Switzerland is famous for its banks and watches – two things that don’t exactly spring to mind are Bitcoin and blockchain. Yet over the past decade, Switzerland has quietly become a world-leading crypto hub. How did this happen?

Swiss officials and regulators saw blockchain technology as an opportunity, not a threat. In fact, a 2024 report found Crypto Valley – the blockchain ecosystem centered in Zug – now boasts 17 unicorns (14 by token market capitalisation, three by private valuation) and a total valuation of $593 billion. This goes to show Switzerland’s status as a blockchain innovation leader, capturing just over 29% of European blockchain funding in 2024.

Can a conservative Alpine country really be this cutting-edge? The answer lies in a mix of visionary rules, eager entrepreneurs, and strong fintech momentum.

But not all of Europe is following the same path…

— Alessandro Palombo (@thealepalombo) December 16, 2024

🇨🇭 Switzerland:

– Crypto Valley thriving

– 13 unicorns (10 by token market cap, 3 by market valuation)

– Favorable regulatory environment

– $382.93B in total valuation

A blueprint for what's possible. pic.twitter.com/xgq08znnO2

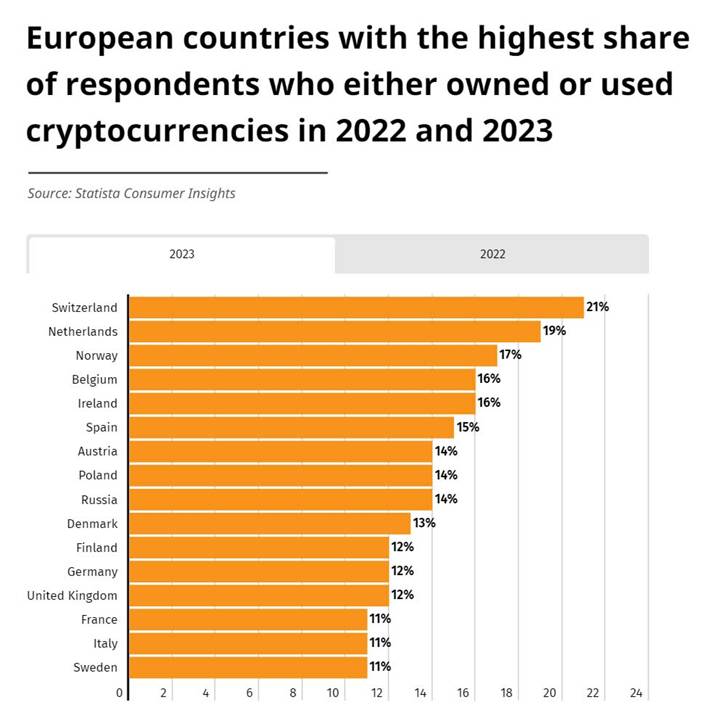

Crypto Winning Over Swiss Citizens

Swiss citizens have been warming to crypto. Surveys show adoption jumped fast. Research from Statista projects that by 2026, the number of crypto users will reach 4.03 million with a user penetration rate of 44.68%, a rise from this year’s estimated 42.93%. About 11% of Swiss said in 2021 that they used or owned crypto, but by 2023 this had risen to about 21%. Assuming the upwards trend continues, this means at least one in five people in Switzerland are involved in crypto.

The projected cryptocurrencies market revenue for 2025 is $446.6 million, representing an annual growth rate of 4.59%, with an average crypto revenue per user estimated to be $115.9 in 2025, according to Statista. This suggests a stable per-user contribution despite market fluctuations.

Table 1: Projected Crypto Market Metrics for Switzerland (2025-2026)

| Year | Number of Users (Millions) | Penetration Rate (%) | Market Revenue (US$ Million) |

| 2025 | n/a | 42.93 | 446.1 |

| 2026 | 4.03 | 44.68 | 466.6 |

Source: Financial Mirror

Why Crypto Payments Are Still Rare in Stores

Crypto-friendly media and education and young people eager for new assets partly account for this apparent boom. But is this interest spilling over into everyday life?

Surprisingly, not much. For example, the largest Swiss online retailer, Digitec (Galaxus), launched a crypto payment trial in 2019 but discontinued it at the end of 2023 citing “very low” demand. If so many people own crypto, why wasn’t it used at checkout?

Perhaps most owners still think of crypto as an investment, not a currency. If so, the gap is worth pondering. If Swiss people have crypto in their wallets, why aren’t shops taking it?

Welcome to Switzerland, where you can buy crypto with cash at convenience stores 🇨🇭 pic.twitter.com/DefjRrxH9m

— fabiano.sol (@FabianoSolana) November 6, 2024

Tax Payments in Crypto – a Look into Zug’s Experiment

On the other hand, Switzerland has experimented with crypto in other everyday ways.

In the canton of Zug – the heart of Crypto Valley – taxes can be paid in Bitcoin or Ether since 2021. Begun as a small pilot scheme with a CHF100,000 limit, by 2023 it allowed taxpayers to settle up to CHF 1.5 million in crypto payments each year, signalling official support for crypto in retail life.

A federal bill currently before the Swiss Parliament seeks to allow Switzerland to automatically share Swiss citizens’ crypto tax data with 74 countries including EU nations and the UK by 2027. The bill is due to enter into force at the beginning of 2026.

The Federal Council has adopted a bill to enable the automatic exchange of cryptoasset information with 74 partners, including 🇬🇧, all 🇪🇺 members, and most of G20 (not 🇺🇸, 🇨🇳, 🇸🇦). Now Parliament is debating the bill.

— Swiss Federal Government (@SwissGov) June 6, 2025

Press release: https://t.co/33vCVtJimI @efd_dff @sif_sfi

Swiss Big Banks and Institutions Go Crypto

Big Swiss banks and institutions have become enthusiastic adopters. Even traditional players now offer crypto. In early 2024, PostFinance – Switzerland’s large retail bank with 2.5 million customers – announced it would provide regulated trading and custody for 11 cryptocurrencies via partner Sygnum Bank.

This was viewed as a milestone. In Sygnum’s words, PostFinance became “the first systemically important Swiss bank” to offer crypto services to retail clients.

In late 2023, the Zug Cantonal Bank joined the race, allowing customers to buy and sell Bitcoin and Ether, with infrastructure provided by Sygnum. The year before, St. Galler Kantonal Bank did the same through SEBA Bank (now trading as AMINA Bank following a rebrand). Industry insiders say at least 10 major Swiss banks are in the “starting blocks” to roll out their own crypto services.

Among the notable firms shaping the global crypto landscape in Switzerland are 21.co – formerly 21Shares – the world’s largest issuer of cryptocurrency exchange-traded products (ETPs), valued at around $8.97 billion by TrackInsight at the time of writing. Others include blockchain companies Bitcoin Suisse, Stakehound, Proxeus and Swisstronik.

BIG BREAKING! 🚨

— Kyle Chassé / DD🐸 (@kyle_chasse) September 4, 2024

🇨🇭SWITZERLAND’S 4TH LARGEST BANK ($290 BILLION) IS NOW OFFERING #BITCOIN AND CRYPTO TO CLIENTS pic.twitter.com/dRDtvDLYP4

Legacy Finance Is All In

What about legacy finance? Many institutions now integrate crypto. Swiss private bank Julius Baer and Liechtenstein’s LGT are clients of Seba Bank for digital assets. Under the Capital Markets Technology Association (CMTA), Credit Suisse, Pictet, and Vontobel have even tested trading tokenized securities on blockchain.

At the infrastructure level, the SIX Swiss Exchange was a pioneer. In November 2018, SIX listed the world’s first physically backed crypto ETP, letting investors buy a Bitcoin product on the stock market. And in 2021, FINMA approved SIX Digital Exchange (SDX), the first fully regulated platform for trading and settling tokenized securities. In essence, Swiss institutions from retail banks to stock exchanges are building crypto into their DNA.

There are 350 merchants accepting bitcoin in Lugano, Switzerland. This makes it the highest density of adoption in Europe. pic.twitter.com/M2eNQLid2A

— Jameson Lopp (@lopp) October 20, 2023

Pro-Crypto Regulation and FINMA’s Tech-Neutral Stance

Switzerland didn’t ban cryptocurrencies. Instead, the Swiss Financial Market Supervisory Authority (FINMA) and the Swiss Federal Tax Administration (SFTA) treated them with a tech-neutral mindset as assets, with requirements for anti-money laundering (AML) and consumer protection. In 2018, FINMA issued coin offering (ICO) guidelines categorizing tokens into payment, utility, and assets. By 2021, Switzerland passed a landmark Distributed Ledger Technology (DLT) Framework to allow on-chain DLT Securities, making tokenized assets fully legal.

Even lighter banking licenses were introduced, like the new FinTech licence that allows firms to take public deposits (including crypto assets) up to CHF100 million. In short, lawmakers built a supportive sandbox. Instead of saying no, Swiss regulators said: “Yes, but with rules.”

Why such a warm welcome for crypto? Well, for one, Swiss leaders believe blockchain can strengthen the financial center. In practice, this means FINMA applies anti‑money laundering rules to crypto exchanges (since 2015) and updated guidance for things like stablecoins and staking, but generally sees innovation as key.

This open-but-sensible stance begs the question: can smart regulation fuel crypto growth without damaging stability? For now, Switzerland is betting it can.

Swiss Crypto: One to Keep an Eye on

According to Dirk Klee, the CEO of Bitcoin Suisse, a major crypto broker founded in Zug, wealthy clients want digital assets professionally managed as part of their portfolios. This leads one to wonder if everyday crypto use will catch up with investment adoption.

Switzerland’s crypto journey may seem like a bold gamble by a famously prudent country; but in finance as in horology, Swiss precision and stability could very well keep pace with this digital revolution – provided the regulators keep building bridges, the banks stay curious, and the technology proves truly transformative.

In any case, the world will be watching as Switzerland’s crypto story unfolds over the next decade.

#Crypto #Switzerland #Blockchain

Author: Ayanfe Fakunle

See Also:

The Rise in Popularity of Crypto in Germany | Disruption Banking

Alpine Tech Forum Spotlights DLT Pioneers | Disruption Banking

Wholesale CBDCs and Stablecoins: A Dual Future for Digital Finance | Disruption Banking