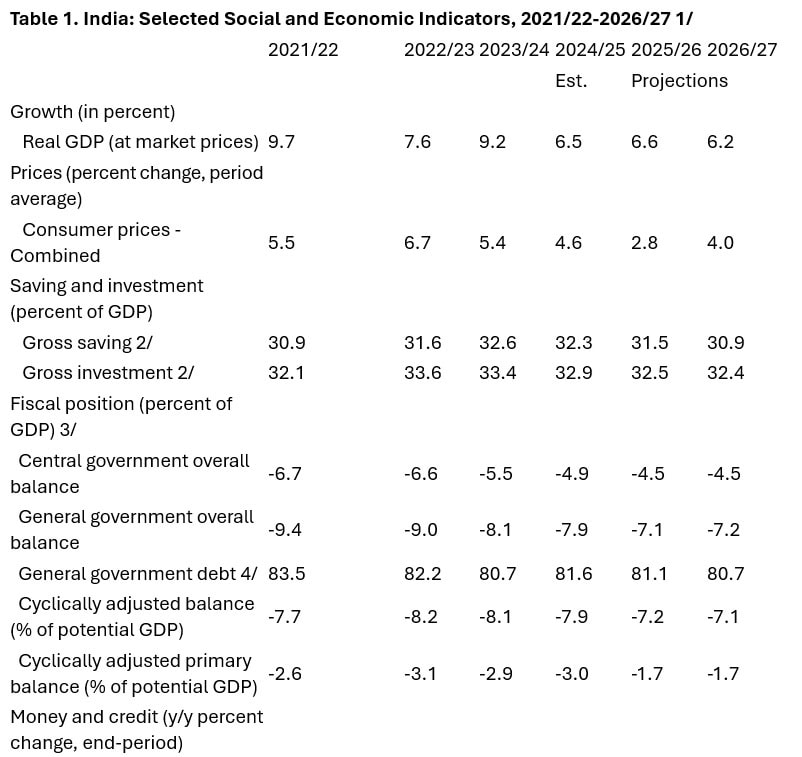

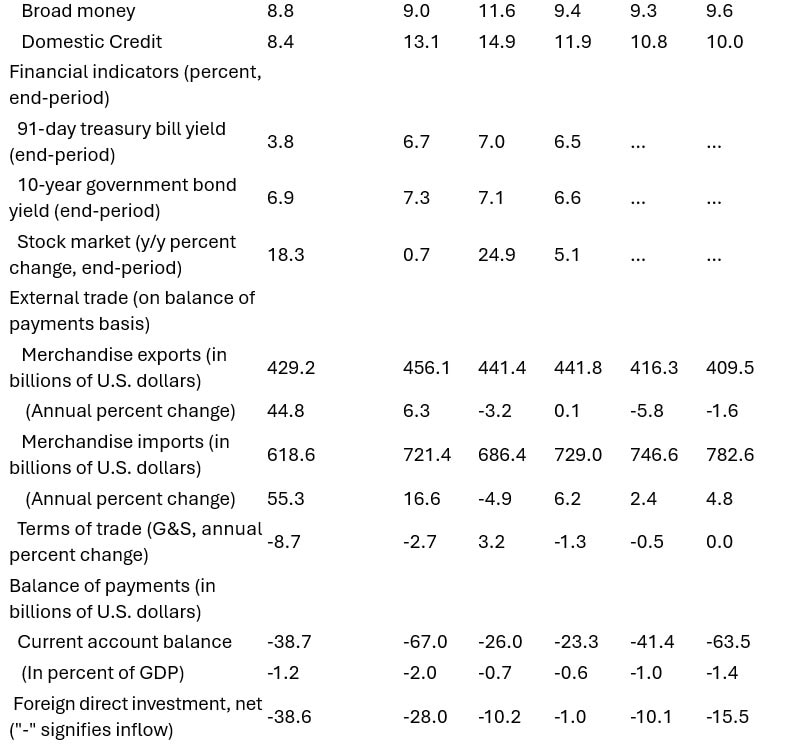

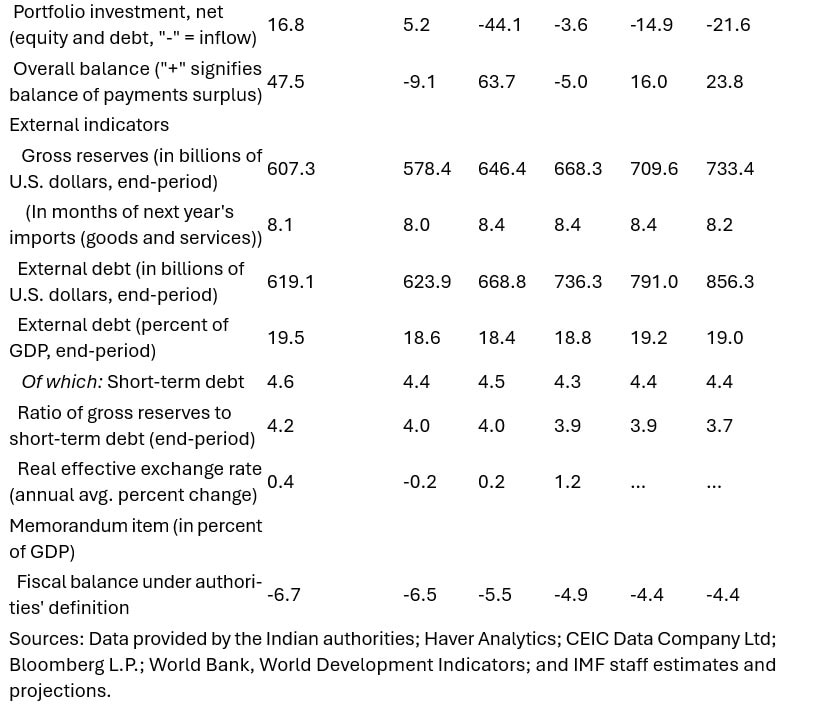

India’s economy has continued to perform well. Following economic growth of 6.5 percent in FY2024/25, real GDP expanded by 7.8 percent in the first quarter of FY2025/26. Headline inflation has declined markedly, driven by subdued food prices. The financial and corporate sectors have remained resilient, supported by adequate capital buffers and multi-year low non-performing assets. Fiscal consolidation has advanced, and the current account deficit has been contained, supported by resilient service exports.

Despite external headwinds, growth is expected to remain robust, supported by favorable domestic conditions. Under the baseline assumption of prolonged 50 percent U.S. tariffs, real GDP is projected to grow at 6.6 percent in FY2025/26 before moderating to 6.2 percent in FY2026/27. The reform of the goods and services tax (GST) and the resulting reduction in the effective rate are expected to help cushion the adverse impact of tariffs. Headline inflation is projected to remain well contained, reflecting the one-off effect of the GST reform and continued benign food prices. Looking ahead, India’s ambition to become an advanced economy can be supported by advancing comprehensive structural reforms that enable higher potential growth.

There are significant near-term risks to the economic outlook. On the upside, the conclusion of new trade agreements and faster implementation of structural reform domestically could boost exports, private investment, and employment. On the downside, further deepening of geoeconomic fragmentation could lead to tighter financial conditions, higher input costs, and lower trade, FDI, and economic growth. Unpredictable weather shocks could affect crop yields, adversely impact rural consumption and reignite inflationary pressures.

Executive Board Assessment (see point 3 below)

Executive Directors commended India’s very strong economic performance and resilience which has benefited from sound macroeconomic policies and reforms. Amid high uncertainty, Directors called for continued sound policies and noted that accelerated implementation of structural reforms will be critical to maintain stability and support India’s ambition of becoming an advanced economy.

Directors concurred with the authorities’ plans for continued fiscal consolidation this year, while noting that achievement of the fiscal deficit target will require strong spending discipline. While welcoming the recent simplification of the goods and service tax (GST), they called for careful monitoring of the fiscal impact of the reduction in GST and personal income tax rates. Directors also recommended that tariff relief measures should be targeted, transparent, and timebound, and that the pace of fiscal consolidation in FY2026/27 should be conditional on the impact of tariffs on the output gap. For the medium term, Directors stressed that fiscal buffers should be replenished by focusing on domestic revenue mobilization, while also raising efficiency of expenditure including through a more targeted social safety net. Directors generally encouraged the authorities to review their medium term debt target in light of the GDP rebasing next year, with a view to making it more ambitious. Enhancing fiscal sustainability at the state level as well as carefully monitoring contingent liabilities would also be important.

Directors supported the RBI’s data dependent approach to monetary policy. They generally felt that, if tariffs persist at current levels, there would likely be scope for further monetary easing amid benign inflation dynamics. Directors broadly recommended continued efforts to enhance monetary transmission, as well as greater exchange rate flexibility to help the Indian economy absorb external shocks, with interventions aimed at addressing disorderly market conditions consistent with the Integrated Policy Framework.

Directors highlighted that India’s financial system has been sound, supported by strong capital and liquidity positions. They encouraged the authorities to mitigate vulnerabilities among nonbank financial institutions and cautiously monitor risks from concentration and rising financial sector interconnectedness. Directors also encouraged the authorities to make further progress on financial structural reforms, in line with the 2024 FSAP and FATF recommendations.

Directors underscored that comprehensive structural reforms are critical to support India’s economic development. They welcomed the recent labor market reforms and encouraged the authorities to enhance human capital and female labor force participation, continue with the public investment push, and strengthen the business environment. Directors stressed that deepening of trade integration can bolster India’s competitiveness and attract FDI. Investment in R&D and fostering innovation will also help support productivity driven development. Advancing the green transition supported by greater access to concessional financing will also be important for promoting sustainable and resilient growth. Noting important progress underway, Directors indicated the value of further enhancements in data quality.

1/ Data are for April–March fiscal years.

2/ Differs from official data, calculated with gross investment and current account. Gross investment includes errors and omissions.

3/ Divestment and license auction proceeds treated as below-the-line financing.

4/ Includes combined domestic liabilities of the center and the states, and external debt at year-end exchange rates.

Additional Information:

(1) Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

(2) Under the IMF’s Articles of Agreement, publication of documents that pertain to member countries is voluntary and requires the member consent. The staff report will be shortly published on the http://www.imf.org/India page.

(3) At the conclusion of the discussion, the Managing Director, as Chair of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country’s authorities. An explanation of any qualifiers used in summings up can be found here: http://www.IMF.org/external/np/sec/misc/qualifiers.htm.

See Also:

India’s Crypto Boom in 2025 | Disruption Banking

How Strong Will The Indian Rupee (INR) Be In 2025? | Disruption Banking