Merck & Co. (ticker: MRK) became the first pharmaceutical company to enter the Dow Jones Industrial Average on 29 June 1979, replacing meat‑packing conglomerate Esmark (Swift & Company). Founded in 1891, Merck was already close to being a centenarian when it joined the 30‑stock index, and the decade leading up to its inclusion was challenging to say the least.

Today, Disruption Banking charts Merck’s evolution — from pre-Dow buildup to its steadfast contributions over the ensuing years — to illustrate how this biotech pioneer has bolstered the Dow Jones.

Merck’s Biotech Edge Joins Dow Jones

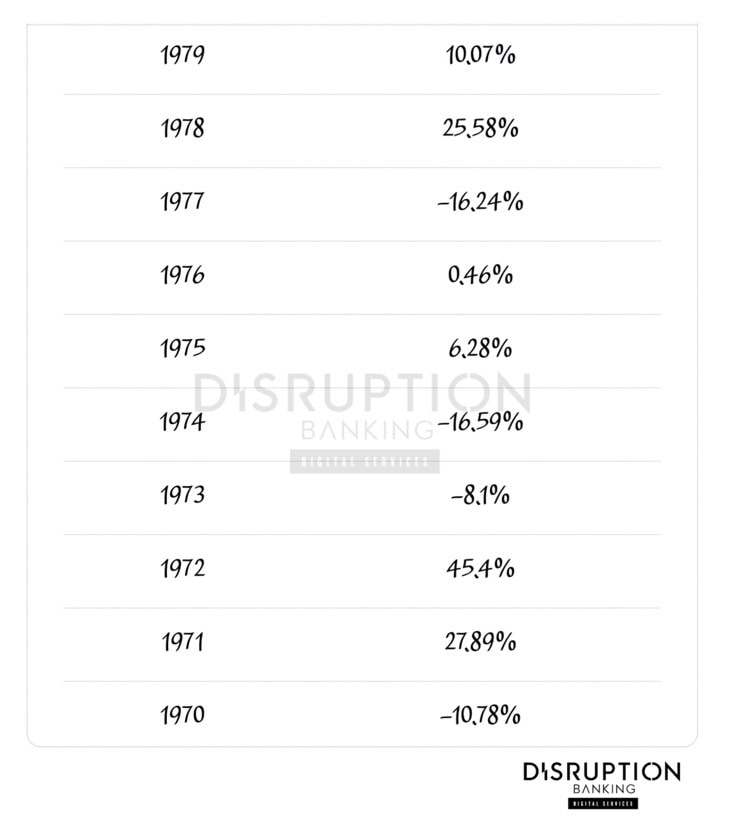

Macrotrends data show that Merck’s annual returns swung from double‑digit gains to steep losses in the 1970s, with declines of roughly 16 percent in both 1974 and 1977, followed by a 45 percent surge in 1972 and a 26 percent jump in 1978.

Averaged across 1969–1978, MRK delivered roughly 8 percent per year, demonstrating resilience through stagflation, oil shocks, and the volatility of a research‑driven company.

Those highs and lows set the stage for Merck’s invitation to the Dow Jones and signalled the index’s willingness to include life‑science innovators alongside industrial titans.

Merck MRK Volatility Shapes Gains

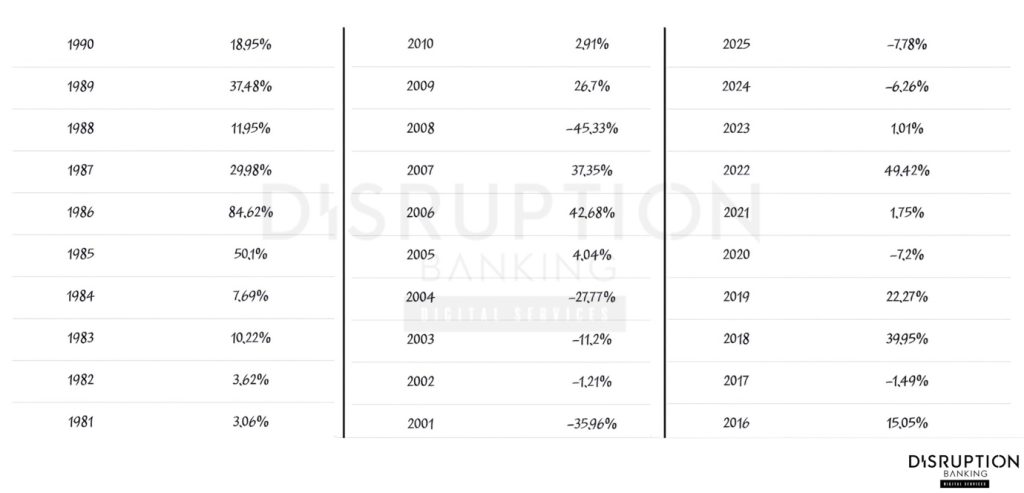

Merck’s addition to the Dow Jones Industrial Average (DJIA) marked the start of America’s biotech boom. Merck’s early years were slow. The stock rose just 3 percent in 1981 and 4 percent in 1982. But the launch of Mevacor and Zocor — Merck’s brand-name statin (a statin is a class of prescription drugs used to lower cholesterol levels in the blood, primarily to reduce the risk of heart disease, heart attacks, and strokes) — turned things around. Returns jumped 50 percent in 1985, 85 percent in 1986, and 89 percent in 1991 in anticipation of HIV drugs.

The company also faced setbacks. The Vioxx scandal and patent losses led to drops of MRK by negative 36 percent in 2001 and negative 28 percent in 2004. Add to that the 2008 financial crisis which cut the share price by 45 percent. However, from 1979 to 2024, MRK still averaged a 16 percent annual return, more than tripling investors’ money — proof of why the Dow continues to keep the Rahway, New Jersey (Merck’s global headquarters) drugmaker in its elite ranks.

Keytruda Boosts Merck’s Dow Jones Role

In the 2010s, Merck staked its future on immunotherapy — and won. Keytruda, its PD-1 checkpoint inhibitor, became the world’s best-selling cancer drug, bringing in $29.5 billion in 2024, nearly half of Merck’s $64.2 billion revenue. Sales rose 7 percent, and non‑GAAP earnings per share (EPS) hit $7.65. Chairman and CEO Rob Davis credited “demand for our innovative portfolio, including for KEYTRUDA…,” forecasting 2025 sales of $64.1–$65.6 billion and EPS of $8.88–$9.03.

By Q2 2025, signs of pressure emerged: revenue slipped 2 percent to $15.8 billion, and Gardasil — Merck’s Human Papillomavirus (HPV) vaccine — plunged 55 percent year-on-year. Still, Keytruda grew 9 percent to $8 billion, while Winrevair, acquired through Acceleron, added $336 million.

Merck responded with a $3 billion annual cost-saving plan by 2027, reinvesting in more than 20 potential blockbusters. As Davis put it, the company must “reallocate money from slower-growth areas to fully fund the fast-growing ones.”

Meanwhile, Merck stock MRK jumped some 6-7% on announcement of the $70 billion TrumpRx deal with Pfizer to “expand its mRNA empire, lower drug prices.”

How Merck’s Pipeline Extends Biotech Gains

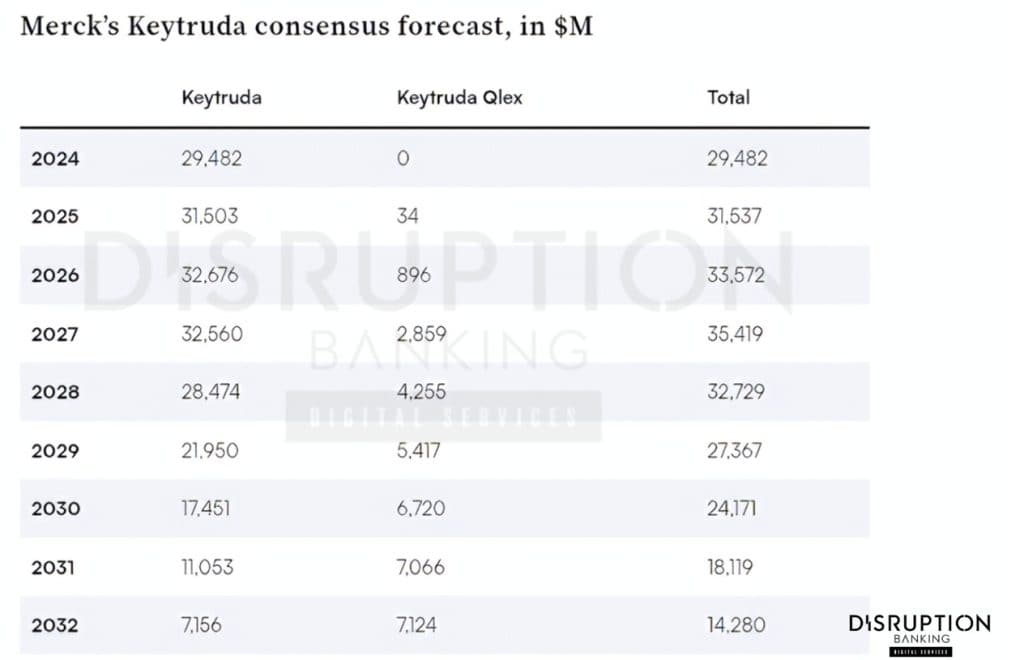

Analysts warn that Keytruda’s patents begin expiring in 2028, which could shrink sales to roughly $7 billion by 2032. To extend the franchise, Merck launched Keytruda QLEX, a subcutaneous version approved by the U.S. FDA last month that takes a one‑minute injection rather than a 30‑minute intravenous infusion.

Oncologist Dr. J. Thaddeus Beck calls it “faster administration,” one that “gives patients more choices of health care settings,” while Dr. Marjorie Green, Merck’s oncology head, says it’s “a new injectable immunotherapy option… in as little as one minute.” Analysts at Evaluate expect it to help Keytruda hit a $32.7 billion peak in 2026, easing the eventual decline.

At the 2024 Goldman Sachs Healthcare Conference, CEO Davis said Merck is pivoting to oral GLP-1 drugs for heart and metabolic health. Its lead candidate, efinopegdutide, targets metabolic dysfunction‑associated steatohepatitis (MASH) instead of weight loss. With 20+ late-stage programs and a $10 billion Verona Pharma deal, Merck is redefining its Dow Jones era through biotech reinvention.

Merck Dividends Anchor Dow Jones Stability

Merck’s dividend remains a key blue-chip draw. Lately, it has raised payouts for 14 straight years and offers a 3.6 percent forward yield, among the highest in the Dow Jones.

At $88.80 per share (TradingView), Merck holds a roughly 1.2 percent Dow weighting (Slickcharts), adding biotech strength alongside Johnson & Johnson and Amgen.

Merck’s Regulatory Risks Test Gains

Merck’s scientific breakthroughs have come with costly missteps. Data from the Corporate Research Project’s Violation Tracker shows Merck has paid over $10.7 billion in penalties since 2000, including a $4.85 billion settlement in 2007 over the painkiller Vioxx and a $950 million fine in 2011 for off-label promotion.

Other cases include a $2.3 billion tax settlement in 2007 and several False Claims Act violations. None threatens Merck’s stability, but they highlight how regulatory scrutiny remains a constant risk for major drugmakers.

Merck MRK Outlook Fuels Dow Jones Upside

Merck’s addition to the Dow Jones over 40 years ago marked biotech’s rise alongside steel, oil, and finance in the U.S. economy. Since then, the company has faced ups and downs driven by blockbuster drugs and patent swings.

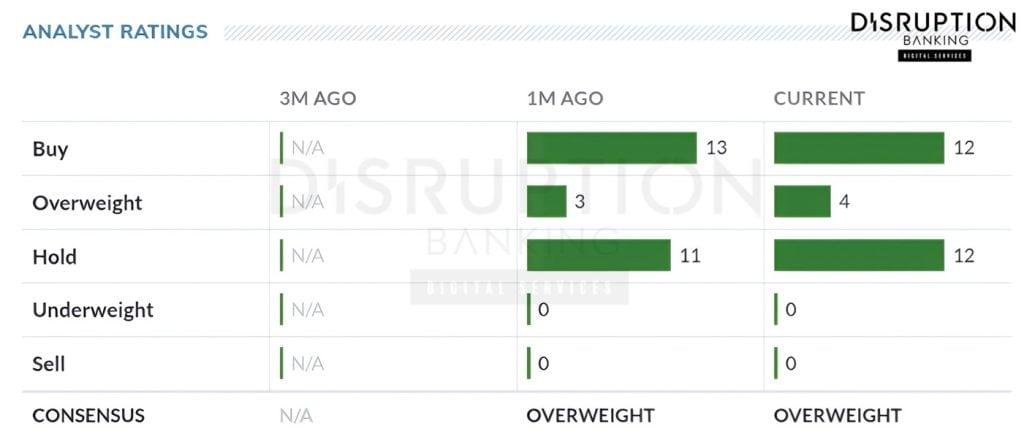

Analysts tracked by MarketWatch now show a median 2025 EPS estimate of $9.10 for Merck, with a consensus price target of $98.00 and an average target around $101.95 — implying about 17–18 percent upside from the current ~$85 level. Meanwhile, Cantor Fitzgerald maintains its Neutral rating on Merck, with a target of $83.00, reaffirmed in July, citing concerns about the company’s growth trajectory once Keytruda faces patent expiry.

With a solid dividend, moderate analyst optimism, and a modest yet meaningful spot in the DJIA, Merck continues to serve as a biotech innovator within the Dow — its fortunes still bound to science, innovation, and long-term shareholder value.

#CapitalMarkets #Merck #DowJones #DJIA # #Industrial #Innovation #Biotech #Dividends #MRK

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Honeywell’s Journey in the Dow Jones: From Conglomerate to Specialist

Amgen: Biotech Pioneer’s Dow Jones Journey

Johnson & Johnson: A Steady Dose of Dividends in the Dow Jones | Disruption Banking