World Liberty Financial (WLF), the Trump family’s DeFi venture, is making waves in the crypto space, approaching the official launch of its WLFI token ($WLFI). The governance token of Aave, the lending protocol, dropped 8 percent after WLF denied that the protocol would host a large stake of WLFI.

At the same time, WLF is moving forward with its USD1 stablecoin, unexpectedly minting $205 million, a 9 percent jump in supply and a new high for the token. The mint—announced via X shortly after a pro–stablecoin speech by Federal Reserve Governor Christopher Waller—boosted USD1’s circulating supply to $2.4 billion and nudged WLF’s treasury to $548 million, making USD1 its single largest holding at around 39 percent of assets.

This move marks the most significant expansion in USD1’s supply since its April launch, propelling it to the sixth-largest stablecoin by market cap. To understand what lies beneath the surface, it’s helpful to juxtapose mainstream coverage of the USD1 mint against investigative insights grounded in on-chain data.

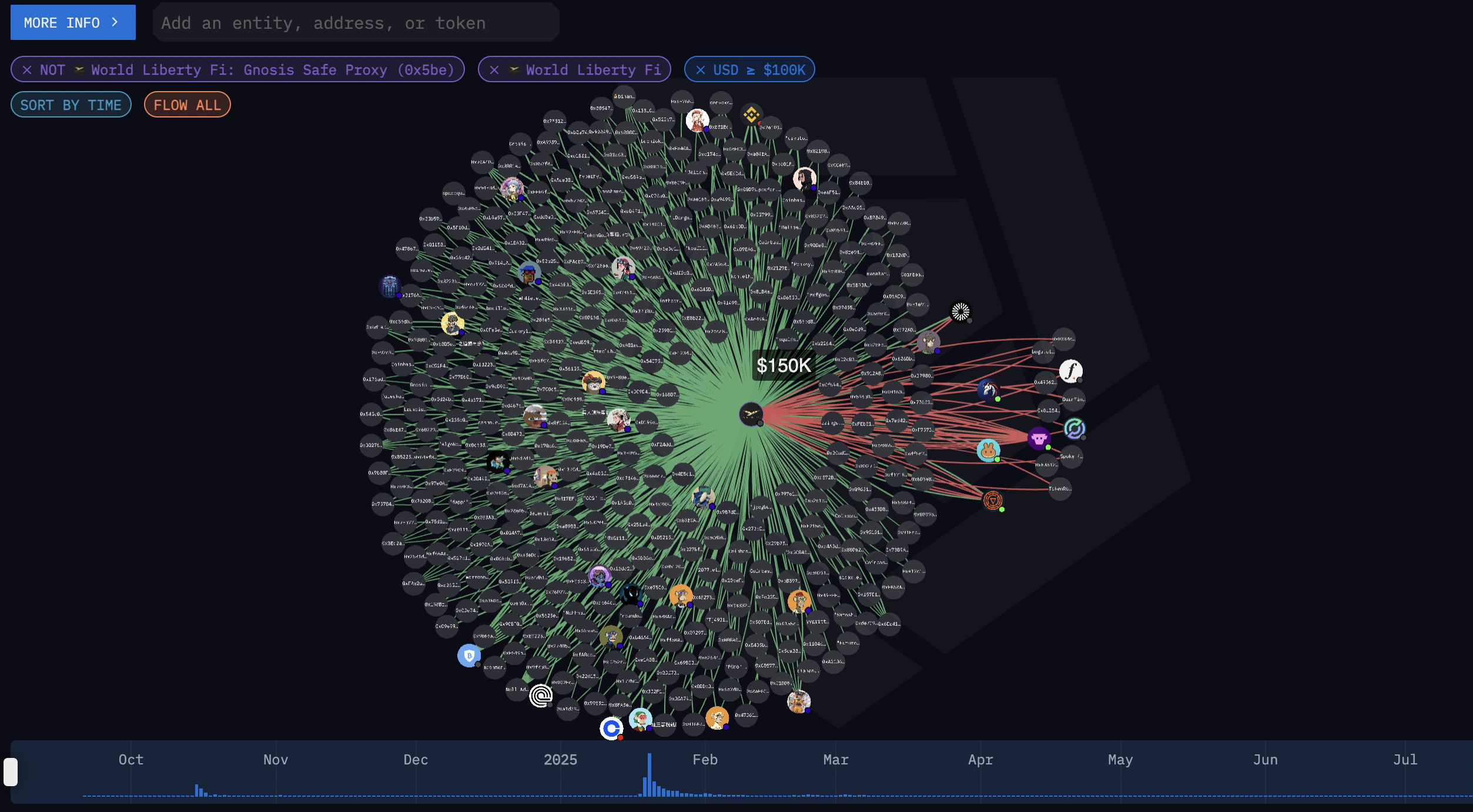

DisruptionBanking traced on-chain wallets associated with World Liberty Financial using Arkham Intelligence, focusing on the characteristics of inflows and outflows. Mapping those wallets and their connections, it is possible to identify the treasury structures, as well as exchanges, and affiliated entities with which WLF transacts.

The Usual Suspects

Among the varied transaction categories, there seems to be a mix of investment and political campaign fund-raising activity. The overlap between donor entities, crypto exchanges, protocols, and aggregators, and WLF-linked wallets suggests a financial ecosystem that blurs the line between political advocacy and direct funding.

In the image below, green means the entities are depositors into WLF. Red means WLF is paying out. Hovering the mouse on the line shows the value of the payment. When all the counterparties are included, there are more senders than receivers of funds. The ones with logos are known wallets, exchanges, and protocols.

The black ones with an alpha-numeric code are anonymous wallets. The ratio of known versus unknown is about 1:25. That’s remarkable, but perhaps also expected considering most of those could be random Trump supporters.

WLF has quickly developed a widespread rolodex of decentralized exchanged (DEX) counterparties. Among them are Aave (UK), Circle (US), Falcon Finance (US), Pancake Swap (Japan), BitGo (US), Coinbase (remote but nominally US-based), KuCoin (Seychelles), Binance (typically associated with the United Arab Emirates, it has recently also been linked to the Cayman Islands), and CoW Protocol (Gibraltar), BitGet (Seychelles), Lido (Cayman Islands), Dolomite (US).

Kucoin, Coinbase, and Binance have had KYC and AML problems in the past.

Binance Fishy, says Star Witness

For Ross Delston, a former U.S. banking regulator who has acted as an expert witness on anti-money laundering issues for the government, the most concerning was Binance.

He said of Binance, “Even before [the 2023 U. S. Justice Department] criminal case against it, Binance had a sketchy regulatory presence. CZ [Changpeng Zhao] was quoted, a few years ago, as saying his company didn’t have a headquarters because ‘Our leadership team are not sitting in one office.’ That’s silly. They didn’t have a home base and didn’t have a home regulator. Binance has done pretty well of staying out of the grasp of regulators and law enforcement in places other than the US.“

Another major recipient of funds, with so many transactions that there is a solid red ribbon between the logo and WLF, is CoW Protocol, a somewhat obscure concern set up in 2021. On-chain data suggests that WLF has been swapping ETH, WBTC, and USDT on CoW, perhaps with the intention of executing institutionalized trades without moving markets.

Wallets Don’t Lie

The transactions are visible on the public Ethereum blockchain and were verified through Arkham Intelligence. Observe these inflows from a BitGo hot wallet to WLF – over $52 million in a few hours.

Since BitGo is an institutional custodian, those are apparently “treasury activities,” meaning major stakeholders (like venture funds or exchanges) are moving stablecoins into WLF’s sphere of control.

The movements suggest institutional coordination rather than retail activity because funds are routed with large transactions in the order of millions or tens of millions that take place simultaneously or within hours of each other. The numbers are round— a hallmark of institutional-style treasury management. The movement is quick, and more capital is being deployed than remaining in the treasury.

Visualizing the fund flows for transactions over a million yields the results highlighted in the graphic below.

The image includes Chinese-born crypto mogul Justin Sun: it’s the green-haired ape with red eyes near the top back row. He’s the founder of Tron and owner of HTX and Poloniex. More about him in a bit.

In just the past six weeks, focusing on transactions over $1 million, some notable transactions have taken place. The transactions suggest that WLF is managing its treasury, minting and moving large amounts of USD1 through its custodian (BitGo), borrowing USDT/USDC through Aave to support liquidity, and seeding liquidity on centralized (Gate.io and Coinbase) and decentralized (Dolomite) platforms as part of USD1’s rollout.

Follow the Funny Money

WLF’s inflows are dominated by large, and sometimes opaque, transfers from crypto whales, foreign funds, and industry insiders. There are also large wallets of unknown provenance and pass-through transactions, suggesting the investors and recipients wish to remain anonymous.

Delston said, “The movement of crypto sure looks like various aspects of money laundering. One of which is velocity – money coming into an account and leaving immediately. These transfers also exhibit the red flag of round numbered transactions – not usually the case in commercial transactions.”

However, he said that without more evidence “it’s difficult to be certain as to whether these transactions were truly suspicious.”

Delston added: “The other money-laundering technique that might account for the large increases in the net worth of these individuals – is that they might possibly be serving as nominees or stand-ins for state actors or other investors who don’t want to be known and/or whose sources of funds might be questionable.“

Keep Following…

In its first six months, WLF reportedly raised over $550 million. Nearly 20 percent of that came from two men investigated for financial crime: the aforementioned Sun, born in China, and Andrei Grachev, a Russian entrepreneur previously convicted of orchestrating pump-and-dump schemes, according to The Nation.

Grachev masked his hand by way of DWF Labs, the entity he controls. Grachev’s past affiliations and partners include a hodgepodge of Chinese-backed investment funds and the subsidiary venture fund of a Russian state bank.

Then there is Aqua1 Foundation. After it bought $100 million in WLFI, Jacob Silverman, a savvy reporter, connected the firm with Web3Port. The latter is associated with David Li, accused of market manipulation. The two companies shared an IP address and Li got sloppy with his new alleged alias: the facts belied sputtering denials of “Mr. Lee” and Aqua1 on X.

All in the Family

Though offered as a decentralized affair, WLF is not a standalone crypto startup – but is deeply entwined with Trump’s business empire.

A Trump family business entity owns 60 percent of WLF and is entitled to 75 percent of all revenue from WLF coin sales. WLF’s fine print and disclosures confirm the Trump family’s controlling stake and token allocations – the family and its affiliates were granted 22.5 billion units of WLFI upfront.

All this means that of the nearly $550 million raised, only 5 percent will be left to build the platform after the Trump family takes its cut.

In addition, the US President’s sons Eric Trump and Donald Trump Jr. are actively involved as co-founders and “Web3 ambassadors.” Even his teenage son Barron Trump is officially dubbed the project’s “DeFi visionary.”

Two of WLF’s co-founders, Zak Folkman and Chase Herro, were replaced back in January as the Trump family took control of the business. Three business partners, Zachary Folkman, Chase Herro, and Zach Witkoff, the son of Trump’s Middle East envoy Steve Witkoff, now round out the executive team.

Our family loves crypto and appreciates the incredible support from the community for @worldlibertyfi. Excited for what’s ahead! pic.twitter.com/8kn8rACyub

— Eric Trump (@EricTrump) November 1, 2024

A Red Flag Blizzard

Sun, whose exploits Disruption Banking has chronicled here and here, spent at least $75 million buying WLFI tokens, becoming the single largest known investor (until recently).

WLF rewarded him with an official advisor role and even adopted Sun’s Tron network to power WLF’s new stablecoin – a move that coincided with U.S. regulators abruptly pausing an SEC fraud investigation into Sun’s companies.

Describing the project as “a blizzard of red flags,” Delston added: “[WLF] is a family business where the head of the family is the president. That is unprecedented in my 74-year lifetime and it’s even hard to go back in presidential history and find anything even close. It’s beyond unusual. It’s unique. You can’t compare it to anything else.”

CBDC Executive Order Pointed Way

He pointed to one of President Trump’s first executive orders in January, which banned Central Bank Digital Currencies (CBDCs) on the basis that a digital US dollar controlled by the Federal Reserve could “threaten the stability of the financial system, individual privacy, and the sovereignty of the US.”

“Why would that be one of his first acts?” asked Delston. “Cui bono? Who benefits? Him personally. The President is launching a stablecoin. The natural competitor to stablecoins are CBDCs. That is in itself nefarious.”

He added: “To have somebody with not just the levers of power, but driving the whole car, who is supporting a particular subcategory of a larger industry, cryptocurrency, is remarkable. At least, for three and a half years, I think he’s pretty safe from regulators and law enforcement.”

Along the same line of reasoning, it’s notable that Trump dismantled the office investigating financial crimes in the crypto ecosystem and proclaimed that fraud in memecoins will no longer be pursued criminally.

👍 #WLFI WLFI minted $205 million worth of #USD1, increasing total supply by 9%. pic.twitter.com/LMaOfSqpHS

— Cryptocurrency Inside (@Crypto_Inside_) August 21, 2025

The Role of USD1

Supporters of USD1, WLF’s dollar-pegged stablecoin, describe it as a strategic breakthrough: a U.S. Treasury-backed digital dollar gaining traction with institutional buyers. Yet a closer look at on-chain data and financial disclosures shows a different picture.

A massive counterparty is MGX, an Abu Dhabi state-backed investment firm. In spring 2025, MGX agreed to use USD1 to facilitate a $2 billion investment into Binance, the world’s largest crypto exchange. Far from broad-based adoption, USD1’s circulation is concentrated in the hands of a single foreign investor, with revenue flowing directly to entities controlled by the Trump family.

The contrast between the bullish narrative and the underlying financial mechanics highlights both the promise and the controversy surrounding USD1. Several major partners are based in the United Arab Emirates (UAE). Lately a popular jurisdiction among crypto firms, especially those which have encountered tough regulators in others, it is in Delston’s words “not known as a tough regulatory environment.”

History Rhymes

Professor James Angel of Georgetown University provided some historical perspective, telling DisruptionBanking: “Scandals around presidential relatives have frequently occurred, often to the embarrassment of the sitting president. Billionaire Howard Hughes lent money to Richard Nixon’s bankrupt little brother Donald when Nixon was vice president.”

Delston harkened back further in history to President William McKinley, who served from 1897 to 1901. “President McKinley was great enabler of the gilded age,” he said. “He supported the monopolistic practices of the then oligarchs were doing. He got assassinated and then Teddy Roosevelt, who was a scion of the oligarchical class, took over. Roosevelt promptly undid everything Mckinley thought about, much less accomplished.”

William Mckinley, The 25th US president, walking into the expo where he would be shot twice and killed. pic.twitter.com/rOpx44Z1GM

— Fascinating (@fasc1nate) July 6, 2025

Stablecoin Future

For investors, WLF represents both an experiment in treasury-backed digital assets and a bet on the political influence of its backers. Beyond domestic politics, WLF also demonstrates how stablecoins are becoming tools of international finance, with Middle Eastern partners and U.S. investors alike using them to bridge capital markets. Its success or failure will have implications well beyond one family or presidency.

Professor Angel said: “Legitimate financial organizations are extremely concerned about their reputation and generally don’t want to have anything to do with shady characters.”

He added, “As one banker told me, ‘If you deal with criminals they will try to steal from you.’ Businesses, just like people, are known by the kind of people they associate with.”

Like earlier eras when business and politics overlapped, WLF highlights how new technologies often emerge at the crossroads of commerce and influence. Whether it proves a triumph or a cautionary tale, its trajectory will shape how the U.S. approaches crypto for years to come.

Author: Tim Tolka, Senior Reporter

#Crypto #Blockchain #DigitalAssets #DeFi

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

Trump-Linked Crypto Deal Blows Up GOP’s First Big Bill | Disruption Banking

Has the Trump Family discussed a new Stablecoin with Binance? | Disruption Banking

One Response

Trump has NO BUSINESS using Executive Order luring 401K pension Holders into this kind of Investment just to drive he and Lutnicks Stable Coin priaces to SOAR in the Biggest Pump and Dump Scheme of the Century !!!!!!!

Congress MUST Intervene !!!

This talks about Trump’s Executive Order luring in 401K Pensions to drive up Crypto prices !!!!!

https://crypto.news/heres-how-high-bitcoin-price-go/

Lutnick’s Bitcoin related holdings

https://accountable.us/wp-content/uploads/2025/05/2025-05-15-Commerce-Sec-Howard-Lutnick-Crypto-Interests-Cantor-Fitzgerald-Q1-2025-13F-Filing.pdf

https://www.warren.senate.gov/newsroom/news-coverage/warren-presses-lutnick-on-crypto-firm-loved-by-outlaws

https://www.investors.com/news/trump-media-cro-6-4-billion-crypto-com-crypto-empire-metaplanet-bitcoin/

So let me get this staright while Trump and Lutnick are holding stable coins as a more stable investment, they also hold Bitcoin to get the benefit from the Early Volatility in Crypto that they think will be the result of 401K Pension money flooding into Crypto markets that they will then cash out of once they feel the price has topped out like a Pump and Dump ???

Unbelievable !!!!