How Japan’s low-interest-rate policy quietly shapes global liquidity, risk appetite, and this week, even the speculative rhythm of crypto.

For decades, the yen carry trade has been a quiet undercurrent in the global financial system, helping inflate booms and deepen busts. When markets rise, its liquidity fuels the surge. When fear returns, it recedes.

Some analysts have taken to calling it “financial dark matter”: all around us, but invisible until it moves. And perhaps, this week, the carry trade strategy surfaced briefly in the ebb and flow of one of Japan’s favoured digital tokens, XRP.

It’s a small echo of a familiar pattern. But to understand why, you need to grasp what the carry trade really is, and why it’s one of the most important forces you never see.

The Simple Math Behind the World’s Biggest Funding Trade

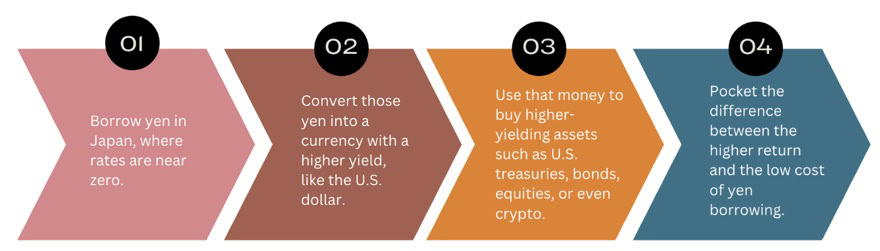

A carry trade sounds arcane, but the logic is simple

Investors borrow money in a currency with low interest rates, traditionally the Japanese yen, and invest in assets denominated in currencies with higher yields. The goal is to “carry” the interest rate difference as profit.

As long as the yen stays weak and volatility remains low, the trade is profitable. But if the yen suddenly strengthens, or investors start pulling back from riskier assets, those positions can unravel quickly. Investors must sell what they own and buy back yen to repay their loans, sending tremors through every market touched by that borrowed capital.

That’s why the carry trade matters: it’s not just a currency strategy. It’s a mechanism that shapes global liquidity. One that can amplify both rallies and sell-offs.

Why Japan’s Cheap Yen Became Global Rocket Fuel

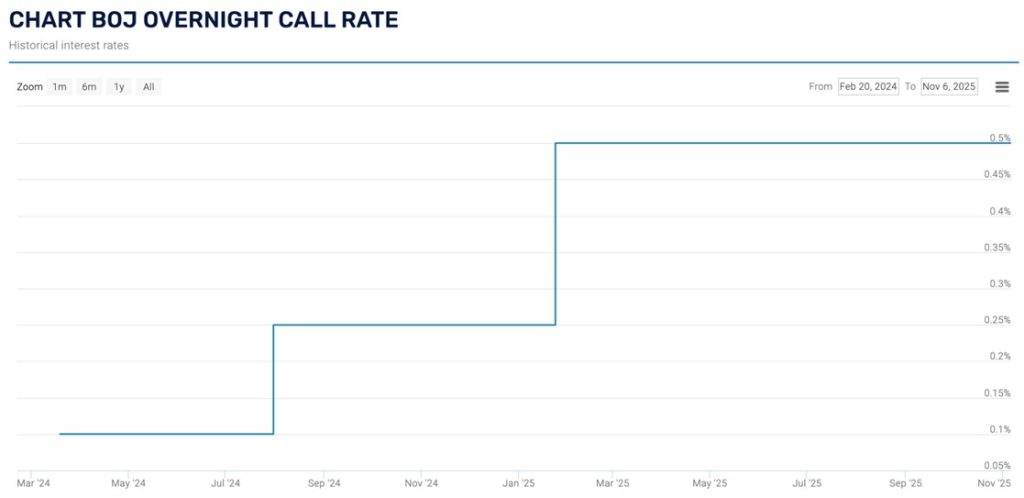

Japan’s central role in this story stems from the Bank of Japan’s ultra-loose monetary policy. Since the 1990s, Japan has struggled with low growth and persistent deflation. To support its economy, the BOJ slashed interest rates to near zero and has kept them there for much of the last two decades. The result: borrowing yen is extraordinarily cheap.

HOW BIG IS THE YEN CARRY TRADE?

— Global Markets Investor (@GlobalMktObserv) August 8, 2024

-$20 trillion, or 505% of Japanese GDP, using its government balance sheet, according to Deutsche bank

– $3.4 trillion (487T yen) based on Japanese investors’ net international investment

– $1 trillion using Japanese banks’ foreign lending data pic.twitter.com/Sz8tLh2w8s

This made Japan an almost bottomless source of funding for the world’s investors. Cheap yen poured into everything from U.S. mortgage securities to Australian dollars, emerging-market bonds, and most recently, speculative tech and crypto assets.

When those investments work, everyone profits. But when markets turn, the reversal can be swift and brutal. Investors buy yen to close positions, strengthening the currency and accelerating the global retreat from risk.

Past Unwinds: 2008, 2015, 2020, 2024 — And the Next One?

The yen carry trade has played a background role in several financial events of the past 25 years:

2008: Crisis

Before the financial crisis, investors borrowed trillions of yen to buy high-yielding assets. The trade thrived as volatility fell, and global growth surged. But when the crisis hit, investors raced to unwind positions, buying yen en masse to repay loans. The result? The yen soared. Even as Japan’s own economy weakened and risk assets collapsed globally.

2015–2016: China’s Slowdown

When concerns about China’s growth rattled markets, the yen again strengthened sharply. As carry trades reversed, global equities and commodities fell in tandem.

2020–2022: The Pandemic

Unprecedented stimulus and near-zero rates worldwide reignited the carry trade on a grand scale. Cheap yen (and cheap dollars) flowed into tech stocks, crypto, and emerging markets. The yen weakened dramatically. A clear sign of abundant global liquidity.

2023–2024: Fragile Waters

As inflation took hold globally, the Federal Reserve and other central banks hiked rates. The BOJ, however, stayed dovish, making the yen even cheaper to borrow. The result was a historically weak yen, hovering near multi-decade lows around ¥150–155 per dollar. That weakness helped fuel a surge of capital into risk assets.

By mid-2024, with the BOJ hinting that it might eventually tighten policy, the world’s biggest funding trade was on watch again.

“The BOJ has definitely been more hawkish than people had anticipated at the start of this year, hiking rates again and strongly signalling that they’re likely to continue to hike rates going forward,” – Lee Hardman, senior currency analyst at Japanese bank MUFG.

XRP’s Japan Link: When Crypto Feels the Yen Squeeze

In 2025, the yen carry trade is still alive but far less carefree. The once-wide gap between Japanese and global interest rates has narrowed as investors anticipate U.S. rate cuts while the Bank of Japan edges toward a modest tightening path.

That’s left the trade more vulnerable: with thinner yield differentials, even small swings in the yen can erase profits on leveraged positions. Positioning data suggests traders are scaling back exposure and watching for signs of stress across higher-risk assets.

It’s in that more delicate backdrop that this week’s move in one of Japan’s favourite digital tokens, XRP, takes on greater resonance.

Over the past week, XRP has come under pressure, part of a broader wave of risk aversion rippling through crypto markets. Just like Bitcoin, XRP has unique ties to Japan. Ripple’s long-standing alliance with SBI Holdings has made Japan one of the most active XRP markets globally, both for retail traders and institutional participants. XRP’s integration into Japanese payment infrastructure and fintech channels means it often reflects Japanese investor sentiment more than other digital assets do.

“Unlike most Asian currencies, the yen moves freely across borders, making it the perfect vehicle for an on-chain carry trade that blends Japan’s easy money with DeFi’s appetite for yield.” – CoinDesk

That’s what makes this week’s price action notable. As XRP fell and global crypto leverage was squeezed, JPY-funding flows may have briefly reversed, rising roughly 0.3–0.5% against the U.S. dollar. That might sound trivial, but when carry-trade yields hover around 1%, even a small yen fluctuation can sting for highly leveraged positions funded in JPY.

“But carry trades are more sensitive to currency moves and rate expectations than the actual level of rates, analysts say. The mere talk of further rate rises in Japan and Fed rate cuts by September (2024) has driven the yen up 13% in a month and narrowed the yield gap, completely wiping out the slim gains in pure yen-dollar carry trades.” – Reuters August 2024

However, this week, this modest move hints at a broader dynamic. It’s not that XRP caused the yen appreciation; rather, the yen and XRP both responded to it, triggering a mini unwind. It’s plausible that a brief bout of risk reduction led some yen-funded investors to repatriate capital, illustrating how tightly connected modern liquidity flows have become.

When global risk appetite fades, capital tends to flow back to Japan, lifting the yen.

The Bigger Picture

The yen carry trade isn’t the driver behind this week’s XRP volatility, but it may be part of the undertow. As one of Japan’s favoured digital assets slipped and traders pared back exposure, a modest yen appreciation hinted at capital flowing back toward home shores.

It’s a humbling thought: in an age of digital assets and algorithmic trading, one of the most important forces in global finance is still old-fashioned currency leverage. It’s a reminder that the global financial system is deeply interconnected. The carry trade may be unseen, but its shadow stretches across every asset class.

Author: Caroline Adams

#Yen #XRP #Japan #CarryTrade #Liquidity #Leverage

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Strong Will the Japanese Yen (JPY) Be In 2026? | Disruption Banking

Japanese Yen (JPY) Hits Lowest Level Since 1986 | Disruption Banking

How XRP Became a Leading Cryptocurrency | Disruption Banking

One Response

Great article, and explains why precious metals spiked in November 2025, especially silver and the demand AI adds to the issue. I wanted to let you know of another troubling story I have 400 hours on involving Beringer Capital Private Equity Firm. See link below.