Cryptocurrency adoption in India has surged in recent years. Just last year, India accounted for over one in five of all crypto holders worldwide. Estimates put India’s crypto users in the tens of millions. One analysis counted approximately 119 million Indian crypto owners this year, making it the largest crypto market globally.

Indian crypto investors tend to be young and tech-savvy. According to a 2025 report, most users under 35 cite the steep 30 percent gains tax as a significant burden, implying that younger investors are still a core constituency.

As this article will show, crypto’s popularity in India is driven by a mix of social, technological, and economic factors — from youth-led enthusiasm and inflation hedging to major startups and evolving regulation — and the trend shows no signs of slowing.

India’s Global Crypto Dominance

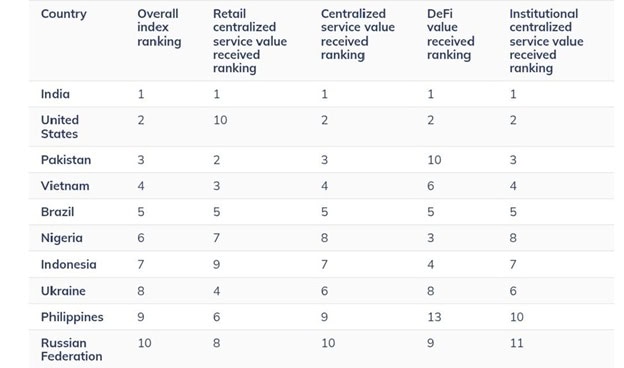

India leads global adoption metrics. According to Chainalysis’s 2025 Global Crypto Adoption Index, India ranks first across all subindices — retail, centralized services, DeFi, and institutional activity. In practical terms, India’s per-capita on-chain crypto activity (adjusted for purchasing power) now exceeds that of any other country. Regionally, India leads in the Asia-Pacific, reinforcing its dominance.

Within Asia, adoption is broad-based. Studies show many South Asian nations — including India, Pakistan, and Bangladesh — show high adoption, often driven by young retail investors. The rise of fintech and internet access means many Indians view crypto as the next step beyond mobile banking and e-wallets.

In short, India today stands alongside the U.S. and Europe as a top-tier crypto market and leads its region.

Youth and Tech Powering Crypto’s Rise

Interest in crypto in India is fueled by curiosity, social influence, economics, and psychological factors — like the fear of missing out (FOMO), awareness through peer networks, and the allure of outsized returns. Many new users cite long-term investment and portfolio diversification as motivation.

Economic conditions add momentum. With low savings and bond yields, many see crypto as an alternative asset or inflation hedge. IIM Bangalore research found households expecting higher inflation were more likely to buy Bitcoin or stablecoins. Easy access through apps, quick rupee deposits, and the $250,000 annual remittance quota also help, with wealthy Indians using it to invest in U.S. Bitcoin ETFs.

Demographics shape adoption, too. A report from CoinSwitch Q2 2025 shows that people under 35 now make up approximately 72 percent of all crypto investors in India, with 44.4 percent in the 26-35 bracket and 27.3 percent in the 18-25 group, while women now make up about 12 percent of India’s crypto investor base. With high digital literacy and widespread fintech use like Unified Payment Interface (UPI), crypto feels like a natural next step for millennials.

India’s Crypto Exchange Giants

India’s crypto scene is dominated by a few major exchanges. Bitbns led the market in 2023 with about 79 percent of local volume, followed by WazirX (11 percent) and CoinDCX (6.6 percent). Others like ZebPay, Unocoin, Giottus, and BuyUcoin also operate. These platforms serve millions. CoinDCX is trusted by over 16 million registered users, per its Web3 Landscape Report 2024. WazirX claims over 15 million users as of early 2025, though its reputation has been affected by a major security breach in July 2024. CoinSwitch, on the other hand, passed 25 million registered users this month. These figures show crypto’s deep penetration in India.

Since 2023, exchanges are required to register with the Financial Intelligence Unit (FIU) and follow KYC/AML rules. Binance complied that year but paid a 188.2 million rupee fine for earlier violations. Platforms like CoinDCX and ZebPay are registered as Virtual Asset Service Providers (VASP), and Paytm’s crypto arm is also licensed. As a result, Indian traders now have regulated platforms — though with strict identity checks.

Institutions Join India’s Crypto Wave

Beyond retail users, crypto is drawing institutional and enterprise interest in India. Venture capital is backing local firms. In Q1 2025, private equity/venture capital investments across India totaled $13.7 billion over 284 deals. While not all crypto, fintech and adjacent sectors remain strong draws.

On the enterprise side, the Reserve Bank of India (RBI) recently cleared a blockchain-based MSME financing solution (by IBDIC) for broader adoption after regulatory sandbox trials, showing institutional willingness to build concrete blockchain infrastructure for credit/supply chain finance.

On the trading side, institutional investors are quietly entering. CoinDCX sees a rising pro-trader segment, and 2024 reports show wealthy Indians buying overseas crypto ETFs.

Overall, India’s crypto scene now ranges from grassroots users to major corporations, signaling deeper institutional involvement.

Navigating India’s Crypto Regulations

India’s regulatory stance on crypto has been cautious and indirect. Cryptos are not legal tender, and there’s no dedicated law yet. Back in 2018, the RBI ordered banks to cut ties with crypto firms, however the Supreme Court overturned that in 2020. Since then, trading hasn’t been banned. No one is jailed for buying crypto. But strict rules apply.

In 2022, the Finance Ministry imposed a 30 percent tax on gains and a 1 percent Tax Deducted at Source (TDS) on transactions, making trading costly.

As of this year, Reuters confirmed India won’t legalize crypto soon, instead opting for “partial oversight” through taxes and anti-money laundering (AML) measures.

Current policy focuses on consumer protection and crime prevention. Though regulators warn about scams and volatility, they have avoided a full ban on ownership or trading.

🚨BREAKING: 🇮🇳 India won’t bring a full crypto law, says it could create systemic risks & hurt UPI.

— Crypto India (@CryptooIndia) September 10, 2025

🔑 Key takeaways:

Regulating crypto may legitimize it & make it systemic

A ban won’t stop peer-to-peer or DEX trades

Stablecoins pegged to the US dollar could fragment India’s… pic.twitter.com/aYKNCX3ou5

India’s Crypto Future Unleashed

The country’s crypto boom reflects a digitally savvy population, with strong awareness, a startup-friendly climate, and a regulatory atmosphere that permits trading under strict rules.

Clearly, as more users plan to keep investing and institutions step in, crypto’s transition from niche to everyday use in India seems underway.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The Rise in Popularity of Cryptocurrency in the United Kingdom | Disruption Banking

India: BlackRock’s Newest Growth Market? | Disruption Banking