Verizon Communications Inc. (VZ) became a Dow Jones Industrial Average (DJIA) component on April 8, 2004, replacing legacy carrier AT&T. This change, part of a three-stock shuffle (AIG and Pfizer also entered), underscored Verizon’s rise after the 2000 merger of Bell Atlantic and GTE merged in 2000. As a descendant of AT&T, Verizon (and SBC Communications, which joined in 1999) took its old parent’s place in the index. In plain terms, Verizon inherited the “Bell” heritage in the Dow.

This piece reviews Verizon’s stock performance before and after DJIA inclusion, its recent financial results, strategy and dividend payouts to shareholders, and why it remains a steady if modest-weight Dow component to this day.

Pre-Dow Stagnation (2000-2004)

Before joining the Dow Jones, Verizon’s stock was largely range-bound. After the Bell Atlantic/GTE merger in mid-2000, the early 2000s telecom bust hit hard. Macrotrends data shows VZ lost 16% in 2000, 15% in 2002, and ~ 6% in 2003.

A $1,000 investment in 2000 barely moved by 2004. In other words, Verizon’s early years as a public company were flat at best. By 2004 the $1,000 investment was near break-even, reflecting price wars and slow growth. Management was building out wireless and fiber networks, but the stock had not yet delivered big gains.

Verizon Post Dow

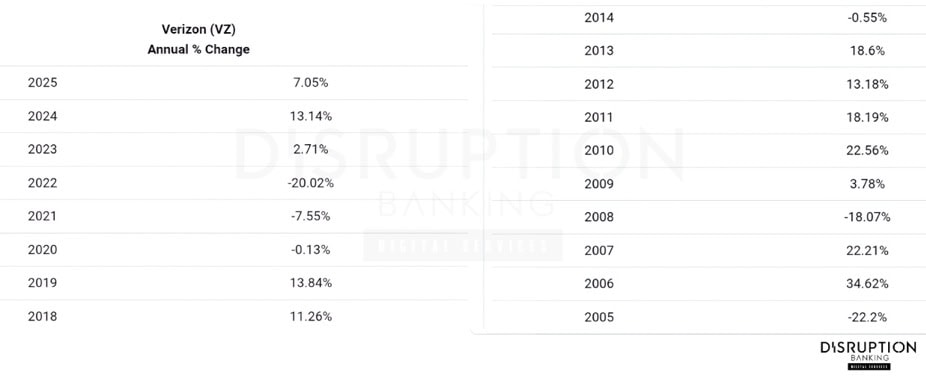

After joining the Dow, Verizon’s progress was uneven. In 2004 and 2006 VZ jumped ~ +20% and ~ +35% respectively, per Macrotrends, but also plunged in downturns: –22.2% in 2005 and –18% in the 2008 crash. The 2010s brought more consistency. Verizon posted double-digit gains in 2010 (~ +23%) and 2011 (+18%), and a strong 21% gain in 2016. Most other years were modestly positive (e.g. +14% in 2019) or near-flat (2017 was +4%; 2014 was –0.55%).

In the last few years Verizon’s performance has been static to weak. According to Macrotrends, VZ stock barely moved in 2020 (–0.13%) despite the pandemic, as rising data use balanced declining travel demand. However, 2021–2022 saw declines (–8% and –20%) under competitive pressure and Covid variants. The rebound came in 2024 (+13%) as fiber and price hikes took effect, and 2025 is modestly up (+7% YTD).

With a market cap of ~ $169 billion (TradingView), at the time of writing, Verizon is far from the highest-flying Dow Jones component, but it has delivered stable, if unspectacular, returns through cycles.

5G, Fiber & Strategy Drive Growth

Verizon’s core business is wireless and broadband. In 2024 it generated $134.8 billion in revenue (up +0.6% YOY), nearly matching 2023’s $133.9 billion. Growth is driven by 5G rollouts and fiber broadband (Fios). Verizon touts “industry-leading” wireless service revenue; in Q3 2025 it hit $21.0 billion (up +2.1% YOY), reflecting pricing power and new 5G device sales. Consumer wireless service was $17.4 billion (+2.4%).

Furthermore, Verizon is extending its network through partnerships and deals. CFO Anthony Skiadas said a new fiber joint venture with Tillman Global will extend Fios beyond core markets, while the pending Frontier Communications deal could add ~ 2.9 million fiber passings for cross-selling plus plans for Amazon’s data centers. Verizon is also leaning on AI and fixed-wireless access (FWA) to lift average revenue per user.

Yet competition is biting. Verizon lost 7,000 retail postpaid phone subscribers in Q3 versus gains at AT&T (+405,000) and T-Mobile (+1 million). CEO Dan Schulman admitted the company is “falling short of our potential” and pledged to be “scrappier” by cutting costs, shedding weak segments, and reshaping its culture to stop being “the hunting ground for competitors.” That overhaul is underway, but the path back to high growth is still being mapped.

Verizon to build new fiber network connecting Amazon's data centers $AMZN $VZ #markets #economy #investing https://t.co/pk84VYquMb

— Seeking Alpha (@SeekingAlpha) November 3, 2025

Verizon’s 19th Straight Dividend Raise

Shareholders benefit mainly through dividends. Verizon raised its payout for the 19th consecutive year to $2.76 per share annually ($0.69 quarterly). At its current share price, that yields roughly 6.8%, among the highest in the Dow Jones.

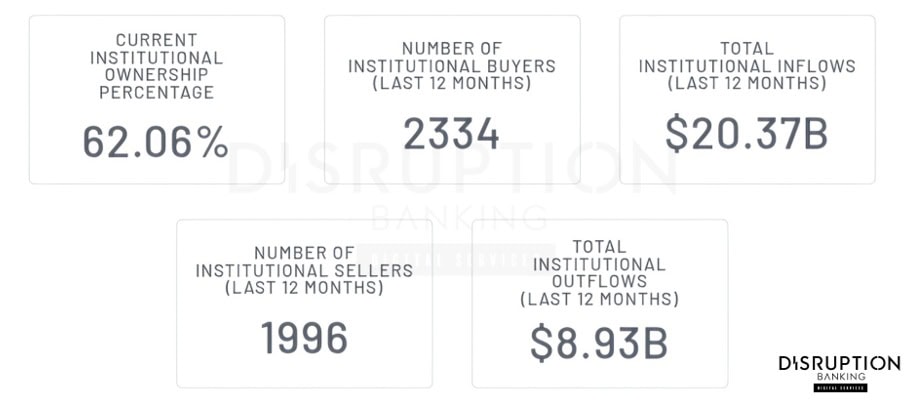

Trading volume suggests roughly 62% of Verizon’s shares are institutionally held. The company also repurchases a few billion dollars in stock yearly. These activities are complimented by dividends, which remain its core return to investors.

Lightweight but Steady in the Dow

In the Dow Jones, Verizon is a lightweight. At $40.03, it makes up only ~ 0.52% of the index (Slickcharts), far below heavyweights like Goldman Sachs (10.3%), Caterpillar (~7.4%), Microsoft (6.5%), Home Depot (~4.9%), American Express (~4.8%), Sherwin-Williams (~4.5%), Visa (4.4%), UnitedHealth Group (~4.3%), Amgen (4.2%), JPMorgan (4.1%), and IBM (~4%). Yet, Verizon remains a steady, low-volatility pillar rather than a growth stock.

For Dow investors, Verizon is a dull-but-durable telecom pillar, not a high-octane growth story. Valuation reflects that reality. Verizon trades at ~ 8x forward earnings, cheap by market standards.

Analysts’ $47 Target: Modest Upside

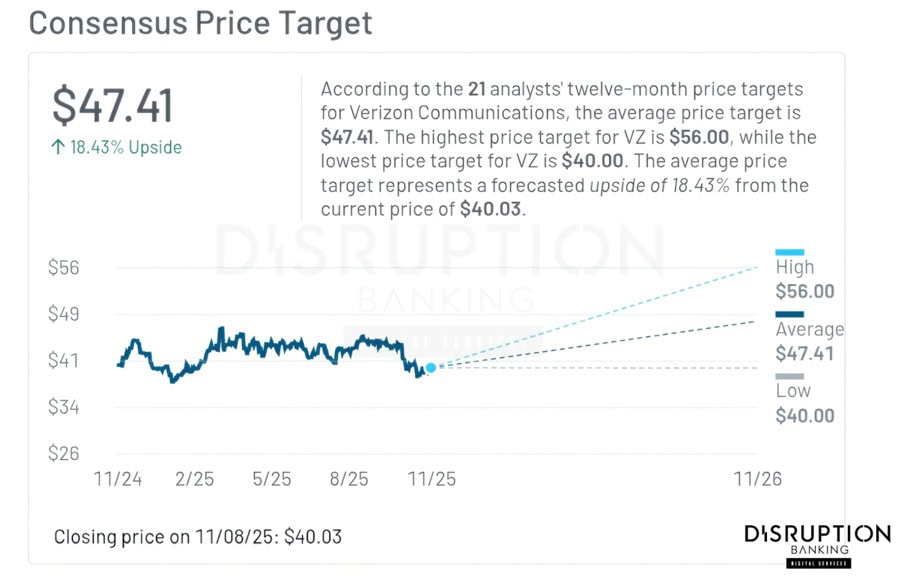

Analysts see only modest upside. The consensus 12-month price target is roughly $47 (about +10% from today) with a “Hold” consensus rating. That implies a view of steady, single-digit growth and fat dividends, rather than breakout momentum.

Indeed, among 21 analysts tracked by MarketBeat, the average 1-year forecast is $47.41 (with a high of $56 and low of $40).

Reliable Dividend Engine in a Fast-Changing Dow

Verizon’s 21+ years in the DJIA have been resilient but unspectacular. Its stock roughly doubled from 2020’s level at the time of writing, largely due to its hefty dividend. It has weathered economic shocks, legacy deregulation, and fierce competition while remaining profitable.

For long-term Dow investors, Verizon offers a stable mix of 5G/mobile and fiber assets, solid cash flows, and a rising income stream. That profile keeps it “connecting” the Dow Jones in a fast-changing economy. Verizon’s latest financials suggest its worst days may now be behind it.

#CapitalMarkets #Verizon #DowJones #DJIA #Telecom #5G #Fiber #Connectivity #VZ

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

UnitedHealth Dow Giant Resets | Disruption Banking

3M in the Dow Jones: from Innovation to Tribulation | Disruption Banking

Caterpillar’s Dow Jones Legacy: Powering Progress Through Innovation | Disruption Banking