Imagine a company so powerful its stock swings can jolt an entire market index. That’s Apple Inc. (AAPL), a tech behemoth that reshaped how we live, work, and invest. Since joining the Dow Jones Industrial Average (DJIA) in 2015, Apple has driven the index upward with its sky-high stock price and relentless innovation. Understanding Apple’s journey within the Dow is key to grasping where the market — and the tech sector — are headed.

Apple’s Entry into the Dow Jones (2015)

On March 19, 2015, Apple joined the DJIA, replacing AT&T, a telecom giant in the index since 1916. This made Apple the fourth company traded on the NASDAQ to be part of the Dow. This change was prompted by Visa Inc.’s 4:1 stock split, effective at the same time, which reduced the weighting of the Information Technology sector in the index. Adding Apple, with its then-market cap of almost $740 billion, helped partially offset this reduction.

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices, called Apple “the clear choice” for its size and innovation, as noted in a 2015 report from The State Journal-Register. Apple’s iPhone and iPad had already changed the world. Its entry marked tech’s growing grip on the economy.

Pre-2015: The Rise of a Tech Giant

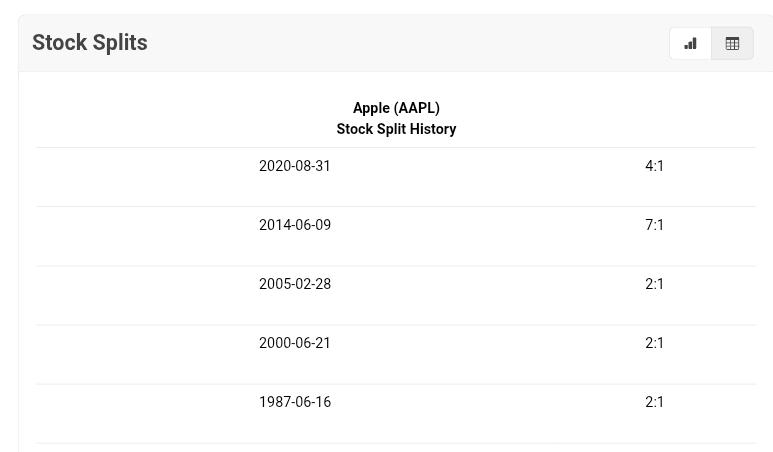

Apple’s rise came from game-changing products. From its 1980 IPO, its stock soared, fuelled by iPhone’s global popularity, launched in 2007, which made smartphones part of modern life. The iPad and Mac built a loyal following. In June 2014, Apple split its stock 7:1, dropping the price from about $650 to $92 to make shares more affordable, according to Apple’s CEO Tim Cook. By March 2015, the stock was $128.36, reflecting strong growth from the iPhone and App Store.

Meanwhile, Apple’s App Store and services like iCloud strengthened the brand offering. These innovations drove substantial growth. For example, Apple’s revenue hit $233.7 billion in 2015, up from $108.2 billion in 2011, according to MacroTrends data. This success showed Apple’s economic impact, making it a perfect fit for the Dow. Apple’s ability to innovate kept investors excited.

Post-2015: Stock Resilience and Innovation

Since joining the Dow Jones, Apple’s stock has been resilient. It hit $184.57 in June 2023 after announcing the Vision Pro, a mixed-reality headset, though it dipped to $177.79 due to its high price and limited production.

Services, like Apple Music and iCloud, drove big gains with $20.8 billion in Q1 2023, despite a 5% revenue dip to $117.2 billion, marking only the second revenue miss since 2017, highlighting adaptability. Also, the iPhone’s success, accounting for 56% of net sales in Q1 2023 at $66 billion, underscored Apple’s ability to drive economic progress and represent the technology sector’s growing importance.

By May 2025, APPL reached a 52-week high of $260.10, with a low of $169.21, reflecting steady growth. As at time of publishing, AAPL is trading at $201.36, with a market cap of $2.96 trillion.

Apple’s Influence on the DJIA

Performance of Apple’s stock since 2015:

The DJIA is price-weighted, so high-priced stocks like Apple have a big impact. At $201.36 in May 2025, Apple holds about 2.98% of the index’s weight, per SlickCharts. In 2015, a one-point move in Apple’s stock could move the DJIA by 6.68 points, according to Business Insider. When Apple jumped in 2023, it helped lift the DJIA. But in 2022, its 26.79% drop dragged the index down. Apple’s moves often signal tech sector trends, making it a key player in the DJIA’s performance.

Pushing Boundaries: Vision Pro and Beyond

Apple keeps pushing boundaries. The Vision Pro, announced in June 2023 and launched in February 2024, blends virtual and real worlds, aiming to redefine entertainment and work. In April 2025, Apple released visionOS 2.4, adding Apple Intelligence features, making it smarter. Plans for visionOS 3.0 at the Worldwide Developers Conference (WWDC) in June 2025 — an annual information technology conference by Apple Inc. — suggest more updates ahead. But sales of theVision Pro have lagged — mostly due to its high cost (around $3,500) and various customer complaints of discomfort. With only 420,000 to 500,000 units sold by the end of 2024, reports suggest Apple stopped producing Vision Pro owing to poor sales, with plans for a cheaper version in 2025.

Navigating Global Risks: Supply Chain Shifts

Globally, Apple faces supply chain shifts. China, where 75% of products like iPhones are made, brought $74.75 billion in sales in 2022, mostly iPhones, according to Statista. The 2022 Zhengzhou lockdown disrupted iPhone 14 production, exposing risks. Now, Apple is moving to India, producing $22 billion in iPhones by March 2025, up 60% from last year.

The pivot is gathering pace. Foxconn, Apple’s largest contract assembler, committed US$1.5 billion to expand facilities in Tamil Nadu, India, while Tata Electronics has begun producing iPhones in Hosur. Apple reportedly aims to supply the majority of U.S.-bound iPhones from India by 2026. Such moves cushion tariff risk, but they also build redundancy against future regional disruptions — an increasingly critical factor for investors.

New U.S. tariffs in 2025, peaking at 145% led to a delay in supply, before the May 12, 2025, deal to roll back the tariff by 10% by both China and the U.S. This temporary relief might help, but long-term impacts are unclear. Still, Apple’s diverse revenue, from iPhones to services, cushions these risks.

Apple’s Lasting Impact on Markets and Tech

Apple’s decade in the DJIA shows its power to shape markets and lives. From a $128 stock in 2015 to $206.86 in 2025, it has driven the index with innovation and resilience. The Vision Pro and supply chain shifts signal Apple’s future focus, keeping it central to the DJIA. As it navigates risks and redefines tech, Apple’s influence on the index and the economy is likely to remain significant.

Author: Richardson Chinonyerem

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

#Apple #DowJones #iPhone #SupplyChain

See Also:

How IBM’s Resilience and Innovation Keep It at the Heart of the Dow Jones | Disruption Banking