Turkey’s crypto story over the last decade reads less like a tech fad and more like a national hedge. When your currency loses value, people stop asking whether crypto is “innovative” and start asking whether it protects their savings.

That simple incentive — preservation of wealth — turned millions of Turks into active crypto users and pushed the market into the billions. Let’s consider how this all came together and what’s coming next.

Billion-Dollar Market Built on Necessity

Turkey’s crypto industry is no niche hobby. Statista forecasts it will generate roughly $2.2 billion in revenue this year, growing year-over-year by 15.33 percent to $2.6 billion by 2026, with 24-26 million users, nearly a third of the population.

That scale didn’t happen because of clever marketing; macroeconomic pain — high inflation, a battered lira — created demand for alternatives. Turkey’s lira (TRY) lost over 450 percent of its domestic purchasing power (inflation) between 2020 and 2024. When money loses value, people look for other ways to keep it safe or make it grow. That’s where crypto comes in.

Lots of folks are using Bitcoin and stablecoins to protect their savings. Trading volume for lira-to-crypto pairs has exploded by over 800 percent since 2021, placing Turkey at number four globally for crypto trading volume, which is pretty impressive.

In fact, local data show Turkish traders vastly prefer dollar-pegged stablecoins. In 2024, the USDT/TRY pair topped Binance’s volume charts at about $22 billion, and USDT now accounts for over half of BTC trades on Turkey’s leading exchange.

🇹🇷BITCOIN TREASURY GOING GLOBAL

— Coin Bureau (@coinbureau) July 31, 2025

Turkish Ride-hailing firm Marti will put 20% of idle cash into crypto — starting with BTC — and may raise up to 50%.

With Turkey’s inflation near 50%, CEO Oguz Oktem says it’s a hedge against fiat risks. BTC is the ultimate currency shield. 🛡️ pic.twitter.com/k0nUNQaFeG

Turkey’s Crypto Investors: Young, Bold, Ready to Grow

So, who’s behind this crypto craze in Turkey? It’s mostly younger people, aged 18 to 44. A survey by KuCoin, a crypto exchange, found that 52 percent of Turkish adults aged 18-60 had invested in cryptocurrencies, which is a reasonable increase from 40 percent in November 2021. The majority, around 48 percent of investors, are aged 31-44, with 37 percent in the 18-30 age group, revealing a strong presence among millennials and Gen Z.

Female participation is substantial, with 47 percent of 18-to-30-year-old investors being women, and 37 percent of those over 45, challenging traditional gender norms in crypto investment.

Motivations for investment include long-term wealth accumulation (58 percent), value storage (37 percent), and portfolio diversification (25 percent), as per the KuCoin report. Bitcoin is the most popular, held by 71 percent of investors, followed by Ethereum at 45 percent and stablecoins at 33 percent, likely used for hedging against volatility.

New users are hopping on board fast, too. Around 31 percent of crypto investors started in just the last three months. Younger folks tend to invest bigger amounts, and a lot of them (57 percent) say they got into it because friends or family told them it’s a good idea, according to the report.

That explains the speed of adoption and why retail flows matter more here than in many developed markets.

Half of the Turkish population now owns crypto.

— Dyor (@dyorexchange) September 4, 2023

That’s what hyperinflation does to you.

The Turkish Lira is 50% down against the US Dollar in the last 12 months.

Fiat is only good for the good times.

Every time the market takes a turn for the worse, people holding fiat pay.… pic.twitter.com/lJtxWt4THV

The Power Players

Turkey’s exchange ecosystem mixes trusted local names (BtcTurk, Paribu, and Bitci) with international platforms operating local arms (Binance TR, Bybit Türkiye). OKX, KuCoin, MEXC, Coinbase, and Kraken are other international platforms also serve Turkish users.

Local regulation and Turkish-language on-ramps make it easy for everyday users to trade lira pairs. These exchanges now offer more than spot trading — staking, NFT marketplaces, and tokenization features pull in different user segments. These apps make crypto easy.

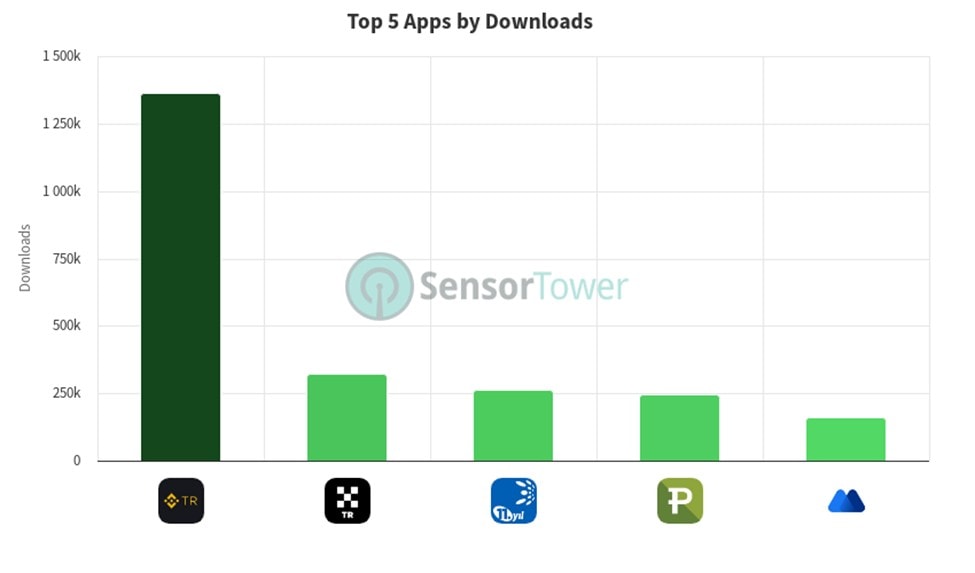

Sensor Tower data show the Binance TR app led Q1 2024 downloads (213K in one week) and usage (nearly 2M active users). Local apps Paribu and BtcTurk saw explosive growth too: by March 2024, they had roughly 360K and 588K active Turkish users, respectively.

Indeed, TV ads in Turkey now routinely list Bitcoin prices alongside dollars and euros.

Source: SensorTower

Traditional banks aren’t just onlookers. In late 2023, Akbank’s investment subsidiary acquired the local crypto firm Stablex. The next day, Garanti BBVA, a top private bank, launched a crypto wallet app enabling customers to hold BTC, ETH, and even USD Coin (USDC) with custodial backing.

Four of Turkey’s top ten banks (handling over a third of market share) are active in crypto services. That institutional involvement reduces friction and signals this is becoming mainstream finance, not just a parallel market.

From Banning to Licensing: Turkey’s Crypto Rules

Turkey’s crypto rules moved fast from an outright ban to tight regulation. After the central bank prohibited crypto payments in April 2021 to “protect the lira,” lawmakers quickly pivoted to regulation rather than prohibition. On July 2, 2024, Parliament passed an amendment to its crypto-assets law, giving crypto firms legal status, forcing registration and licensing under the Capital Markets Board (CMB), and requiring AML/KYC, plus an annual fee (about 2 percent of trading income).

In March this year, the CMB’s Communiqués III-35/B.1 and B.2 spelled out licensing details: high minimum capital (roughly TRY150 million for exchanges), robust security, asset segregation, transaction monitoring, and internal controls. Only licensed Crypto Asset Service Providers (CASPs) may operate (including foreign platforms serving Turkish residents), a push regulators say helps meet Financial Action Task Force (FATF) standards and exit the “gray list.”

There’s a trade-off. Strong regulation raises operational costs and can chill startups. But at scale, the net effect is credibility: fewer scams, more institutional on-ramps, and a more stable market, which Turkey badly needed to attract larger domestic players and foreign capital.

🇹🇷 NEW: Turkey tightens crypto regulations with rules for exchanges and investors, giving the Capital Markets Board full oversight over crypto platforms and stricter compliance requirements. pic.twitter.com/khTCoGchlE

— Cointelegraph (@Cointelegraph) March 13, 2025

CBDC on the Cards

The near-term picture looks like consolidation and maturation. Expect larger exchanges and banks to deepen services (custody, tokenization, derivatives) and smaller players to either specialize or get acquired. There’s also persistent talk of a Digital Turkish Lira (a CBDC). If rolled out thoughtfully, this could not only streamline payments and financial inclusion but also reshape stablecoin demand and how people use crypto as a store of value.

Whatever happens, the result of Turkey’s crypto boom is an ecosystem moving from chaotic retail fever toward scaled, regulated finance — still fast-moving and risky, but far less ephemeral than it might have seemed a few years ago.

#Crypto #Blockchain #DigitalAssets #DeFi #Turkey

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

The Rise in Popularity of Crypto in Canada | Disruption Banking

The Rise in Popularity of Crypto in the Netherlands | Disruption Banking

The Rise in Popularity of Crypto in Pakistan | Disruption Banking