U.S. President Donald J. Trump’s time in office, especially his second term, has been marked by his usual purposefulness. His trade tariffs and outspoken criticism of the Federal Reserve are just some examples. Trump’s approach in the past and today has had an impact on the value of U.S. bond yields, has it also had an impact on the Dow Jones?

Last month, we covered four different stories about the Dow Jones. Today we look at how Trump’s actions impact the Dow Jones. We also briefly examine the implications of Trump’s tariffs and his disagreement with the Chair of the Federal Reserve.

Historical Context and Trump’s First Term Performance

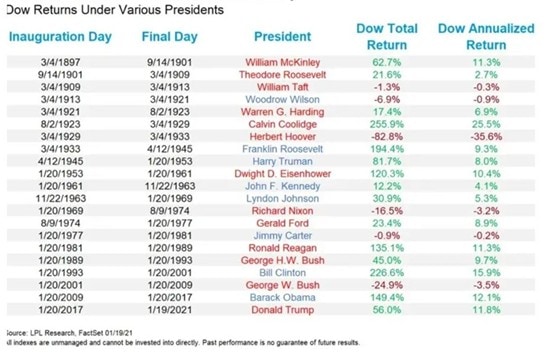

Trump’s first term began with the DJIA at 19,827.25 on January 20, 2017. By the end of his term on January 20, 2021, it had climbed to 31,188.38, mirroring a substantial 56% increase, even after the 2020 COVID-19 pandemic hit hard. This growth was aided by several pro-business policies. One was reasonable tax cuts enacted in 2017, which reduced the corporate tax rate from 35% to 21%, and the other, deregulation efforts that eased business operations. During this period, the Dow performed well, with an annualized gain of 11.8% It was one of the best performances of any Republican president since Calvin Coolidge.

The Dow’s performance during Trump’s first term was also supported by an optimistic economic outlook, with investors responding positively to his focus on economic growth. A report noted that the DJIA gained 31% in Trump’s first year alone, the best since Franklin D. Roosevelt’s first year, attributed to lower taxes and reduced regulation.

Image showing how stocks performed under President Donald Trump’s first term in office. Source: Business Insider

Trump’s Second Term: First 100 Days and Market Challenges

Things look different in Trump’s second term. Right after the 2024 election, markets reacted well, with the DJIA gaining 3.57% (around 1,500 points) on hopes of tax cuts and deregulation. However, by February 2025, the Dow slipped 1.6% (700 points), according to Forbes, marking its worst month since December 2024. Early excitement had faded into caution.

In April 2025, the Dow experienced a sharp decline, dropping 9.1% over just two trading days (April 2 to April 4), following Trump’s announcement of new tariffs. It was the Dow’s worst April performance since April 1932 during the Great Depression.

Trump’s Tariffs: A Driver of Volatility

Trump’s aggressive tariff policies have been a major cause of recent Dow declines. On April 2, he rolled out hefty new tariffs. These measures, intended to boost U.S. manufacturing and lead to reindustrialisation, are projected to raise $2.1 trillion over a decade but have sparked fears of inflation and reduced consumer confidence. MarketWatch reports that the tariffs have increased costs for U.S. households by an estimated $3,800 annually, with higher-income households facing up to $8,100 in added costs.

Ruined it: Trump's first 50 days — the worst start to a presidential term since 2009

— NEXTA (@nexta_tv) March 11, 2025

The first 50 days of Donald Trump's second presidential term can be characterized as a failure for the U.S. economy.

Stock markets have suffered significant declines: the S&P 500 dropped by… pic.twitter.com/Q3qPp6O468

Markets reacted sharply to the tariff announcement. On the same day, April 2, dubbed “Liberation Day” by Trump’s administration to mark the enactment of tariffs, the Dow plummeted 1,679 points (closing at 40,545.93 from 42,225.32 on April 2), a 3.98% drop — the biggest one-day fall since the 2020 COVID crash. The next day, April 4, futures signalled more trouble, with the Dow down another 1,053 points in pre-market trading, and the actual close saw a further 2,200-point drop (to 38,314.86). These swings highlight how Trump’s trade stance impacted markets.

Trump-Federal Reserve Tensions and Market Uncertainty

Trump’s dealings with the Federal Reserve have increased the levels of uncertainty. He has often clashed with Fed Chair Jerome Powell, pushing for lower rates and slamming the central bank for not backing his economic targets. On April 21, he upped the ante, calling Powell a “major loser” and demanding instant rate cuts.

This friction has sparked worries about the Fed’s independence, a bedrock of market trust. Bank of America economists Antonio Gabriel and Claudio Irigoyen noted that “Trump cares about the stock market” and his policy decisions follow price changes, but eroding trust could continue if market-friendly policies are not enacted. That unease has fed into a broader sense of instability.

Trump’s Impact on the Dow Jones

Trump’s first term delivered robust growth through tax cuts and deregulation. His second term has been rockier, with tariffs and trade tensions driving sharp swings.

As of writing, the market is still finding its footing as these changes unfold. The Dow is at 41,200 now declining more than 500 points so far today. Reuters reported that this was due to investors assessing comments about trade between the U.S. and China. Trump, earlier today, offered to drop tariffs from 145 percent to 80 percent. He believes that this “seems right.” Markets reacted immediately after Trump’s proposal today and have been plunging for the last two hours (TradingView).

The Dow Jones stood above 42,000 on the day that tariffs were announced, this should be the short-term goal for investors. There was news of a deal with the UK announced yesterday. The UK deal, especially the mysterious nature by which it was announced, saw the Dow Jones briefly rise to 41,760 yesterday. But going by today’s market reaction, China will have a bigger impact on the Dow Jones.

Author: Richardson Chinonyerem

#Trump #DowJones #DJIA #Trade #Performance #LiberationDay

The editorial team at #DisruptionBanking has taken all precautions to ensure that no persons or organizations have been adversely affected or offered any sort of financial advice in this article. This article is most definitely not financial advice.

See Also:

How Did the Dow Jones React to the U.S. Economy Shrinking? | Disruption Banking

Dow Jones Tumbles as Market Crash Continues | Disruption Banking