Lithuania has quickly become a European fintech powerhouse. Crypto adoption has been relatively slow to date, but is speeding up as clearer rules and new technologies make their presence felt. Bitcoin ownership in Lithuania is around 1.17 percent of the population, but its overall crypto usage rate is about seven times higher.

Statista forecasts the country’s crypto market revenue will hit $11.2 million this year. With an annual growth rate of 5.27 percent, it is expected to rise to roughly $11.8 million by 2026.

Sometimes known as the “the land of storks” after the native bird species, Lithuania might also be seen as the India of Europe in terms of fintech — it has surely come far, but just how much farther can it go?

Lithuania’s Crypto Growth

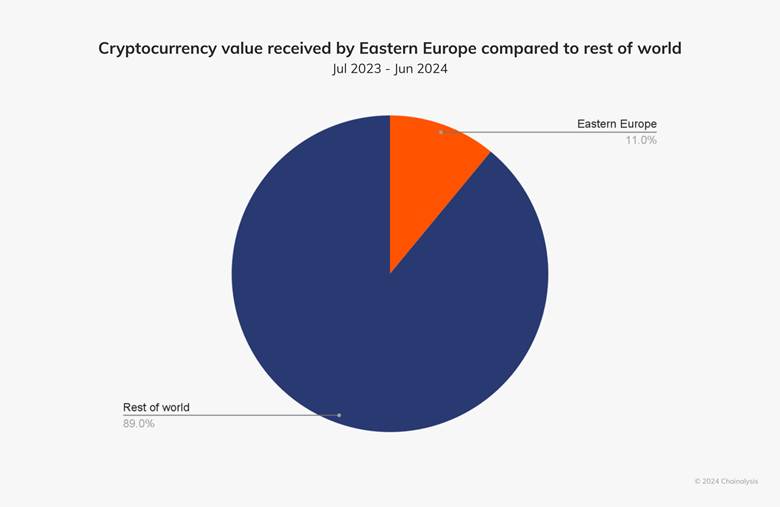

Chainalysis places Lithuania inside Eastern Europe’s booming crypto scene. The region is now the world’s fourth-largest crypto market, receiving nearly $500 billion in on-chain value between July 2023 and June 2024.

That surge underlines Lithuania’s role as a eurozone gateway for crypto. Its EU membership and innovation-friendly climate are helping pull in platforms, talent, and capital.

Source: Chainalysis

Crypto Ownership among Lithuanians

Crypto ownership in Lithuania is steadily climbing, supported by high digital literacy and infrastructure. Statista estimates 7.79 percent of its people use it, which assuming a 2.8 million population works out to around 218,000 cryptocurrency users in 2025. These user numbers are expected to top 231,000 next year.

While global surveys like ConsenSys and YouGov indicate 40 percent of people worldwide have owned or bought crypto, European rates are lower but rising — EU ownership grew from 30 million in 2023 to 50 million in 2024.

Triple-A’s earlier data pegged overall crypto ownership at 2.58 percent in 2021, but recent growth aligns with broader EU trends where 83 percent of investors plan increased digital asset allocations in 2025. Many view crypto as a tool for financial inclusion, with average revenue per user at just over $50 this year.

🇱🇹 Lithuania became a manufacturing and fintech hub.

— Daniel Foubert 🇫🇷🇵🇱 (@Arrogance_0024) June 23, 2025

– Over 250 fintech companies, including Revolut's EU base

– Rapidly growing semiconductor and battery industries

– Strategic infrastructure for NATO and EU logistics (rail, ports, roads)

3/

Who is Buying Crypto?

If the global trend is anything to go by, Lithuanian crypto investors are likely to be mostly young, educated, and middle class. Over 70 percent worldwide are aged under 34 and hold bachelor’s degrees or higher.

With internet access in Lithuania above 90 percent and a lively startup scene, enthusiasm runs high. Most earn under €30,000 a year, so crypto here is driven by broad retail adoption, not just the wealthy.

Usage extends beyond speculation. Stablecoins facilitate cross-border payments and remittances for Lithuania’s diaspora, while DeFi platforms attract users who are hedging against inflation. Retail drives the overall transaction volume, but institutional interest is rising post-MiCA implementation.

Top Crypto Platforms Push Boundaries

Lithuania hosts a mix of global and local platforms, leveraging its licensing regime. Binance leads in trading volume, followed by Bitget, OKX, Kraken, and CEX.IO — all regulated under local or EU rules. eToro stands out for its user-friendly app and wallets, while Revolut, holding a Lithuanian banking license, integrates crypto seamlessly for millions.

Robinhood secured a MiCA license in Lithuania this year, enabling EU-wide brokerage. Local players like CoinGate offer payment gateways, and Blockchain Lithuania fosters ecosystem growth. Bitpanda and CEX.IO provide EUR deposits, low fees, and support, making crypto accessible.

These platforms emphasize compliance, with many holding virtual asset service provider (VASP) registrations from the Bank of Lithuania.

Congrats, @vladtenev 👏🏻👏🏻👏🏻 “The Bank of Lithuania has issued the country’s first license for crypto asset services to Robinhood Europe, a subsidiary of US-based fintech company Robinhood.” $HOOD https://t.co/dGYHZ0cBTK pic.twitter.com/grd8cnKNTo

— Jevgenijs Kazanins (@jevgenijs) May 31, 2025

Whales Love Storks?

Institutional engagement in Lithuania’s crypto sector is expanding, though retail still dominates. Banks and funds are increasingly engaging with digital assets — recent data shows bank crypto custody jumped from €400 million in 2023 to €4.7 billion in 2024.

Institutions like Intesa Sanpaolo and Santander are actively testing crypto and stablecoin services. Meanwhile, global inflows into crypto investment products hit a record $44.2 billion in 2024.

The EU-driven Markets in Crypto Assets (MiCA) regulation has brought clarity that has attracted firms like Robinhood and Veli, which raised six-figure funding this year for institutional crypto tools. The Bank of Lithuania has registered hundreds of VASPs pre-MiCA, paving on-ramps for larger players, although the number subsequently dropped due to stricter regulations. Strict anti-money laundering (AML) rules and taxation keep some cautious, though venture-backed startups signal growth.

Crypto Stays Legal, Taxman Smiles

Lithuania boasts a progressive crypto framework, now aligned with MiCA, effective December 2024. The Bank of Lithuania oversees licensing, requiring VASPs to register for AML compliance and obtain MiCA authorizations by the end of 2025, or face penalties.

Crypto is treated as a financial asset, not legal tender, with taxation under standard rules — in other words, there are no specific crypto taxes but gains from it are taxable. A transitional MiCA ‘grace’ period ends in December this year, mandating unlicensed firms to exit.

This proactive stance, which includes government data usage guidelines, positions Lithuania as a safe hub.

Small Country, Big Energy

Lithuania is evolving from a crypto newcomer to European player, with robust platforms like Binance and Revolut. Regulations under MiCA foster trust, drawing institutions and innovators.

As a tech-loving nation, Lithuania is well positioned to embed cryptocurrency in its economy and shape Europe’s digital future, perhaps even guiding the continent toward broader Web3 integration.

#Crypto #Blockchain #DigitalAssets #DeFi #Lithuania

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The Rise in Popularity of Crypto in Canada | Disruption Banking

The Rise in Popularity of Crypto in the Netherlands | Disruption Banking

The Rise in Popularity of Crypto in Pakistan | Disruption Banking

The Rise in Popularity of Crypto in Turkey: When Fiat Fails | Disruption Banking