LONDON, 24th June 2025 – Leading market sentiment provider Permutable today announced the launch of its War Sentiment Index, a real-time data feed that quantifies global conflict sentiment to provide institutional investors with unprecedented insight into geopolitical risk factors affecting market volatility.

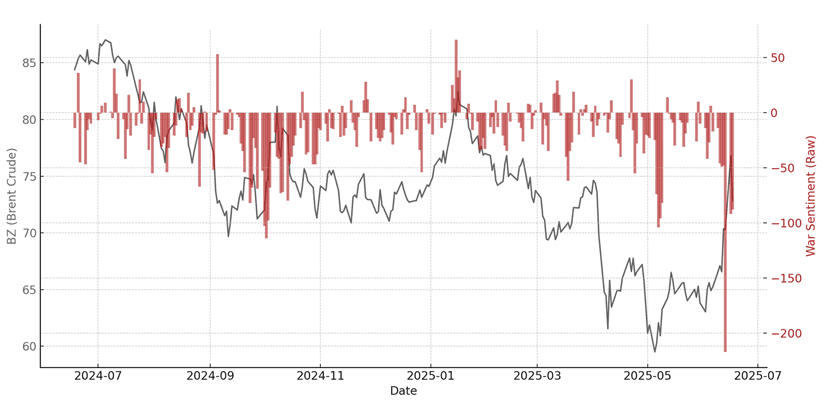

With the ongoing Iran-Israel conflict, continued Middle East unrest, and ongoing Russia-Ukraine tensions creating significant market uncertainty and driving commodity price fluctuations, currency movements, and sector rotations, the War Sentiment Index delivers the precise, quantitative intelligence that investors require to navigate geopolitical turbulence and capitalise on sentiment-driven market opportunities.

The War Sentiment Index transforms complex global events into actionable investment intelligence. Going back to 2015, Permutable’s proprietary AI-driven system has tracked every major conflict and geopolitical event, providing institutional clients with the data foundation to make informed decisions during periods of maximum market stress.

“Our War Index is the simplest marker available for global war tension, cleanly representing overall sentiment from all global news providers,” said Wilson Chan, CEO of Permutable. “The index precisely determined the point of Israel’s first strike and nervousness in Iran’s nuclear reactions the day before. This helps asset managers position assets accordingly during vulnerable and sensitive periods.”

The War Sentiment Index forms part of Permutable’s comprehensive 22-index macro intelligence feeds, providing institutional investors with complete visibility across all market-moving global events:

- Political Tension Index – Tracking diplomatic crises and political instability

- Natural Disasters Index – Quantifying climate and geological event impacts

- Election Index – Monitoring democratic processes and political transitions

- 19 Additional Specialised Indices – Covering the full spectrum of macro event drivers

Key technical specifications:

- 200+ news sources: Comprehensive coverage from world’s leading financial and news publications

- Hourly updates: Real-time sentiment tracking for immediate market response

- Sophisticated scoring algorithm: Each article scientifically scored from -1 to +1 for precise sentiment quantification

- Decade-long track record: Continuous operation since 2015 with proven market correlation

Designed specifically for hedge funds, asset managers, pension funds, and institutional trading desks, the War Sentiment Index delivers data-driven insights for tactical asset allocation and sector rotation intelligence, measuring sharp drop-offs in war sentiment for tactical positioning enabling precise timing for defensive positioning in hedging strategy optimisation.

The system integrates seamlessly into existing risk management and alpha generation strategies providing quantified sentiment data for algorithmic implementation in systematic trading strategies. It serves as an early warning system for geopolitical risk exposure, helping derisking decisions by detecting nervousness and fragile states of global conflict.

About Permutable AI

Permutable AI is the leading provider of real-time sentiment and event intelligence for institutional investors. Our proprietary AI-driven platform transforms global news flow into precise, actionable investment intelligence, serving hedge funds, asset managers, and institutional trading desks worldwide. Permutable AI’s analytics have become essential infrastructure for sophisticated investment strategies in an increasingly complex global environment.