Platform experiencing 30x growth as hypergrowth companies abandon traditional tools for unified AI-powered finance operations

Copenhagen and London, 25 September 2025 – Light, the AI-native finance platform that processes 280 million records in under a second, today announced $30 million in Series A funding led by Balderton Capital. The investment comes as the company reports 30x growth over the past 12 months, with customers reducing finance operations time by 84% after switching from legacy ERPs.

Atomico, Cherry, Seedcamp, and Entrée participated in the round alongside notable angels, including Thomas Wolf (Co-founder and Chief Science Officer, Hugging Face), Charles Songhurst (Board Member, Meta), and several customers-turned-investors. The funding brings Light’s total raised to $43 million.

The End of Financial Admin

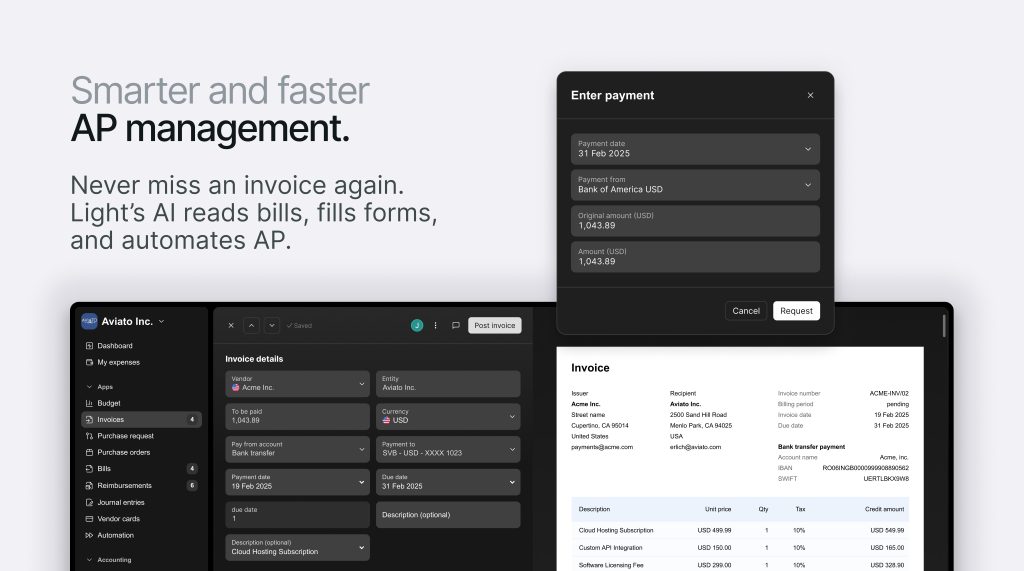

Founded in 2022 by serial entrepreneur Jonathan Sanders, Light solves a critical problem: providing finance tools able to keep pace with hypergrowth companies that are scaling much faster than traditional SaaS businesses. While competitors add AI features to decades-old architecture, Light built its entire platform with AI at the core to be organic software that evolves and improves over time – from database design to user experience.

The result is dramatic. Where legacy systems fail at processing 1 million records, Light handles 280 million in under a second. Balance sheets generate instantly. Multi-entity accounting, global payments, and expense management happen automatically across jurisdictions. The platform’s AI matches human accuracy while catching errors that professionals often miss.

“We’re not patching old systems with chatbots,” said Jonathan Sanders, founder and CEO of Light. “We built finance software from scratch for how companies actually operate today. Companies shouldn’t have to spend $50,000 and 5 months just to expand into a new country. With Light, it happens instantly.

“ERP was built for factories. Light is built for the fastest-growing companies of the 21st century.”

Trusted by the Fastest Growing Companies

Light’s approach has attracted category leaders experiencing explosive growth. Lovable, Sana, and Legora are among the hypergrowth companies that have replaced their fragmented finance tools with Light’s unified platform. These businesses needed more than incremental improvements – they needed infrastructure capable of scaling at their speed without adding headcount or complexity.

The platform already partners with established financial infrastructure including JP Morgan, Adyen, and BDO, ensuring enterprise-grade reliability while delivering startup-speed innovation. Light’s engineering team, drawn from Spotify, Google, Klarna, AWS, Booking.com, and Shopify, has built a system that’s primed for global companies rather than forcing businesses into rigid workflows.

Accelerating Global Expansion

The Series A funding will accelerate Light’s geographic expansion by setting up a new office in New York to meet client demand. The company plans to triple its engineering team by Q2 2026, launch a process optimisation workbench and further build out the deployment department.

“We’ve seen countless finance platforms over the years, but almost all of them tweak at the edges,” said Rob Moffat, Partner at Balderton Capital. “Light is the first to throw out the old playbook. By rebuilding the general ledger from scratch instead of bolting onto legacy systems, they’ve unlocked the full power of AI. The result isn’t just faster, it’s a step-change. This is the financial platform hypergrowth companies have been waiting for.”

About Light

Founded in 2022, Light is the new accounting and finance platform for businesses of all sizes, able to automate everything from payments to expense management and reporting across different jurisdictions in an organic platform able to grow and scale as a business does. Built by a team drawn from Twitter, Pleo, Google, Spotify, Klarna, AWS, Booking.com, and Shopify; Light is creating the future of finance.

About Balderton Capital

Balderton Capital is a multistage venture firm with more than two decades of experience supporting Europe’s best founders from Seed to IPO. We have both early and growth funds and invest across the technology sector, with a proven track record backing AI, fintech, B2B SaaS, digital health, mobility, gaming and marketplace companies. Previous investments include Darktrace (LON: DARK), Depop, Dream Games, Flywire (NASDAQ: FLYW), Kobalt, MySQL, Nutmeg, Peakon, Recorded Future, Talend (NASDAQ: TLND) and THG (LON: THG). Balderton’s current portfolio includes: Aircall, Contentful, Cleo, Fuse, GoCardless, Lendable, Matillion, Photoroom, Primer, Proxima Fusion, Quantum Systems, Revolut, The Exploration Company, Tibber, Wayve, Writer and ZOE.