The Netherlands is fast becoming a fintech powerhouse, with billions in crypto moving through the region. Startups are launching every day, and the momentum is undeniable. However, with growth come rules, and Dutch regulators are serious about compliance.

With EU laws in place, the pressure to play by the book is higher than ever: miss the mark, and fines will follow. This is where innovation meets regulation – right in the heart of Europe.

Fintech Innovation Meets Robust Regulation

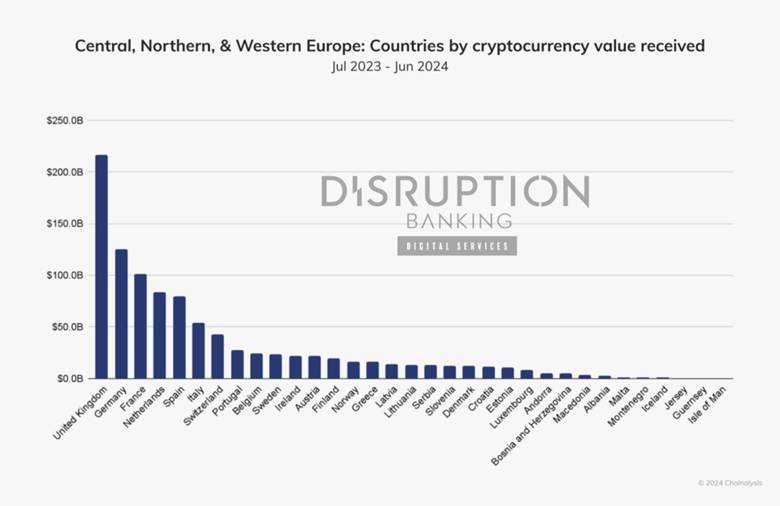

Central, northern and western Europe (CNWE) – which includes the Netherlands – saw just over $987 billion in crypto inflows between mid-2023 and mid-2024, a 44% jump from the previous year, according to Chainalysis. Dutch authorities are actively supporting innovation. For example, the Dutch Finance Ministry’s FinTech Action Plan has driven a one-third increase in fintech firms (from 645 in 2019 to 861 in 2023).

CNWE Countries by cryptocurrency value received (July 2023-June 2024). Source: Chainalysis

At the same time, regulators emphasize compliance. Dutch law requires crypto asset service providers to register with the Dutch Central Bank (DNB) under AML rules. Non-compliance attracts a fine, as in the cases of Binance and Coinbase, which were fined €3.3 million each in 2022 and 2023, respectively, for failing to register.

With the EU’s new Markets in Crypto Assets (MiCA) framework fully up and running since the end of 2024, the Dutch Authority for the Financial Markets (AFM) requires crypto exchanges and token issuers to obtain licenses. AFM began accepting applications in April 2024, and these measures aim to integrate crypto into the formal financial system while protecting investors.

The only legal way to offer crypto services in NL is by registering with the regulator. Perfectly possible: others, including our own @XRPLLabs did so)

— WietseWind (🪝🛠 @ Xaman®, XRPL & Xahau) (@WietseWind) June 16, 2023

"Exploring alternative avenues" = "finding ways around playing by the rules"

I read: "we can't/won't comply with the rules" pic.twitter.com/ER7yBlVUxv

Exchanges Fuel €10 Billion Boom

Dutch fintech innovation is thriving, particularly in blockchain and payments. The Netherlands is home to several leading crypto exchanges and startups. Bitvavo, founded in 2018 and based in Amsterdam, has become one of Europe’s largest platforms. It now lists 350+ digital assets and serves over 1.5 million users, with roughly €10 billion in monthly trading volume, as at November 2024.

🚨 TODAY: MoonPay, BitStaete, ZBD, and Hidden Road secure EU-wide MiCA licenses in the Netherlands, enabling operations across all 27 member states. pic.twitter.com/y2cwlXAb8G

— Cointelegraph (@Cointelegraph) January 6, 2025

Just last month, Bitvavo obtained a MiCA license from AFM, enabling it to operate across the EU. Other domestic platforms include Coin Meester (BCM) – which is being acquired by Kraken to expand EU reach – and Bitonic. Founded in 2012, the latter is one of the oldest Dutch Bitcoin brokers.

International players have also launched Dutch entities. Global exchange Bybit, the world’s second largest by volume, opened “Bybit Powered by SATOS” in the Netherlands and is listing Quantoz’s EUR/USD stablecoins for Dutch users. Meanwhile, Crypto.com has also been cleared since 2023 by the DNB as a digital currency service provider in the Netherlands.

Collectively, these exchanges feed a vibrant retail market in the Netherlands, supported by high internet penetration and crypto-friendly infrastructure.

We're excited to share that https://t.co/vCNztATSCO has been approved for registration in the Netherlands🇳🇱 as a provider of crypto services.

— Crypto.com (@cryptocom) July 28, 2023

This registration confirmation follows a comprehensive review of https://t.co/vCNztATSCO’s business and compliance practices.

Learn… pic.twitter.com/MSiRJJ9KDy

Stablecoins: Holland’s Digital Currency

On the technology side, Dutch firms and regulators are focusing on blockchain applications beyond trading. Netherlands-based fintech Quantoz Payments (part of financial software firm Quantoz N.V.) has obtained a Dutch Electronic Money Institution license to issue MiCA-compliant euro and dollar stablecoins on the Ethereum blockchain.

Its euro- (EURQ) and USD-pegged (USDQ) e-money tokens (EMTs) are fully backed by fiat reserves and EU government bonds under DNB supervision, embodying the EU mandate for regulated stablecoins.

Cheap and Fast Transfers

More broadly, stablecoins have become a major global asset class, valued at $180 billion in 2024, with key infrastructure for trading and payments. More recent estimates place their total market capitalization value at around $250 billion, as at June 2025.

For retail users, stablecoins offer fast, low-cost transfers. For exchanges, they provide essential liquidity. Dutch innovation in this area is significant. For instance, Bybit’s Dutch arm now lists Quantoz’s USDQ (a MiCA‑compliant EMT) for local trading.

The country is also involved in broader blockchain initiatives – DNB is researching a digital euro (CBDC) and has signaled a favorable stance toward central bank digital currencies. In the private sector, traditional banks are experimenting too. Take ING Bank, for example, which is reportedly developing a euro stablecoin in collaboration with other banks, leveraging MiCA’s framework.

Younger Dutch Love Crypto

Cryptocurrency remains a niche but growing market for Dutch consumers. A 2018 survey (Kantar TNS) found about 580,000 Dutch retail investors held crypto in early 2018 (roughly 3.5% of the population), tapering to around 480,000 by year’s end, with Statista reporting a 200,000 increase in crypto users between 2021 and 2022.

Most Dutch crypto holders view assets like Bitcoin and Ethereum as investments rather than cash for everyday spending. Younger demographics (Gen Z and Millennials) dominate this market. Adoption has likely increased since, helped by user-friendly platforms and the entry of compliant stablecoins and payment solutions.

Furthermore, Dutch have even bought crypto firms – ABN Amro acquired trading app BUX in 2024, showing confidence in retail interest.

Meanwhile, demand from Dutch citizens and businesses is expected to keep rising. Industry forecasts predict global crypto users may exceed 950 million by the end of 2025, and Europe’s share of that growth will include strong interest in the Netherlands, as noted in centralized exchange OKX’s findings.

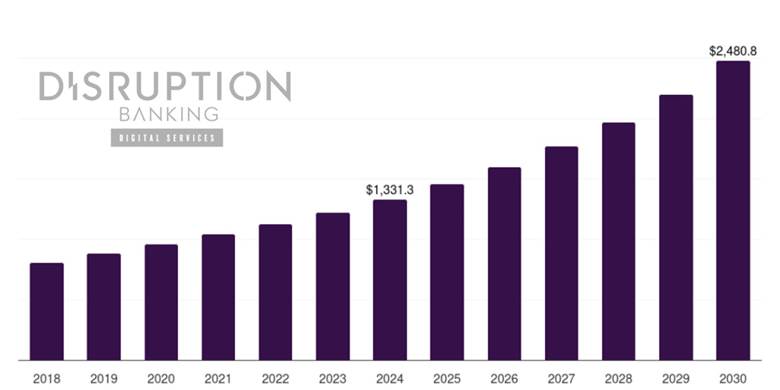

Forecast of Europe’s cryptocurrency market revenues (in USD). Market research pins growth from about $1.33 billion in 2024 to $2.48 billion by 2030 (a CAGR of 11.2% from 2025-2030), reflecting rising demand for digital assets (including crypto exchanges, mining hardware, and fintech services). Source: Horizon

Institutions Embrace Blockchain Shift

On the institutional side, the Netherlands is carefully embracing crypto and blockchain. Major banks and asset managers are exploring use cases under clear regulatory guidelines.

The Dutch Crypto Valuation and Applications initiative (involving industry players) works on tokenization and custody services. Even payment companies see opportunities: for instance major industry player Mollie supports crypto merchants.

At the same time, regulators and banking associations advise caution. Potential risks such as fraud and volatility do exist.

GM fam!

— Captain GM (@g13m) April 23, 2025

🇳🇱ING Bank from the Netherlands intends to launch its own stablecoin

The project is being developed in collaboration with other banks and cryptocurrency companies.

With the introduction of the MiCA regulatory framework in the EU, banks can now issue regulated… pic.twitter.com/y5iiczr3LT

Bright Future for Digital Assets

As regulatory clarity improves under MiCA and related EU laws, industry observers anticipate that user numbers and transaction volumes will keep rising.

Driven by a tech-savvy population and fintech-friendly policies, the Netherlands’ digital economy is well-positioned to participate in this growth, balancing innovation with compliance. Thanks to this, the country seems well prepared for an increased uptake of crypto.

Author: Ayanfe Fakunle

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

#cryptocurrency #blockchain #Netherlands #adoption #crypto #roadmap

The Rise in Popularity of Crypto in Malaysia | Disruption Banking

The Rise in Popularity of Crypto in Germany | Disruption Banking

Swizterland and Crypto: a Match Made in Banking Heaven? | Disruption Banking