London, 18 November 2025 – Permutable AI, leading provider of AI-driven market intelligence for institutional investors, has released one-year performance results of its live systematic commodity trading strategy, demonstrating how sentiment-based models can offer earlier conviction in markets defined by geopolitical volatility and rapidly shifting narratives.

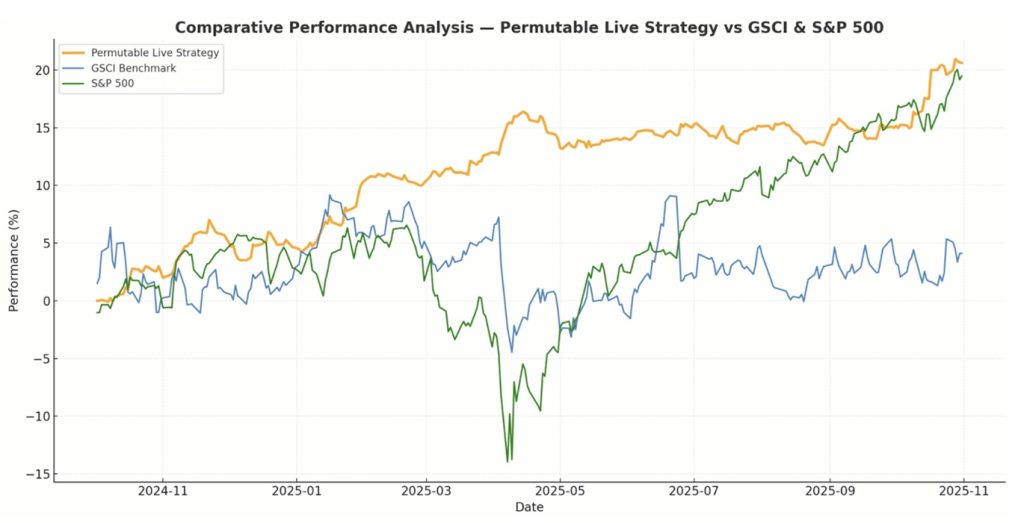

From 1 October 2024 to 1 November 2025, the strategy generated a 20.6% return with 7.3% volatility, a maximum drawdown of 4.4%, and a Sharpe ratio of 2.85. Over the same period, the S&P 500 returned 18.1% with 18.2% volatility, while the S&P GSCI delivered 4.1% at 17.2% volatility. The strategy outperformed the majority of CTAs, supported by a balanced long-short structure and evenly distributed VaR across energy, agriculture and metals.

The results come at a time when institutional investors are grappling with markets in which prices increasingly react to headlines driven by geopolitics, sanctions, supply dislocations and policy risk. Traditional indicators often lag these narrative shifts, while many AI approaches remain opaque or difficult to justify under governance and model-risk frameworks. Permutable’s system was designed to address both challenges by providing real-time sentiment signals with full explainability.

“Our live track record demonstrates what matters most for our clients: sentiment is actionable,” said Wilson Chan, Founder & CEO of Permutable AI. “We built this for institutional teams who need clarity earlier and who require transparency behind every signal shift. Our job is to help them see around corners.”

Michael Brisley, Chief Commercial Officer, added that institutions increasingly want intelligence rather than outsourced asset management. “Explainable, real-time sentiment can be a performance lever when used by people who understand their markets. The heroes here are the traders and portfolio managers who use the information to make sharper calls. We simply give them the advantage.”

October served as a meaningful test of the system’s ability to navigate event-driven commodity markets. Permutable’s models captured early sentiment around tightening sanctions and logistics friction in Brent crude; responded to rapid, weather-led reversals in natural gas; identified the mid-month safe-haven rotation into gold; and detected improving sentiment across key agricultural markets. In areas where signals were early, risk controls helped contain losses. Across assets, the company says signals consistently turned ahead of price.

Permutable provides its intelligence through two delivery mechanisms: a real-time API licence for integration into OMS, risk and execution systems, and the Trading Co-Pilot, an interface that offers live signals, narrative drivers, explainability modules and a full audit trail. The company has opted not to launch a fund, positioning itself instead as an infrastructure and analytics provider that enables institutions to deploy AI within their existing investment processes.

About Permutable AI

Permutable AI is a London-headquartered specialist in AI-driven global narrative intelligence and real-time sentiment analytics. The company helps institutional investors incorporate explainable AI into trading, risk and macro strategy, delivering live insights across commodity, FX and cross-asset markets.