- The economy is expected to grow gradually in the near term amid necessary fiscal consolidation, which is essential to address the widening twin deficits. Inflation will remain elevated temporarily before falling within National Bank of Romania (NBR)’s tolerance band by the end of 2026.

- The recent reform package for 2025–26, including tax reforms, is welcome and marks an important step forward. Its full execution and additional adjustment measures from 2027 to reduce the fiscal deficit to below 3 percent of GDP are critical to restore fiscal and macroeconomic sustainability.

- The NBR’s cautious approach remains appropriate, and policy rate cuts should resume only after inflation is on a firm downward trend. Greater exchange rate flexibility over the medium term would enhance resilience to shocks.

- Advancing structural reforms, including strengthening the efficiency of the state, are crucial to make full use of EU funds and support growth and the needed fiscal adjustment.

Washington, DC – November 14, 2025: The Executive Board of the International Monetary Fund (IMF) concluded the Article IV Consultation with Romania on November 7, 2025 (1 – see below). The authorities have consented to the publication of the Staff Report prepared for this consultation.

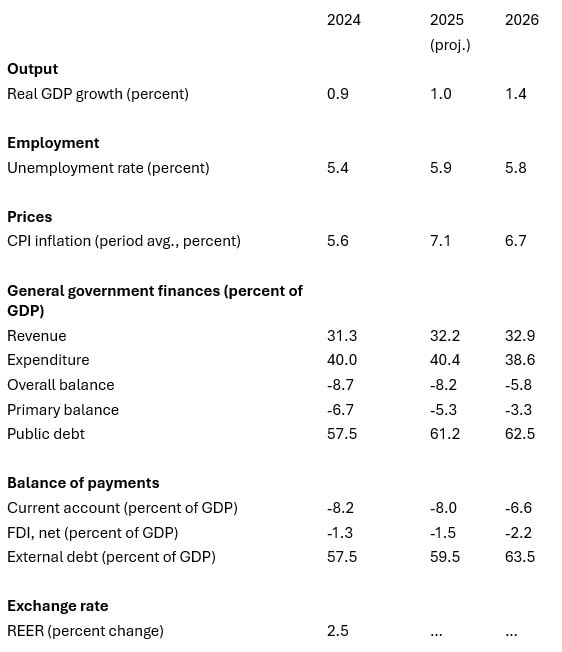

Romania’s economic growth has been subdued, with real GDP growth softened to 0.9 percent in 2024, as strong private consumption on the back of robust wage growth was offset by continued contractions in investment activities. In the meantime, twin deficits have deepened further as rising fiscal deficits contributed to a widening current account deficit. The resilience of the banking system has improved with stronger balance sheets.

The economy is expected to grow gradually by 1.0 and 1.4 percent in 2025 and 2026, respectively, amid necessary fiscal consolidation addressing the widening twin deficits. Headline inflation, which rose to 9.9 percent (y/y) in September 2025 upon the removal of the electricity price cap and the VAT rate increase, is expected to remain elevated temporarily until mid-2026 before returning to the NBR’s tolerance band by end-2026.

The risks to the outlook are tilted to the downside for growth and to the upside for inflation. A sovereign credit rating downgrade remains a risk as concerns persist regarding the execution of the planned fiscal consolidation for 2025–26 and the sustainability of public finances due to the still high fiscal deficit. On the upside, strong implementation of the fiscal adjustment and EU-funded investment projects could strengthen investor sentiment and lower risk premia faster than expected, resulting in higher private investment and growth. Stronger-than-expected wage growth, possibly driven by temporarily high headline inflation, could make inflation expectations unanchored and delay the projected normalization of core inflation.

Executive Board Assessment (2 – see below)

Executive Directors welcomed the recently adopted large fiscal reform package for 2025‑26, which marks an important step in addressing the widening twin deficits. Amid a necessary large fiscal consolidation, and with risks tilted to the downside, Directors called for the right policy mix and ambitious structural reforms to support growth, restore fiscal sustainability, and safeguard financial stability.

Directors stressed the criticality of the full execution of the planned fiscal consolidation in 2025–26 followed by additional adjustment in the medium term to buttress market confidence and ensure fiscal sustainability. To facilitate a growth‑friendly and equity‑enhancing fiscal consolidation, they considered that further tax reform over the medium term should aim at mobilizing revenues and improving fairness while strengthening work incentives and remaining attractive to capital investments. A few Directors recommended caution in applying new tax measures to avoid further dampening domestic demand. Directors recommended continued efforts in fiscal structural reforms including in public financial management to improve fiscal governance and spending efficiency.

Directors agreed that the re‑emergence of inflation pressures calls for a cautious monetary policy approach to ensure that inflation securely returns to the tolerance band. They recommended that policy rate cuts should resume only after growth of wages and prices moderate in a sustained manner. Directors noted that a gradual increase over the medium term in two‑way exchange rate flexibility would enhance economic resilience to shocks; nonetheless, a number of Directors recommended a cautious approach toward greater exchange rate flexibility in the near term, given Romania’s sizable foreign exchange exposure.

Directors welcomed enhanced financial sector soundness, with stronger bank balance sheets. However, amid banks’ growing sovereign exposure, buoyant consumer credit growth, and sizable unhedged FX loans, they emphasized the need to continue monitoring asset quality, stress‑testing liquidity conditions, and strengthening crisis management. Directors also recommended that the authorities should be prepared to recalibrate macroprudential policies and continue to enhance the AML/CFT framework.

Directors underscored the importance of advancing structural reforms under the authorities’ National Recovery and Resilience Plan and enhancing public investment management to unlock available European Union (EU) funds. These reforms together with full use of EU funds will enhance medium‑term growth potential and support fiscal consolidation and external rebalancing. Governance reforms, including better management of the large state‑owned enterprise sector, and greater regulatory predictability are also critical to reinforce Romania’s attractiveness for investment. Raising labor force participation through human capital investment would help mitigate the effects of an unfavorable demographic outlook. Romania’s planned transition to a low‑carbon economy, along with the completion of the EU‑wide Energy Union, will help strengthen energy security.

Explanations:

- Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

- At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country’s authorities. An explanation of any qualifiers used in summings up can be found here: http://www.IMF.org/external/np/sec/misc/qualifiers.htm.

See Also:

Romania: Staff Concluding Statement of the 2025 Article IV Mission | Disruption Banking