Hedera Hashgraph, an alternative distributed ledger system, has many big institutions intrigued. Some big players in DeFi and high finance are on the roster, along with the first stablecoin sponsored by a U.S. state: Wyoming‘s Frontier (FRNT) Stablecoin issued on Hedera. The Australian Digital Dollar (AUDD) recently launched on Hedera (as one leg of a multichain strategy) in June, and Coinbase announced it was listing it on September 24.

There’s momentum driving a bullish narrative in the news, but don’t put too much stock in the hype. The network is lagging behind in activity, despite copious activity on Github.

Behind the Hype: TradFi

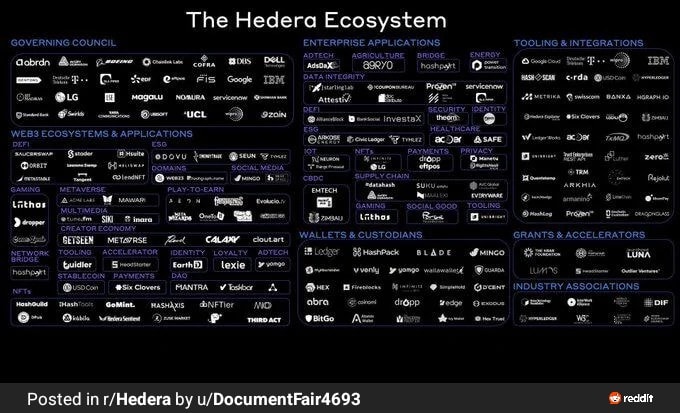

Upon its inception, Hedera promised to deliver a faster and more efficient ledger system with carbon-friendly transaction fees. It garnered credibility from the members on its governance council, which is like a who’s who of Davos. Hedera’s governance council is a melange of blue-chip firms in payments, banking, tech, telecom, and high-net-worth families. Hedera’s enterprise-backed model, trusted by firms like IBM and Google, strengthened its case.

Grayscale has filed a petition for an HBAR ETF with the SEC, while Wyoming’s Stable Token Commission selected Hedera after reviewing speed, governance, and compliance standards.

If these types of entities trust Hadera, it’s more likely that they have done due diligence on the governance model, right?

Don’t be so sure. The hype has to be backed up by adoption, but the majority of projects built on the network over the last four years have been abandoned, according to an investor’s post on Reddit. The investor, who claimed to have invested their life savings in the token, recently sold 1.5 million HBAR.

Centralization without Adoption?

Hedera is a paradoxical protocol in DeFi due to its conflicted structure between decentralization and centralization. Hedera Hashgraph (HBAR) positions itself as a “leaderless proof-of-stake network,” claiming superiority over previous blockchains, specifically in terms of speed and energy efficiency.

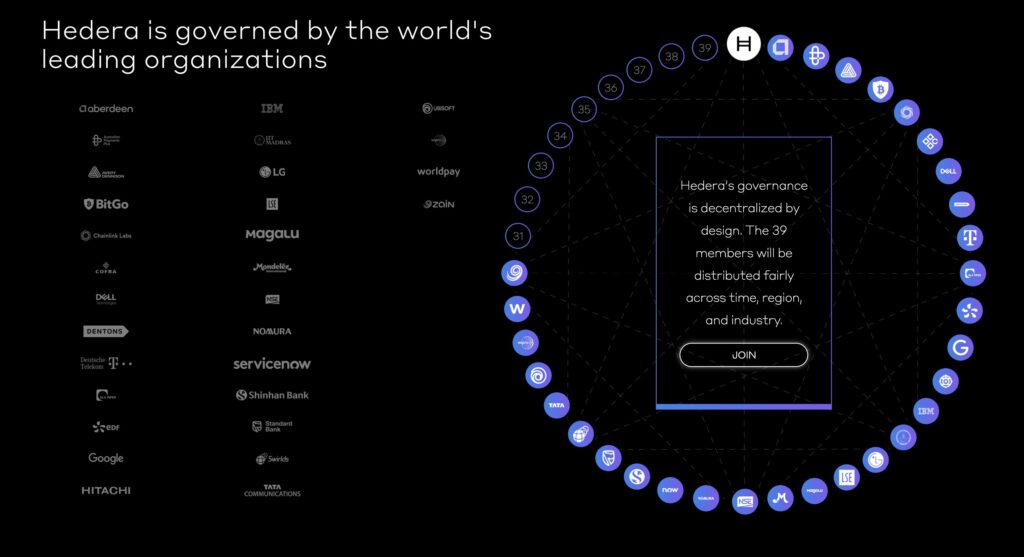

The Members govern the nodes that verify transactions and provide consensus in the network. The Membership page displays 30 members, down from 32 in January. DBS Bank resigned from the council in July 2024 due to term limits.

Some of Hedera’s members are providers of financial infrastructure to integrate DeFi to TradFi. That’s the case with Archax, which Disruption Banking wrote about here. Arrow and Blockchain For Energy are new members this year. Hitachi, Bitgo, Mondelez International, and Nairobi Securities Exchange joined in 2024.

Chainlink Labs, the decentralized oracle network, is a member of the Hedera Governance Council. Hedera plugs into Chainlink’s infrastructure to access its suite of assets, including data feeds and proof of reserve. As of now, Chainlink Labs is still on the governance list, meaning the company renewed its membership in May of 2025.

Having big names throw their lot in with the project is normally taken as a sign of faith by the market, but it’s less clear that TradFi and Big Tech know how to pick winners among digital assets.

Corporate Consensus and Decentralization

HBAR bills itself as decentralized, but a research article by Lucas Amherd, Sheng-Nan Li, and Claudio J. Tessone noted, “Hedera Hashgraph exhibits a high centralisation of wealth and a shrinking core that acts as an intermediary in transactions for the rest of the network.”

The article was published in 2023. In the interim, between Hedera’s 2022 4th quarter report and its most recent Treasury Management Report shows that unallocated supply has collapsed from several billion HBAR to just 0.13%, while purchase agreements have nearly doubled to 25.4% of supply and network governance & operations have slipped to 16.2%.

This suggests that Hedera is shifting toward a more ecosystem-driven model with over half of all tokens (50.5%) earmarked for development, meaning that Hedera appears to be becoming more ecosystem-driven.

Despite those shifts, the on-chain stats show mixed adoption: daily active accounts fell from ~10,100 to ~6,700 QoQ in mid-2025, while smart contract activity has grown but remains concentrated. That means the tokenomics look more mature and ecosystem-oriented, but user engagement hasn’t yet caught up, and the network still struggles to translate that into broad, decentralized adoption.

Worst Case Scenario: Sell at 3x?!

Minting more unallocated supply would mean getting unanimous approval from all members of the governance council. Scarcity would be good for investors, but it’s not clear how the allocated supply actually breaks down.

For example, we don’t know how much has been released to user accounts, or how much remains in the treasury, or what share of the total is under the control of council members.

On StackOverflow or Github or Reddit, there are voluminous technical discussions about this or that functionality on the network, but it seems like the many have described it as “straightforward.” That’s not to say that there aren’t other developers who have found the system cumbersome or otherwise counterintuitive, but there are a lot of them building on Hedera.

#Hedera has more core developers than BNB, Base, and Solana combined. Over the past three years, Hedera has seen a 3.5x increase in core developers, while Solana has experienced a slight decrease. As more Web 2 companies transition to blockchain, it will be interesting to see… pic.twitter.com/MJY1I3evC7

— Diffused Labs (@DiffusedLabs) July 25, 2024

There was even a follow-up discussion about these stats on Reddit, including the following image of supposed developper activity on HBAR.

However, there was not clear-cut consensus that the data was authoritative. In the final analysis, the destiny of Hedera isn’t necessarily in the hands of its blue-chip partners; it’s in the hands of developers and dApps who will use the network and build on the ecosystem. If history is any guide, that’s where it should be.

Grassroots Adoption vs. Institutional Endorsements

Whether Hedera can bridge the gap between institutional endorsements and grassroots adoption will determine if HBAR becomes a lasting player in digital assets, or just another well-funded promise that failed to deliver.

The disgruntled investor on Reddit explains, “I used to be so excited when the Saudi Arabian government invested $200 million into HBAR. That’s gonna kick it off, I thought. But now, two years later, I can’t find a single application that was built with that 200 million. How can you get that big of a funding with nothing to show?”

Regardless, Hedera is a much-needed experiment in decentralized governance. Disruption Banking has meticulously dissected the unforeseen pitfalls in DeFi governance, and new experiments must heed the lessons of the past.

The assets of the Hedera network are geographically distributed, with nodes diversified across industries and continents. There are sensible term limits on the governance council, and no single council member can hold more than one seat. Software updates require a majority approval, and minting any new supply would require unanimous consent.

These safeguards make Hedera less susceptible to capture, even if it has not yet reached the permissionless ideal of Bitcoin or Ethereum.

As for the early investor who sold his stake, he didn’t sell at a loss; he tripled his investment. But he wasn’t the rule, most others are still hoping for a return.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Hedera is Gaining in Popularity Down Under | Disruption Banking

Will HBAR Break Out in 2025? Hedera’s Upgrades and SpaceX Connection Explored | Disruption Banking